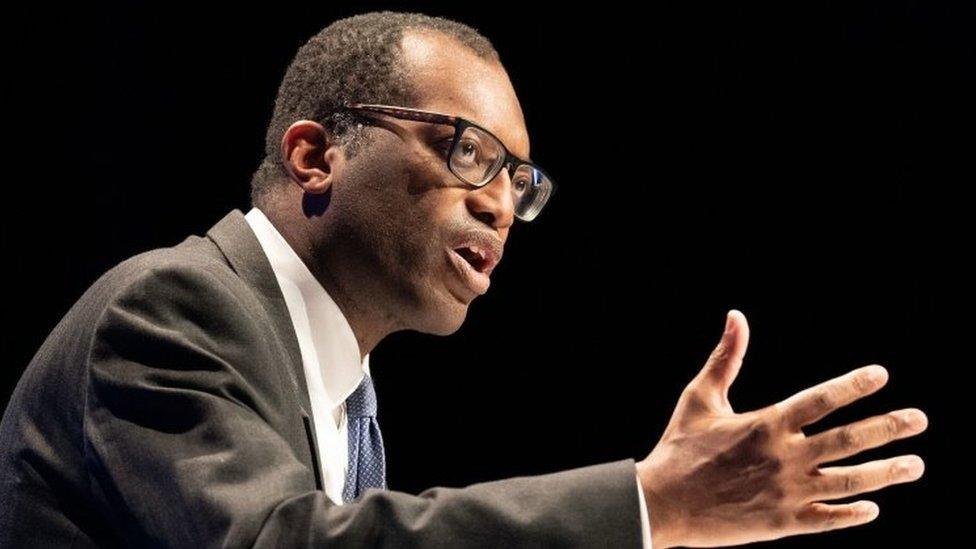

Kwasi Kwarteng quietly preparing Plan B

- Published

- comments

It was not a normal Chancellor of the Exchequer speech. The clue was in its brevity.

There was no new content, no rabbit out of the hat. As others have remarked, the top rate tax rabbit had in fact been returned to the hat on Monday morning.

The markets did not respond during the speech because there was nothing to respond to. Sterling remained up on the day, and the effective borrowing costs of government down.

Number 11 will take that after the experience of the last speech, 10 days ago.

Indeed it is difficult not to conclude that the speech, and others at this conference, have been edited to remove anything that could reignite market jitters.

That seems fairly sensible given the circumstances. It is often forgotten that Theresa May's conference speeches in 2016 at this same venue made sterling fall. But such restraint cannot have been the original plan.

Instead, significant announcements came before and after the main show on the conference floor. The markets can't wait seven weeks for hard numbers - that is the reality that Number 11 has come round to, after pressure from the chair of the Treasury Select Committee. Plan B is quietly taking shape.

It was the third time in two days Downing Street had finally accepted a market consensus view it had at first resisted.

First the PM acknowledged some mishandling of the mini-budget, then the chancellor U-turned on the top rate of tax abolition, and now those eagerly awaited numbers are being fast tracked.

Whatever the impact of these reversals in politics, they should help settle some nerves in markets. They will provide the basis for solid judgements by traders.

It shows the government is prepared to do what it takes to regain market confidence. If there was any doubt in the need for that, mortgage broker Paul Butlin - whose office is a 10-minute walk from the conference centre - could set it straight.

NatWest had just returned to the mortgage market, he told me, repricing five-year fixes at 1.5 percentage points higher than a week ago. Halifax is following suit today. As I left, the interest rate on a landlord mortgage had just doubled to over 7%, well above a commercial return.

It's affected business lending too, with big name firms facing borrowing costs of over 10%. Many cannot really raise finance at that rate and will have to turn to shareholders. What happened in last week's market turmoil is only now fully filtering into the economy.

So Plan B needs to work.

Critical decisions

The Office for Budget Responsibility (OBR) will cost all the policies announced by the chancellor and provide new numbers for extra borrowing, taking into account a slowing economy and higher interest rates.

The budget watchdog will also cast judgement on the government's claims that its raft of reform policies will boost economic growth. The less convinced the OBR is on growth, the bigger the fiscal hole.

The numbers will set the parameters for critical decisions on the extent of spending cuts required to meet the chancellor's fiscal targets, given he has promised £43bn of unfunded tax cuts.

Coalition-style austerity cuts will be difficult to balance with a cost-of-living crisis, promises to "level up" and backlogs in many public services.

While Downing Street will say that new OBR forecasts necessitate changes of this order, the experience of the top rate of tax U-turn shows that MPs will weigh them directly against tax reforms that benefit the wealthy.

The popularity of a fiscal measure does, after all, matter. Consideration of the impact of such changes on the rich and the poor is also a material factor. The desired impact on growth will have to be weighed against the impact on macroeconomic stability.

There may be a few more U-turns yet to come.

Related topics

- Published4 October 2022

- Published3 October 2022

- Published3 October 2022

- Published3 October 2022