Backing for Adam Neumann's new firm prompts outrage

- Published

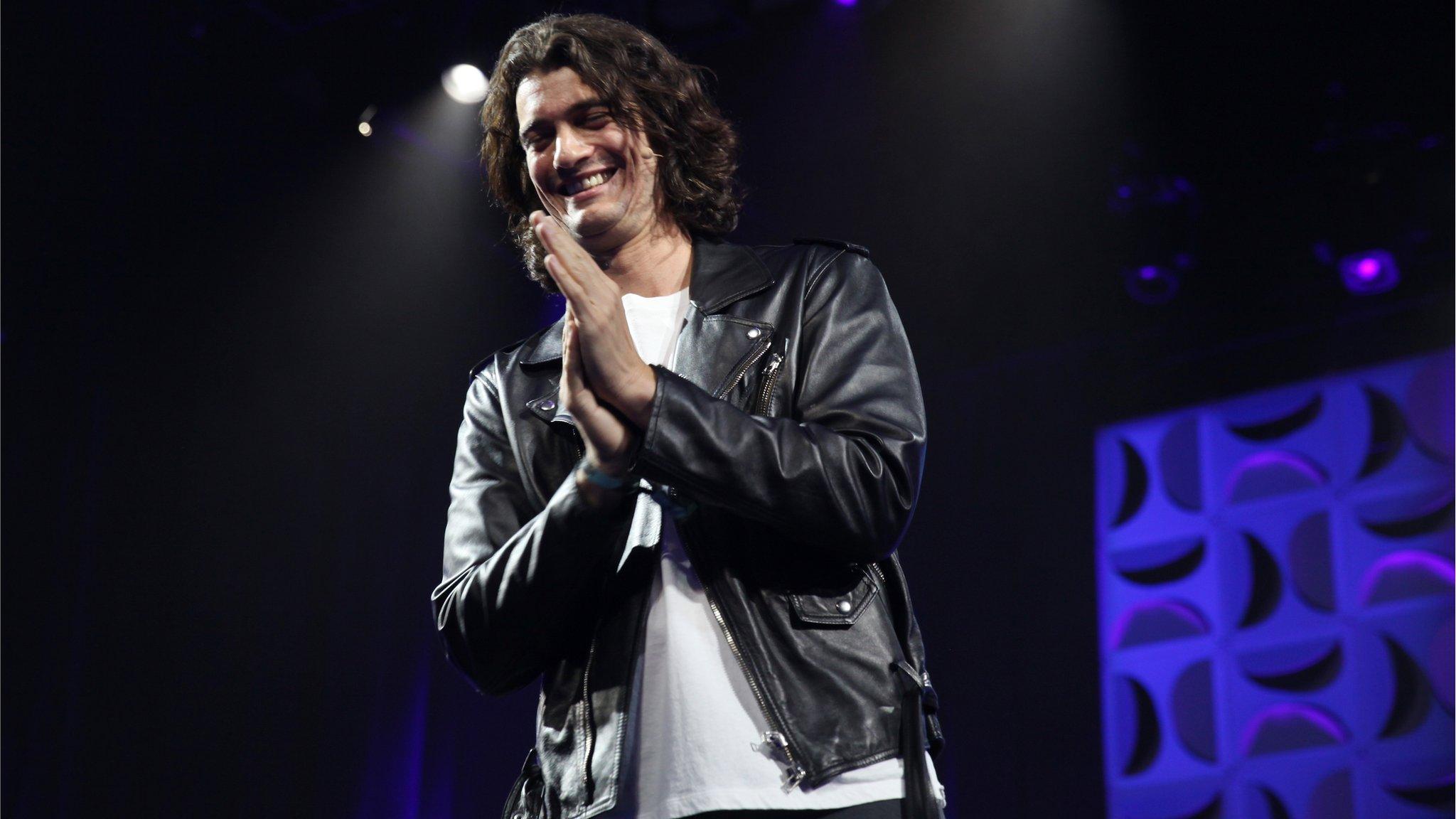

Adam Neumann is readying for a comeback

Adam Neumann left WeWork, the once globally-hyped, now much-diminished, office space sharing company, under a cloud of questions about his management.

Less than three years later, he appears poised for a comeback.

The long-haired entrepreneur, whose staggering rise and fall has inspired reams of articles, several books and a television drama starring Anne Hathaway and Jared Leto, made headlines this week for winning hundreds of millions of dollars in backing for a new property venture - this time focused on apartments.

In the process, he also ignited another firestorm.

Details about Mr Neumann's new company, called Flow, are scant. In January the Wall Street Journal reported that Mr Neumann had purchased stakes in more than 4,000 apartments in the US, with an aim to create a "widely recognised apartment brand, stocked with amenities".

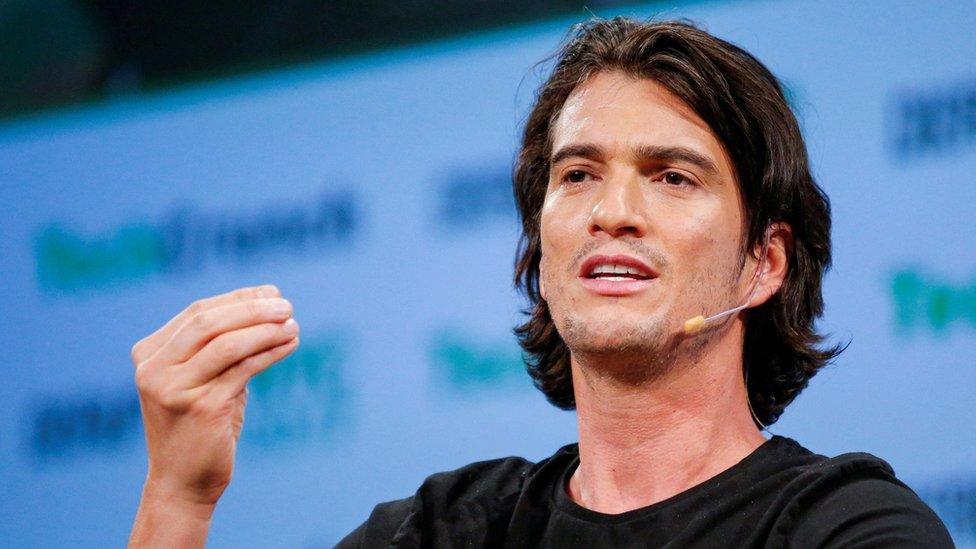

But this week storied Silicon Valley venture capital firm Andreessen Horowitz announced it was backing the firm, praising Mr Neumann as a "visionary leader" who had "fundamentally redesigned the office experience" and betting he will do the same for rental life.

The New York Times, which first reported the deal, wrote that Andreessen had invested $350m (£290m) - "the largest individual cheque" the investment firm has written for a start-up. It said the deal valued Mr Neumann's new venture at more than $1bn.

Making waves

"We love seeing repeat-founders build on past successes by growing from lessons learned," Marc Andreessen wrote in a blog.

"We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes. Residential real estate — the world's largest asset class — is ready for exactly this change."

WeWork aimed to revolutionise the world of work by offering co-working spaces in big cities

Flow, which did not respond to a request for comment, is set to launch next year, according to its website.

Andreessen Horowitz, which has backed Mr Neumann before, also did not respond to a request for comment. But the firm's vote of confidence has other investors raising eyebrows at the lofty language surrounding the plans, while others are pointing to the episode as a sign of the relative ease with which white men can raise money in the tech world, compared to women and other under-represented groups.

"There is a reason why this is making such waves.... Because of the size of the cheque, because of the unprecedented funding of somebody who has been popularised as an immoral business person, it creates a more emotional reaction," said Allison Byers, founder and chief executive of Scroobious, which aims to help start-ups led by under-represented groups find funding.

She was one of many who took to social media to express frustration at the investment. "For anyone else, we're held to these impossible standards. That's the outrage."

And the giant bet on Mr Neumann comes at a time when much of the tech industry is facing a slowdown, that's making it harder for start-ups to raise money and has led to layoffs and hiring slowdowns or freezes.

Failing up

Investor Leslie Feinzaig, founder and managing director of the venture fund Graham & Walker, said in that context the reported size of the investment in a yet-to-launch company felt like a "gut punch".

"My immediate reaction was, 'Man, I wish women had the same opportunity to fail up as spectacularly as Adam Neumann has,'" said Ms Feinzaig, whose firm has focused on investing in firms founded by women.

Companies founded solely by women secured just 2% of venture capital in the US last year - the smallest share since 2016, according to Pitchbook. Companies with black founders accounted for even less, according to Crunchbase.

"Great entrepreneurship is the ability to come back from mistakes and come back from stumbles. But Andreessen didn't just give this guy a chance," Ms Feinzaig added. "It's like they're celebrating Adam Neumann instead of giving him a chance, and that part feels hard."

Mr Neumann's new venture aims to change the US home rental market

There are doubts more broadly within the property world, despite Mr Neumann's obvious strengths.

Mr Neumann, an Israeli-born entrepreneur, is known for his charm and charisma, which helped build WeWork into a a internationally recognised brand. But in 2019 plans to float shares on the stock market imploded as questions swirled around financial losses, and links to Mr Neumann's personal finances. He received an exit package worth more than $1bn, including $200m in cash.

WeWork finally listed last year in a deal that valued the firm at $9bn, down from $47bn at its peak. It's now worth $4.2bn.

But Mr Neumann appears undaunted by that experience - or sees an opportunity to make money that looks too good to pass up.

Rents are rising at a historically rapid pace, up 14% in the 12 months to July in the US according to a recent Redfin report, and the high cost of buying a home is pushing more people into the rental market.

But in the industry there remains widespread scepticism over Mr Neumann's latest ambitions to shake up the market, where many of the country's biggest companies are already active, said John Drachman, co-founder of established real estate firm Waterford Property Co.

"Adam is clearly an incredible sales person and he can create a narrative and a vision. He was very successful at raising a lot of capital for WeWork," he said.

But in the property world, people are still reserving judgement. "There was a heavy, heavy scepticism when this came out. There's a thought of, is this WeWork part two? And only time will tell."

Related topics

- Published26 March 2021

- Published25 September 2019