National Insurance rise to be reversed in November

- Published

- comments

A 1.25% rise in National Insurance will be reversed from 6 November and the government will axe a planned levy to fund health and social care.

The rise was introduced in April under ex-Chancellor Rishi Sunak, but during the Tory leadership race Liz Truss pledged to change it.

The funding for health and social care will now come from general taxation.

Chancellor Kwasi Kwarteng made the announcement ahead of a "mini-budget" on Friday.

The Treasury said the change would save nearly 28 million people an average of £330 per year.

Most employees will get the tax cut in their November pay packets, with some getting it in December or January "depending on the complexity of their employer's payroll software", the Treasury said.

About 920,000 firms will get a tax reduction of nearly £10,000, it added.

National Insurance is a tax paid by employees, employers and the self-employed.

Employees pay National Insurance on their wages as well as income tax, employers pay extra NI contributions for staff, and the self-employed pay National Insurance on their profits.

"Taxing our way to prosperity has never worked," Mr Kwarteng said.

"To raise living standards for all, we need to be unapologetic about growing our economy. Cutting tax is crucial to this."

The National Insurance rise was put in place to help the NHS recover from the coronavirus pandemic, and the planned social care levy was also designed to support the NHS from April.

The levy was expected to raise around £13bn a year to fund social care and deal with an NHS backlog that built up during Covid.

You only needed to tune in to the Conservative leadership contest for a minute to know that the rise in National Insurance would be reversed if Liz Truss became prime minister.

Now we know the result of that promise will be seen in pay packets from November.

But there are so many other factors in play at the moment. This has been a topsy-turvy time for our finances.

Changes to policy, prices, bills and the economy as a whole have made it tough to budget, even for the near future.

Experts would encourage everyone to prepare the best they can. Prioritising essential bills, building a savings buffer, perhaps putting even a small amount aside for Christmas are all sensible ambitions, they say, even if the rising cost of living - and events you cannot control - make those habits so much more difficult to maintain.

There are weekly thresholds for National Insurance. There is nothing to pay on the first £242 earned per week, then it is 13.25% on earnings between £242.01 and £967 and 3.25% on the rest.

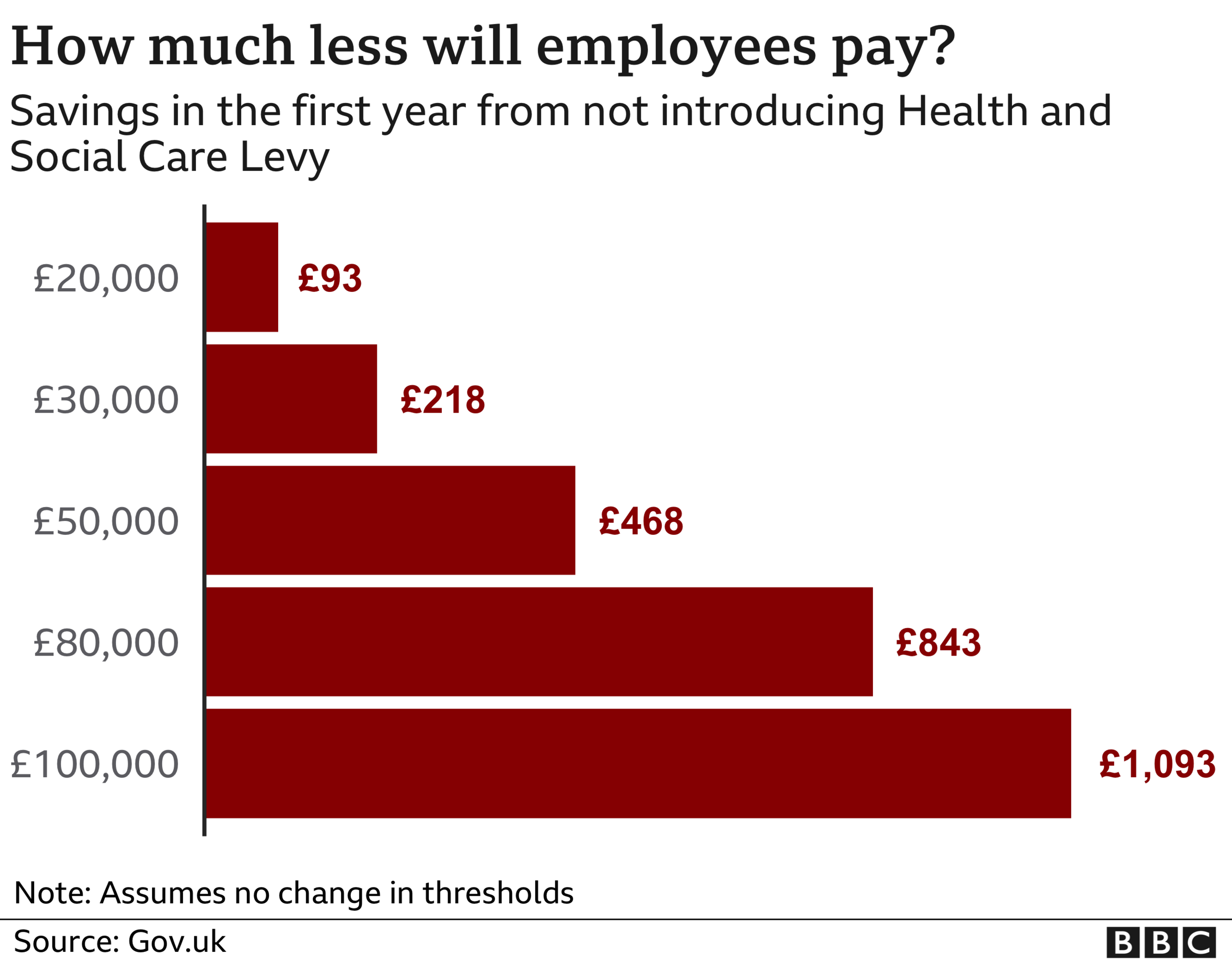

That means, in general,people who earn more than £12,570 a year pay National Insurance, and the more they earn, the more they will benefit from this change.

For example, somebody earning £20,000 will save about £93 a year, and somebody earning £100,000 will save £1,093, compared to now.

From April 2023 Mr Kwarteng will also scrap an increase to dividend tax. This change was brought in alongside the payroll tax increase to raise taxes on people paid in a different way.

Kitty Ussher, chief economist at the Institute of Directors industry body, said raising employers' National Insurance had been "a mistake".

"This was quite simply a tax on jobs, which businesses had to pay regardless of whether they are profitable," she said.

"Many of our members told us that the impact of the increase was that they would have no choice but to push up prices, making inflation even worse.

"Others said the rise in the cost of employing people meant they would think twice about taking new staff on, or potentially make the difficult decision to let colleagues go."

The government announcement came ahead of a "mini-Budget" which is expected to be announced on Friday.

Measures could include:

Scrapping a planned increase in the tax companies pay on their profits

Possible cuts to other taxes, including stamp duty which is paid on house purchases

Ending the cap on bankers' bonuses

Plans to boost economic growth, such as creating low-tax zones around the UK