Rich to get twice as much cost-of-living support, says think tank

- Published

Rich households will receive twice as much support aimed at reducing the cost of living than poorer households next year, a think tank has claimed.

The Resolution Foundation said if the government cuts National Insurance and limits energy bill rises, richer homes will get support worth £4,700 in 2023, compared to £2,200 for the poorest.

A typical household energy bill will be limited to £2,500 annually until 2024.

The think tank said "details and costings" were missing from the plan.

Support for the richest tenth of households will "far exceed the level of support for the poorest tenth of households despite the latter being most exposed to high energy bills", the Resolution Foundation, which focuses on low to middle income households, said.

The huge support scheme could cost up to £150bn, but Prime Minister Liz Truss has refused to put a figure on it, saying "extraordinary times call for extraordinary measures".

The Department for Business could not offer a comment when contacted by the BBC, due to the period of national mourning.

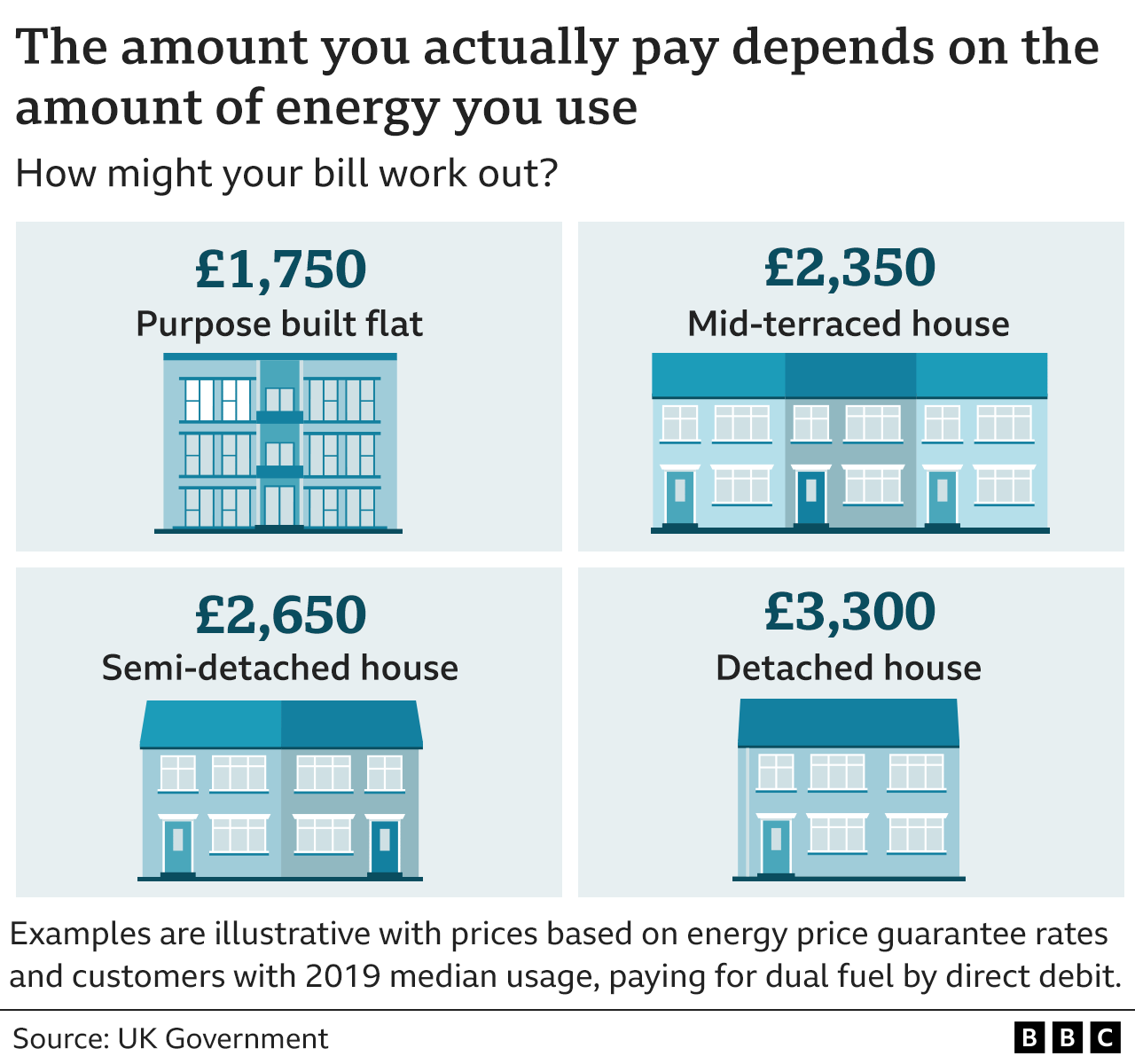

Under the government's Energy Price Guarantee, suppliers are limited in the amount that can be charged for each unit of energy.

For a typical household - one that uses 12,000 kWh (kilowatt hours) of gas a year, and 2,900 kWh of electricity a year - it means they will pay an average of £2,500 a year on their energy bill for the next two years.

Without this intervention, that annual bill would have been £3,549 a year. Last winter it was £1,277 a year.

The support with energy bills will be available for households in England, Scotland and Wales with equivalent assistance for Northern Ireland.

Torsten Bell, chief executive of the Resolution Foundation and former Labour adviser, said the government's support was "colossal" and "bold", but warned families should "still expect a tough winter ahead", but still said limiting bills was "absolutely the right thing to do in terms of providing support where it's needed."

The Resolution Foundation said the "near-universalist intervention" fitted with previous support offered in the form of a £150 council tax rebate and a £400 energy bill discount.

The think tank added that targeted help had also been provided for lower income households through the benefits system, but said tax cuts benefitting the richest half of households meant "the total package of government support now in place to support incomes in 2022-23 provides no more support to poorer than richer households".

The Energy Price Guarantee comes with an enormous price tag for the government. Although they won't state how much it may total, this report suggests it could be bigger than the banking bailout during the financial crisis. Think about that for a second.

Although welcomed as some action after a summer of stasis, there are plenty of organisations saying that this huge sum of money is flowing in the wrong direction.

Although most households had been facing the same huge price increase in October, those price rises do not affect everyone in the same way. Those with less money spend proportionately more of their income on energy, and are likely to have smaller properties to heat, which means they won't save as much with this guarantee, and will still struggle to pay bills at the current rate.

There will be what the government is calling a "fiscal event" this month, and the pressure is mounting on the government to provide more detail and more targeted help for the poorest households. Although this was the first announcement of Liz Truss's premiership, the scale and the repercussions mean that it is likely to be the economically defining one.

Paul Johnson, director of the Institute for Fiscal Studies (IFS) recently described the support package as "very poorly targeted".

"Finding a way of targeting [support] to the many, many millions who really need it, without giving it to the many, many millions who don't, appears to be something that has stumped the Treasury and the government for finding a mechanism of achieving that," he said.

The state intervention will be funded by government borrowing, adding to the UK's already large debt pile. The total cost of the support will depend on the cost of energy on the international energy markets, which can be volatile.

Mr Johnson questioned: "Is it the best way of spending the money?

"I rather suspect it is an inevitable way in the short run if everybody who needs help is to get that help, but I do think it's incredibly important that the government thinks through and gets to a better or more targeted way of supporting us as we get through to next winter."

Ms Truss has rejected calls to extend a windfall tax on gas and oil company profits to pay for the package, after calls from the Labour party, the Liberal Democrats and the SNP to do so.

A windfall tax is a one-off tax imposed by a government on a company. The idea is to target firms that have benefitted from something they were not responsible for - in other words, a windfall.

Mr Bell said that by ruling out "any attempt" to fund the government's new support through further windfall taxes, "the welcome support today could have a nasty sting in terms of higher mortgage payments and higher taxes tomorrow".

A mini-Budget outlining how the government intends to pay for measures to tackle the cost-of-living crisis is set to take place this month.

Other plans include lifting the ban on fracking and new licences for North Sea oil and gas, to boost domestic energy supplies.

- Published22 September 2022

- Published13 September 2022