The teenagers helping to save - not spend - their parents' money

- Published

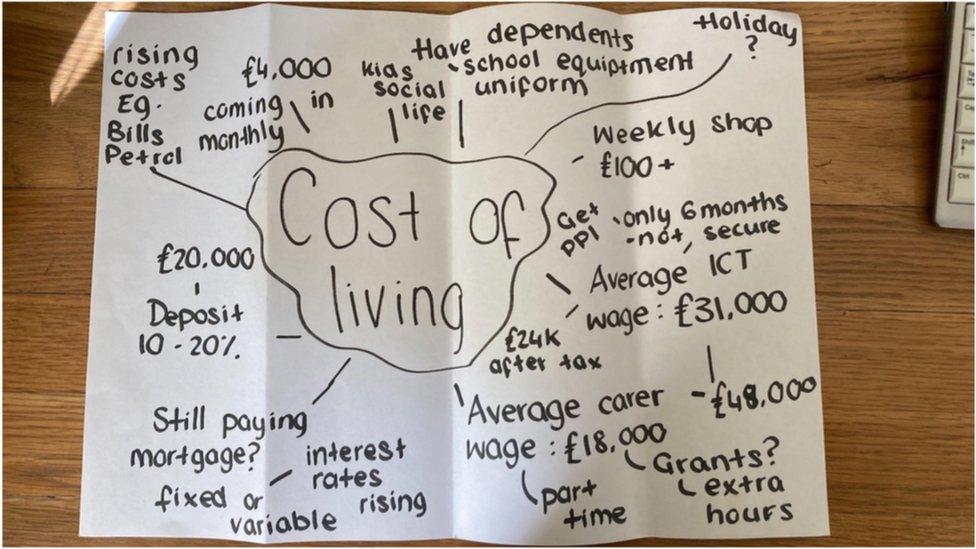

Finance class at Eirias High School where pupils learn about budgeting

Life as a teenager means rarely straying too far away from the fridge or the TV. With the cost of food and energy driving the UK's fastest rise in prices for 40 years, it leaves many families with soaring bills.

Many youngsters will be oblivious to the costs, but innovative finance lessons at one school in Colwyn Bay, north Wales, are allowing young pupils to teach their parents a thing or two about budgeting.

As the cost of living continues to accelerate, this is what it means for a pupil, a mum, and the teacher at the helm.

Oscar - the teenager

Towering teenager Oscar loves to get a takeaway with his friends.

"I've noticed it getting a lot more expensive, particularly because of the delivery costs. We might have to eat toast instead," the 18-year-old says.

Oscar has a part-time job, like most of his friends

He also loves to play video games at home, but the smart meter tells him and his mum that it "eats up the power".

Food (93% of respondents), gas and electricity (86%) and fuel (80%) are cited by consumers as having the biggest impact on their cost of living, according to a survey, external by the Office for National Statistics (ONS).

That is no surprise to Oscar and, thanks to the finance lessons and a recently completed A-level in the subject, he is well placed to do something about it.

"We learnt how to budget. It is a huge topic and very helpful at the moment," he says. "I also know my rights to pay and benefits."

Some of the schoolwork focusing on the cost of living

He has a part-time job in McDonald's and plans to stay if he gets the grades to study politics at university.

"The job helps me buy some of my own food to alleviate the pressure on my mum," he says. "I've offered some money for the bills, but she's said no to that.

"I've made the financial decision to live at home when I go to uni, which should help out.

"After the lessons, I've definitely taught my mum some things about finance!"

Claire - the mum

As a full-time master's student, Oscar's mum Claire has to drive to study and for work placements - just when the price of filling the tank has soared.

"It has gone up massively. I budget for about £30 a week. At the start of the year, I could fill up the car for about £50, but now it is £70 or £80," the 46-year-old says.

Claire says she now buys only essential range food

She says the food budget of £60 a week is very stretched, and the electricity is expensive with two teenagers in the house.

Spreading a supermarket own-brand jam on two slices of toast for breakfast, she says: "We've had to cut back on things like snacks and any luxury items, and just get the essential items. My fridge isn't full like it used to be. It has just got food for meals in there now, and that's it.

"I cringe when I see the smart meter ticking by. It resets on a Sunday, so I'm shouting at Oscar on a Saturday night to get off the computer, which doesn't necessarily go down very well.

"I'm struggling to contemplate what it is going to be like in October, when the gas prices go up."

Thankfully, she says, the youngsters are more aware of the impact they have on the family finances owing to the money lessons at school.

Nicola - the teacher

Nicola worked in banking for nearly 20 years until 2012, before becoming a finance and maths teacher at Ysgol Eirias.

"The finance lessons are to make them more aware of what is going on when they get out into the real world and have to manage their own money. We want them to avoid the bad debt that goes with the high cost of living at the moment," she says.

Nicola Butler uses her pupils' own experiences for money lessons

The age group she teaches want to drive, but the cost of everything involved in learning, as well as owning and running a car is "astronomical", she says. Even so, they are now well-versed in budgeting and taking on casual jobs to pay for it.

Her pupils' own experiences are fruitful for teaching, she says, such as a lesson based around one girl's monthly repayments to cover the cost of her hair extensions.

"They are young adults, with their own situations. I encourage them to talk about it, and see how we can solve it in the classroom. I'd like to think they use it to help with the cost of living at home. We are getting some great feedback from parents.

"There is a big gap in financial literacy of people inside and outside of school. That gap needs filling, and if I can do that via the classroom and via the pupils in the classroom, then great."

Such examples drew the attention of the judges when she won the interactive investor Personal Finance Teacher of the Year Award last year - an accolade for which she was nominated by her pupils. Organisers are now inviting nominations and applications for this year's award, external.

Pupils' top tips for teenagers

Eirias High School pupils (l-r) Ellis, Libby, Olivia, Boe, Luca and Oscar offer their tips

We asked a group of teenagers learning finance at Eirias High School for their money tips as prices rise:

Ellis: Think about your own finances - don't just think your parents will cover it. Walk to keep costs down

Libby: Keep your money for what you really need

Olivia: Don't waste your money just to follow a trend

Boe: Start saving now to prepare for the future because the cost of living is going to carry on increasing

Luca: Establish your priorities, avoid those little spends that can build up and have a long-term plan in mind for the big purchases

Oscar: Save as much as you can and keep that money safe

- Published17 June 2022

- Published1 July 2022

- Published1 July 2022

- Published1 June 2022