Mortgage rate rises set to put pressure on house prices, says Halifax

- Published

- comments

The UK's housing market is showing signs of slowing and rising interest rates are set to exert "significant downward pressure" on prices in the months ahead, the Halifax has said.

The mortgage lender said house prices had been "largely flat" since June.

Prices rose at an annual rate of 9.9% in September, the Halifax said, the slowest rate since January.

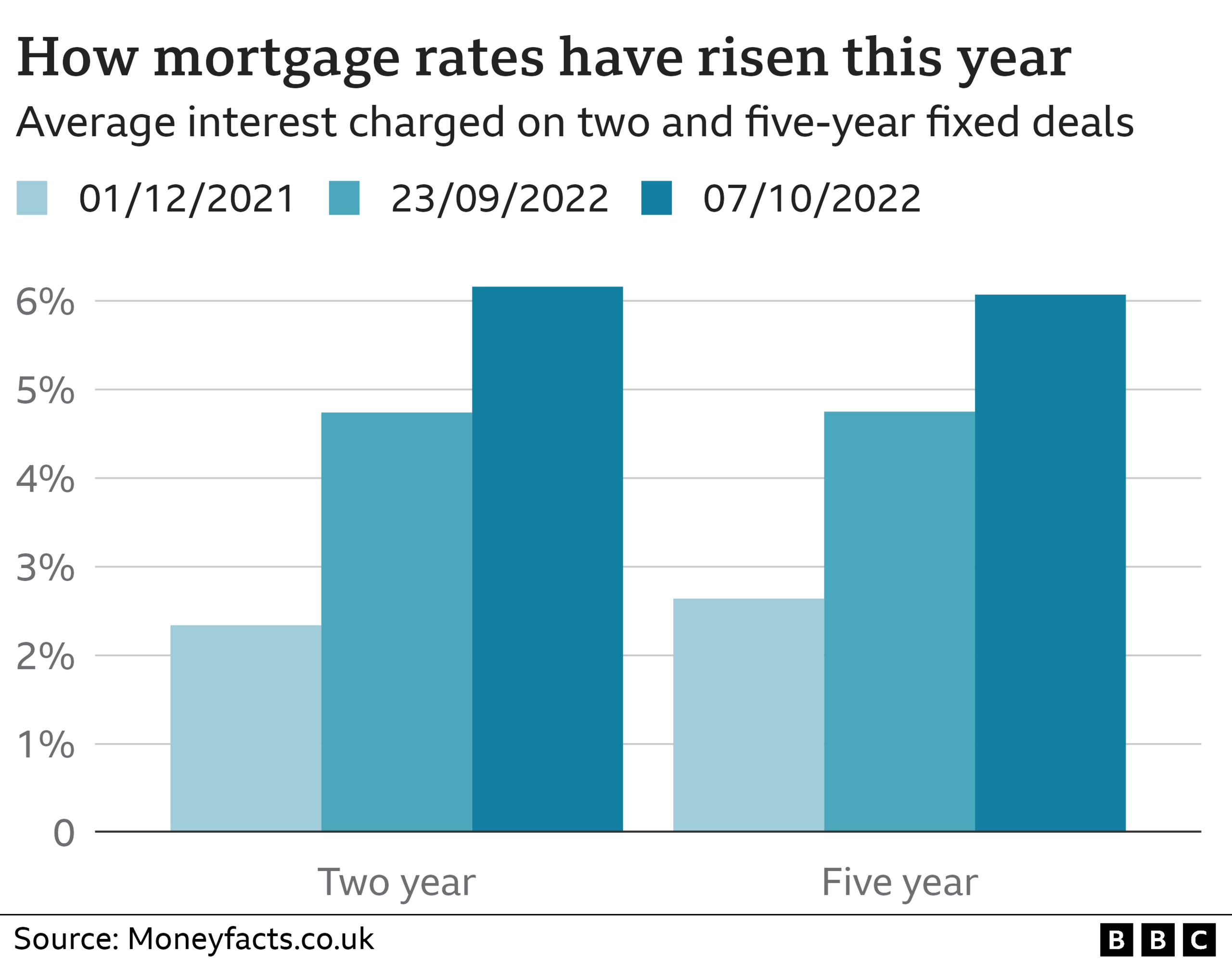

Interest rates on typical two- and five-year fixed rate mortgages hit their highest for a decade this week.

And on Friday they rose further still. The rate on a typical two-year fixed rate mortgage hit 6.16%, according to Moneyfacts, the highest for 14 years.

The rate on a typical five-year fixed rate mortgage deal has also topped 6% this week for the first time in 12 years, with the rate now at 6.07%.

Mortgage rates have been rising for months but saw a sharp increase following the mini-budget last month.

Uncertainty over future interest rates after the mini-budget also led lenders to pull more than a thousand mortgage deals from the market.

The Halifax said that house prices dipped slightly in September, external, falling 0.1% from the month before, with the typical UK property now costing £293,835.

Kim Kinnaird, director at Halifax Mortgages, said that even before the fallout from the mini-budget, its figures suggested that the housing market "may have already entered a more sustained period of slower growth".

"Predicting what happens next means making sense of the many variables now at play, and the housing market has consistently defied expectations in recent times," she added.

"While stamp duty cuts, the short supply of homes for sale and a strong labour market all support house prices, the prospect of interest rates continuing to rise sharply amid the cost of living squeeze, plus the impact in recent weeks of higher mortgage borrowing costs on affordability, are likely to exert more significant downward pressure on house prices in the months ahead."

Earlier this week, the Halifax, which is UK's biggest mortgage lender, raised its rates on a range of deals for new borrowers to well over 5%.

On Thursday, the bosses of major UK banks met the Chancellor, Kwasi Kwarteng, and the latest developments in the mortgage market were discussed.

It was reported that the chancellor is considering extending the mortgage guarantee scheme beyond December, when it is due to end, after banks raised this at Thursday's meeting.

The scheme - which was launched in April 2021 during Covid - is designed to help people get on the property ladder, as it allows homebuyers to buy a property with only a 5% deposit.

It is available to anyone buying a home costing up to £600,000, unless they are buy-to-let or second homes.

Under the scheme, the government offers a partial guarantee, generally of 15%, to compensate lenders if the borrower defaults on repayments.

Related topics

- Published7 October 2022

- Published6 October 2022

- Published5 October 2022

- Published28 September 2022