Two million workers free from National Insurance

- Published

- comments

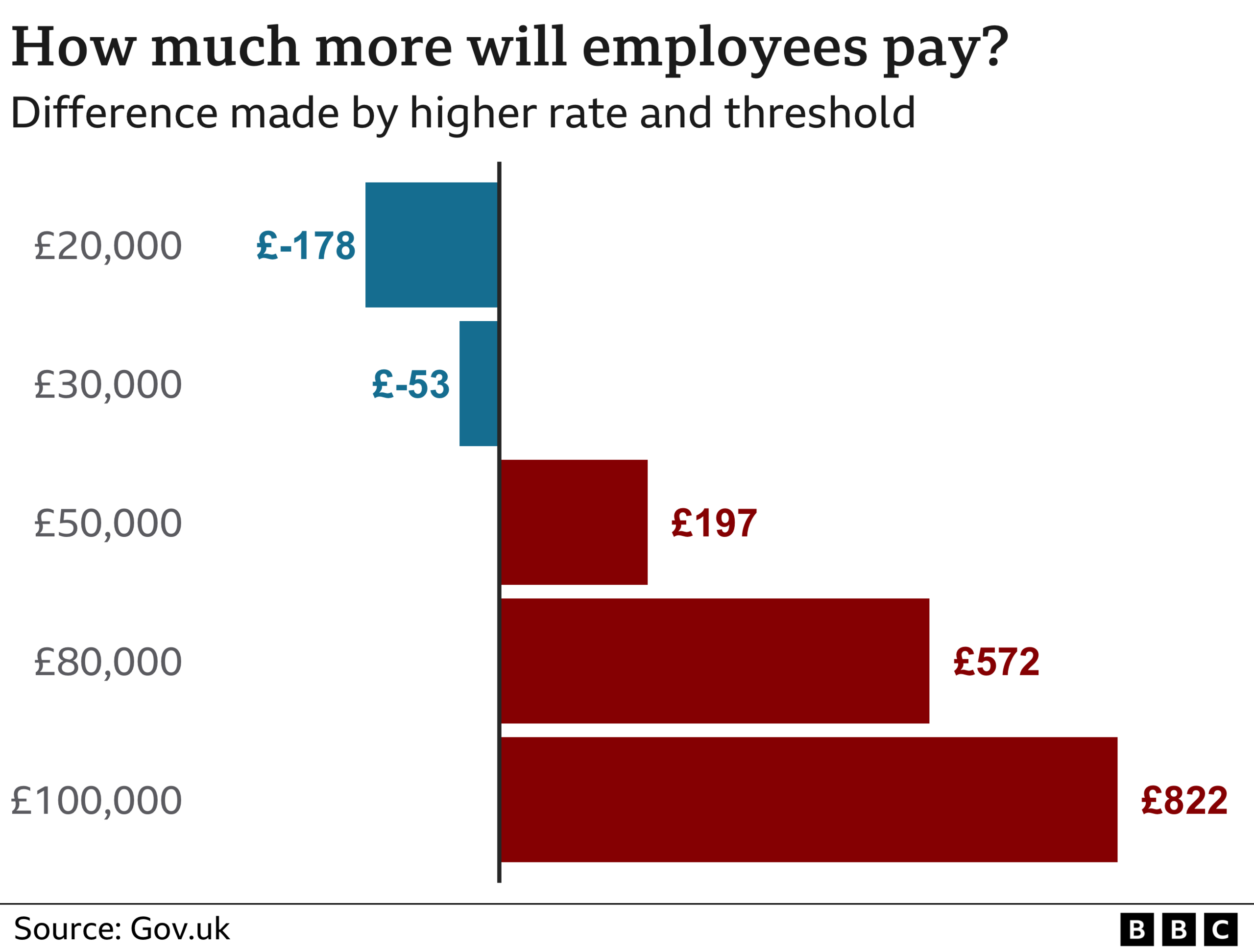

An employee earning £20,000 a year will pay £178 less National Insurance in 2022-23 than they did the previous tax year

More than two million low-income workers will no longer pay National Insurance from now, owing to a change in the way the tax is collected.

Employees can now earn £12,570 a year before paying National Insurance, up from £9,880 a year previously.

Although, in April, the government increased the rate paid - to raise money to fund health and social care.

Taken together, these changes mean workers earning less than about £34,000 a year will pay less.

Analysts said the latest change, which takes effect in pay packets from Wednesday, marks another turn in the "swings and roundabouts" of National Insurance policy.

While helping individuals manage the rising cost of living, any savings could quickly be cancelled out by increasing prices and bills, they said.

Three-stage change

Employees across the UK pay National Insurance on their wages, employers pay extra contributions for staff, and the self-employed pay it on their profits.

The first alteration to payments came in April, when employees, businesses and the self-employed started paying an extra 1.25p in the pound.

It meant that, instead of paying National Insurance contributions of 12% on earnings up to £50,270 and 2% on anything above that, employees now pay 13.25% and 3.25% respectively.

The self-employed have seen their equivalent rates go up from 9% and 2%, to 10.25% and 3.25%.

Ministers said the money raised was earmarked for health and social care in England, and would be available to the administrations in Scotland, Wales and Northern Ireland to spend in the same way.

The move met with disapproval from opposition parties and some backbench Conservative MPs as it coincided with price rises, and increases in energy bills.

Rishi Sunak, when chancellor, responded by raising the earnings threshold at which National Insurance starts to be paid by employees to £12,570 - a policy that has now taken effect.

The government said that 2.2 million workers would be taken out of paying National Insurance contributions completely, and would still receive credits towards their future state pension. Seven in 10 employees would be better off as a result of the changes, it said.

For example, an employee on £20,000 a year will pay £178 less National Insurance in 2022-23 than they did the previous year, while someone on £50,000 will pay £197 more.

The final change comes in April 2023, when National Insurance rates return to their previous level. The extra 1.25% charge will be collected as the new Health and Social Care Levy and, unlike National Insurance, will also be paid by state pensioners.

Many employers now find themselves paying more in National Insurance

Alice Haine, personal finance analyst at investment platform Bestinvest, said the savings for some people "could be the difference between having dinner every night and sometimes going without".

"For others, however, that amount will barely make a dent in their budgets as they struggle to pay the household bills amid rampant inflation as soaring food, fuel and energy prices become the norm," she added.

Many employers are paying more in National Insurance, and business groups say that may affect their capacity to pay higher wages.

"Higher employer National Insurance contribution rates still mean less money in the economy for pay rises, let alone sustainable investment, recruitment and discretionary spending," said Tina McKenzie, from the Federation of Small Businesses.

Overall, the increases in National Insurance for employers and higher-income workers will raise an extra £10.9bn in a year for the government, according to the Institute for Fiscal Studies.

Steven Cameron, director at pensions company Aegon, said that ministers had been "playing swings and roundabouts" with income tax and National Insurance.

That was because the income tax threshold, known as the personal allowance, was frozen in the April 2021 Budget until 2026. The earnings level at which the higher rate of tax is paid has also been frozen.

The result is that some people receiving pay rises are being drawn into a higher income tax bracket.

- Published6 November 2022

- Published30 June 2022