Treasury refuses to publish UK economic forecast

- Published

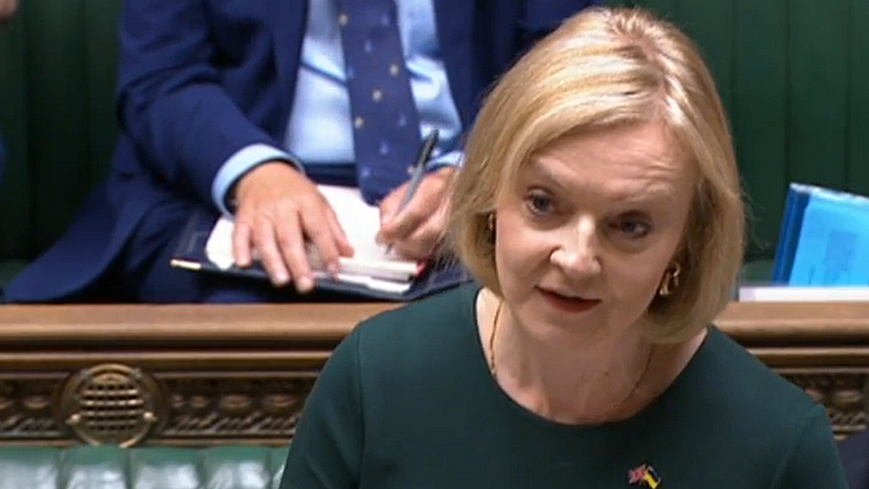

The Treasury is refusing to publish a forecast of the UK's economic outlook alongside this Friday's mini-Budget.

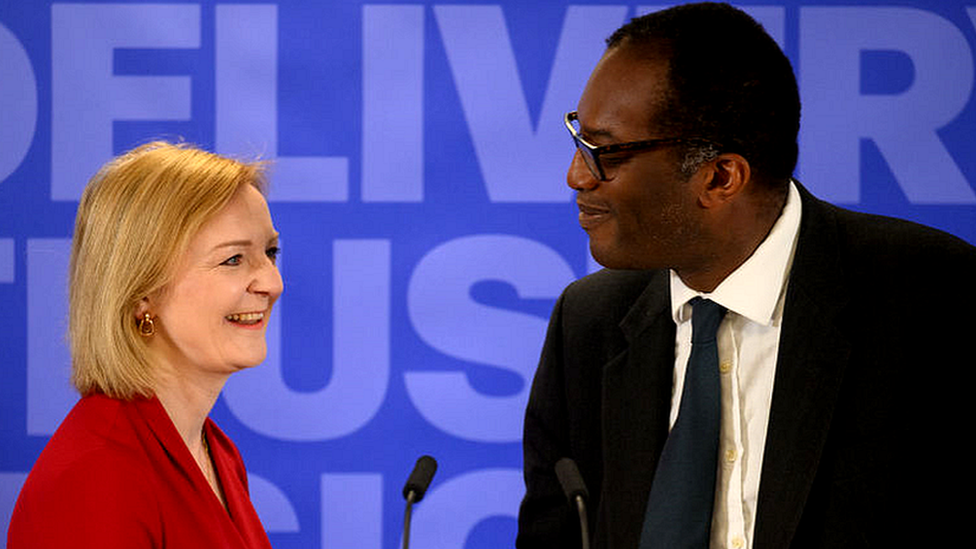

Independent forecaster the Office for Budget Responsibility (OBR) has already provided a draft to Chancellor Kwasi Kwarteng, the BBC understands.

The Treasury Select Committee says a forecast is "vital" given recent government moves to curb living costs.

Action to cap annual energy bills could cost about £150bn, and tax cuts are expected on Friday.

The mini-Budget is expected to see the government reverse a rise in National Insurance and scrap a planned increase in corporation tax, which reports say could cost £30bn.

The draft forecast the OBR has provided does not include the impact of the energy bill help. It has offered to provide a forecast including this impact, but that has been rejected.

The fact the offer has not been taken up is raising some concerns about whether the government's tax and spending policy is "flying blind", given predictions that the UK is facing a lengthy recession.

MPs on the Treasury Select Committee wrote to the chancellor on Tuesday seeking assurance that an OBR forecast would be published.

"These forecasts are a vital indicator of the health of the nation's finances, and provide reassurance and confidence to international markets and investors," said the committee's chairman, Mel Stride.

"There has been a deterioration in our economic outlook since the last OBR forecast in March. There have been significant fiscal interventions since then and we are told there will be further significant interventions including major permanent tax cuts to be announced on Friday.

"Under these circumstances, it is vital that an independent OBR forecast is provided."

The OBR is obliged to produce economic forecasts twice a year, usually accompanying the Autumn Budget and Spring Statement.

On Friday, there will be no independent assessment about whether permanent tax cuts and some one-off spending increases are consistent with the government's Budget rules.

The lack of OBR forecast also means it will not cast judgement on the impact of the new tax measures on growth - a key target for the government which wants to increase the trend rate of growth to 2.5%.

A spokesperson for the Treasury said: "Given the exceptional circumstances our country faces, we have moved at immense speed to provide significant energy bill support for households and businesses, and are acting swiftly to set out further plans to kickstart economic growth later this week.

"We remain committed to maintaining the usual two forecasts in this fiscal year, as is required."

In its latest long-term forecast in July, the OBR said trend growth had fallen from 2.2% to 1.4%, partly because of a declining size of the workforce.

In the City, where in recent weeks the value of the pound sterling has fallen and the cost of borrowing for the UK government has risen, there is some expectation that the Treasury will imminently have to formally increase its "remit" for borrowing.

The Financing Remit is given to the Debt Management Office based on a forecast for borrowing. Extra sales of government loans, known as gilts, also need to be co-ordinated with the Bank of England, which is planning to sell off some of the gilts it owns, as it starts to reverse its long-running programme of stimulus.

Government insiders say that the main motivation behind Friday's announcements is to enact the PM's leadership campaign promises as quickly as possible, and that a full forecast will accompany an upcoming Budget statement.

The cost of the energy package, for example, could vary considerably depending on market prices for gas, and the ability of the government to renegotiate expensive contracts for renewable energy.

- Published20 September 2022

- Published15 September 2022

- Published8 September 2022