Spring Statement: Is this really the biggest personal tax cut for 25 years?

- Published

Chancellor Rishi Sunak told parliament during his Spring Statement that his "tax plan delivers the biggest net cut to personal taxes in over a quarter of a century".

But does that mean people will actually be paying less tax?

The two big measures announced on Wednesday afternoon will mean less money for the government from income tax and National Insurance in 2024-25 than had previously been planned.

But the announcements are smaller than the increases in taxes Mr Sunak has announced in the past year.

Taking all these changes together, people will be paying more taxes by 2024-25.

Record planned tax cuts

The income threshold at which point people start paying National Insurance will rise from £9,570 to £12,570 in July, which Mr Sunak said was a "tax cut for employees worth over £330 a year".

This is expected to cost the government about £6bn this year and about £5bn in 2024-25.

The chancellor also promised to cut the basic rate of income tax from 20p to 19p in the pound in 2024.

Taken together, the effect of these two measures announced yesterday will cost the Westminster government about £10bn that they might have raised that year.

The National Insurance changes will apply across the UK (but income tax rates in Wales and Scotland are partially set there).

The Treasury calculates that, taken in isolation, this is a bigger giveaway for personal taxes than we have seen since Autumn 1995.

But they are not the only ways in which the government has changed the tax system this year.

Last year's tax rises are bigger

Last autumn, the government announced that employees would pay 1.25p more in the pound in National Insurance contributions from this April.

And a year ago the chancellor announced that he would freeze the amount you can earn before paying tax or paying it at the higher rate.

Normally, governments increase these personal allowances each year, so that someone can get a pay rise that matches the cost of living without getting dragged into paying a higher tax rate.

The decision to freeze these thresholds increases the amount of tax that the government earns from peoples' salaries. Helen Miller, deputy director of the Institute for Fiscal Studies think tank, calls it "a tax rise".

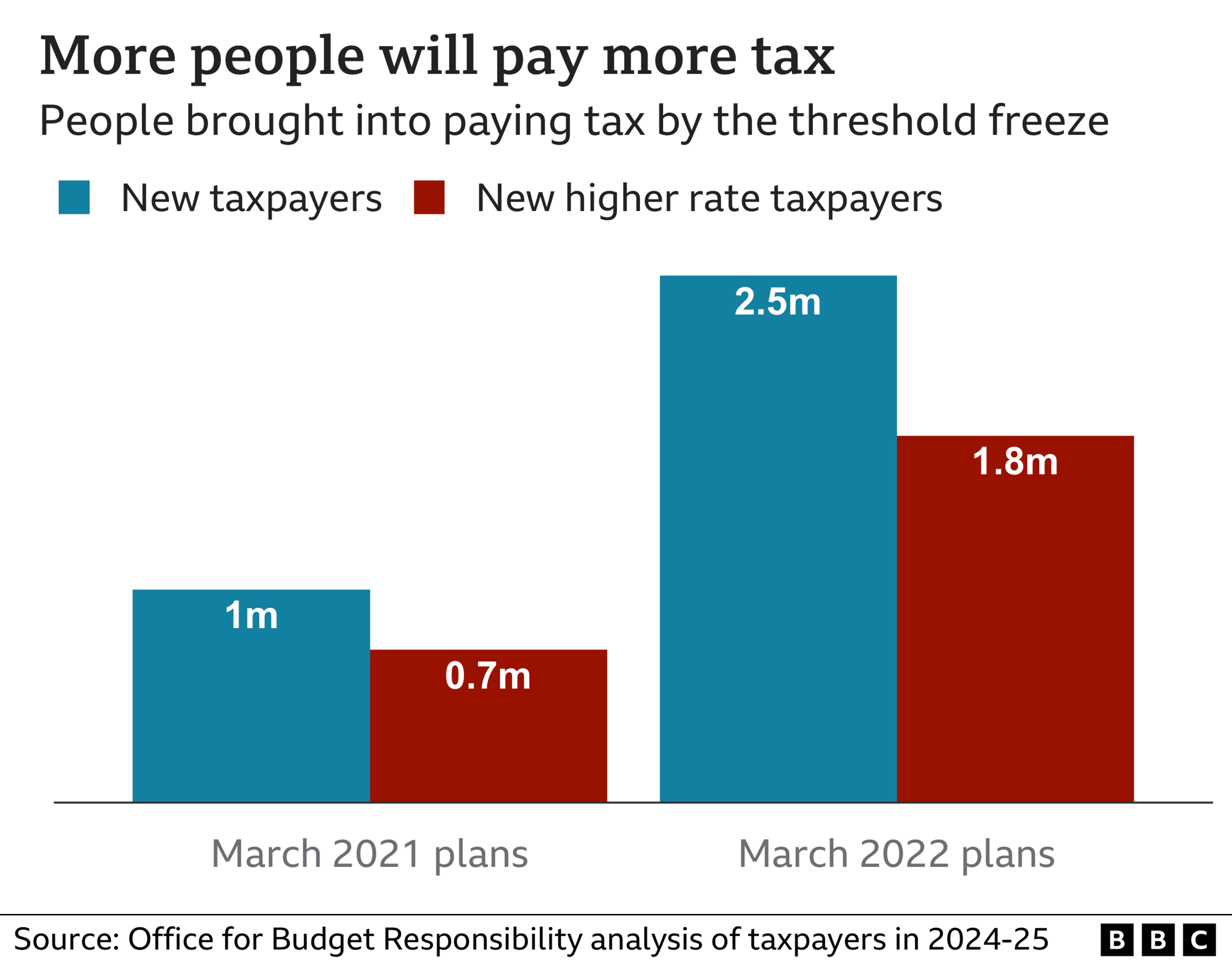

The Office for Budget responsibility says that, by 2024, 2.5 million more people would be paying tax than would have been the case if tax thresholds had not been frozen.

And another 1.8 million extra people will be brought into paying the higher rate of tax. Both figures are larger than was expected when the policy was first announced last March.

Overall "for most people, personal taxes are going up", explains Helen Miller. She says that next year "workers earning between around £10,000 and £25,000 will see a cut in their personal taxes as a result of the policy changes. But, by 2025-26, accounting for all changes, almost all workers will be paying more".

Who will pay the most?

Overall, the planned tax increases will hit the highest earners hardest.

The higher thresholds for National Insurance will help lower paid workers while those who earn more will feel the full effect of the 1.25% increase.

The Resolution Foundation estimates that, taking into account both National Insurance and income tax changes, a household on average earnings would be about £535 worse off by 2024-25.

They say that households in the top 10% will be hit harder, losing out on about £2,000, which is also a larger share of their disposable income.

Total tax burden the highest since the 1940s

Taking together the effect of changes to personal taxes and business taxes, the Office for Budget Responsibility says that the government's tax take will rise to 36.3% of GDP by 2026-27.

This would be the highest amount of tax in relation to the size of the economy since the 1940s.

Additional reporting by Daniele Palumbo