New shared banking hubs to open in 13 more places

- Published

- comments

A trial bank hub, run by the Post Office and shared by five mainstream banks, opened in Essex last year

Another 13 locations have been earmarked for shared banking hubs in areas where the last branch has closed.

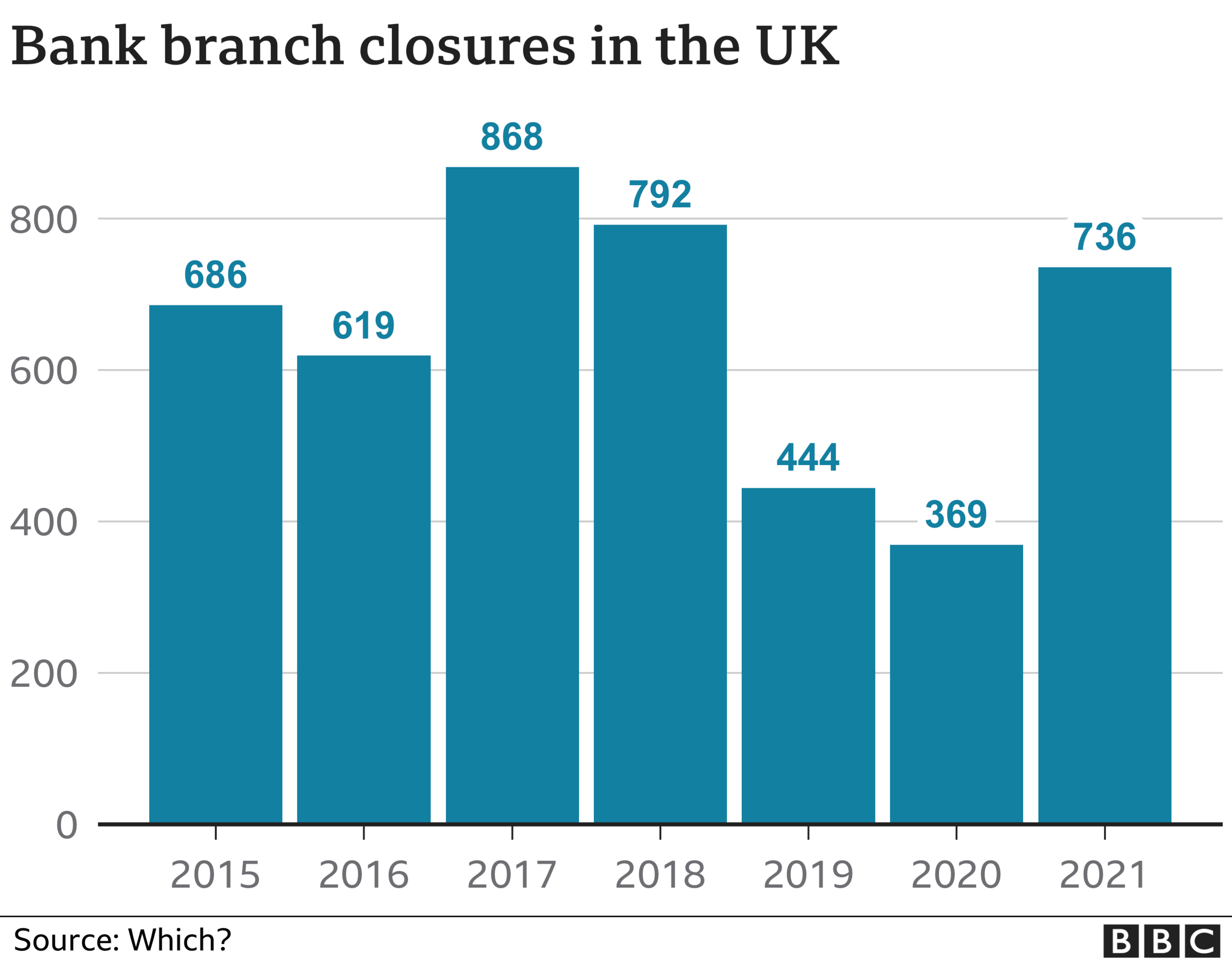

A swathe of branch closures have raised concerns about access to cash for those who need it, and difficulties for small businesses trying to deposit takings.

Ten other areas were previously identified, but the doors have yet to open on any of their new hubs.

Ministers have prepared legislation to ensure people can access cash locally, while experts say hubs are not enough.

"Cash is disappearing at a frightening rate, and so are ATMs and branches and it is not acceptable to leave communities without access to cash," John Howells, chief executive of Link - which is the biggest interbank network in the UK - told BBC Radio 4's Today programme.

"There is real investment and effort going in by the banks now…But now that pace needs to be picked up," he added.

At these hubs, customers of any bank can access their accounts, deposit cash and cheques, and withdraw money at any time. Trickier enquiries are dealt with by a representative from one of each of the major banks who each visit once a week.

Among the 13 new proposed banking hub sites, four are in Scotland and, for the first time, one is in Northern Ireland, in Kilkeel.

They will be in Brechin in Angus, Forres in Moray, Carluke in Lanarkshire, Kirkcudbright in Dumfries and Galloway, Axminster in Devon, Barton-upon-Humber in Lincolnshire, Lutterworth in Leicestershire, Royal Wootton Bassett in Wiltshire, Cheadle in Staffordshire, Belper in Derbyshire, Maryport in Cumbria, Hornsea in Yorkshire, and also in Kilkeel.

The BBC visited a prototype shared banking hub in Rochford, Essex, and was told it had been "a lifeline" for many people living in the area after the last branch in town closed.

Running costs are the same as a small branch, but are shared between different banking groups that use it.

Natalie Ceeney, who chairs the Cash Action Group which is overseeing the project, said: "Cash still matters hugely to millions of people across the UK and with the cost-of-living crisis biting, more and more people are turning to cash as a way of budgeting effectively. Banking Hubs are an important part of the solution."

Wait to open

Each time a core banking service such as a cash machine or bank branch is closed, an assessment is carried out by Link - the organisation which currently oversees the UK's ATM network.

The review studies the cash needs of the community, such as how easy it is to travel to the nearest alternative service, as well as the demographics and vulnerability of local residents. The criteria are set by a group of banks and consumer representatives.

The latest locations have been identified as part of that work.

However, it can take months for these new hubs to open. As well as finding a suitable premise, often changes are needed to ensure it is fully accessible and secure enough for banking services.

There has been some criticism that services have not yet started in any of the previously-announced locations for banking hubs, apart from the two trial premises in Rochford and Cambuslang, in Scotland.

Ron Delnevo, a business consultant with years of experience in the ATM industry, said that "the promised hubs don't even scratch the surface in terms of satisfying the banking needs of the UK".

Mark Aldred, of banking technology company Auriga, said: "As we go into a cost of living crisis that's hitting households and businesses alike, these shared hubs are good on paper but could go further and faster."

A Financial Conduct Authority spokesperson said: "Firms need to pick up the pace and deliver more banking hubs. We expect this to be done as a priority.

"Banks and building societies must treat their customers fairly and provide alternatives to branches where needed. Banking hubs are one of a range of tools they can use to ensure communities have easy access to bank services and cash."

In addition to the hubs, withdrawal and deposit machines - which are unstaffed but can allow businesses to cash in their takings - will be placed in libraries and community centres and available during their opening hours.

They will be in Swanley and Faversham, both in Kent, Holywood in County Down, Shanklin on the Isle of Wight, Atherstone in Warwickshire, Billericay and Dunmow, both in Essex, Bourne in Lincolnshire, Holyhead on Anglesey, llfracombe in Devon, Swanage in Dorset, and Wallingford in Oxfordshire.

The government has been planning to bring in new laws to ensure people only have to travel a relatively short distance to access cash withdrawal and deposit services.

This is seen as vital to the future of cash, and particularly for its acceptance by businesses in rural communities who currently find they are shutting and travelling miles for their nearest banking services.

Related topics

- Published25 June 2021

- Published28 April 2021

- Published15 December 2021

- Published18 August 2022