Average two-year mortgage rate highest for 14 years

- Published

- comments

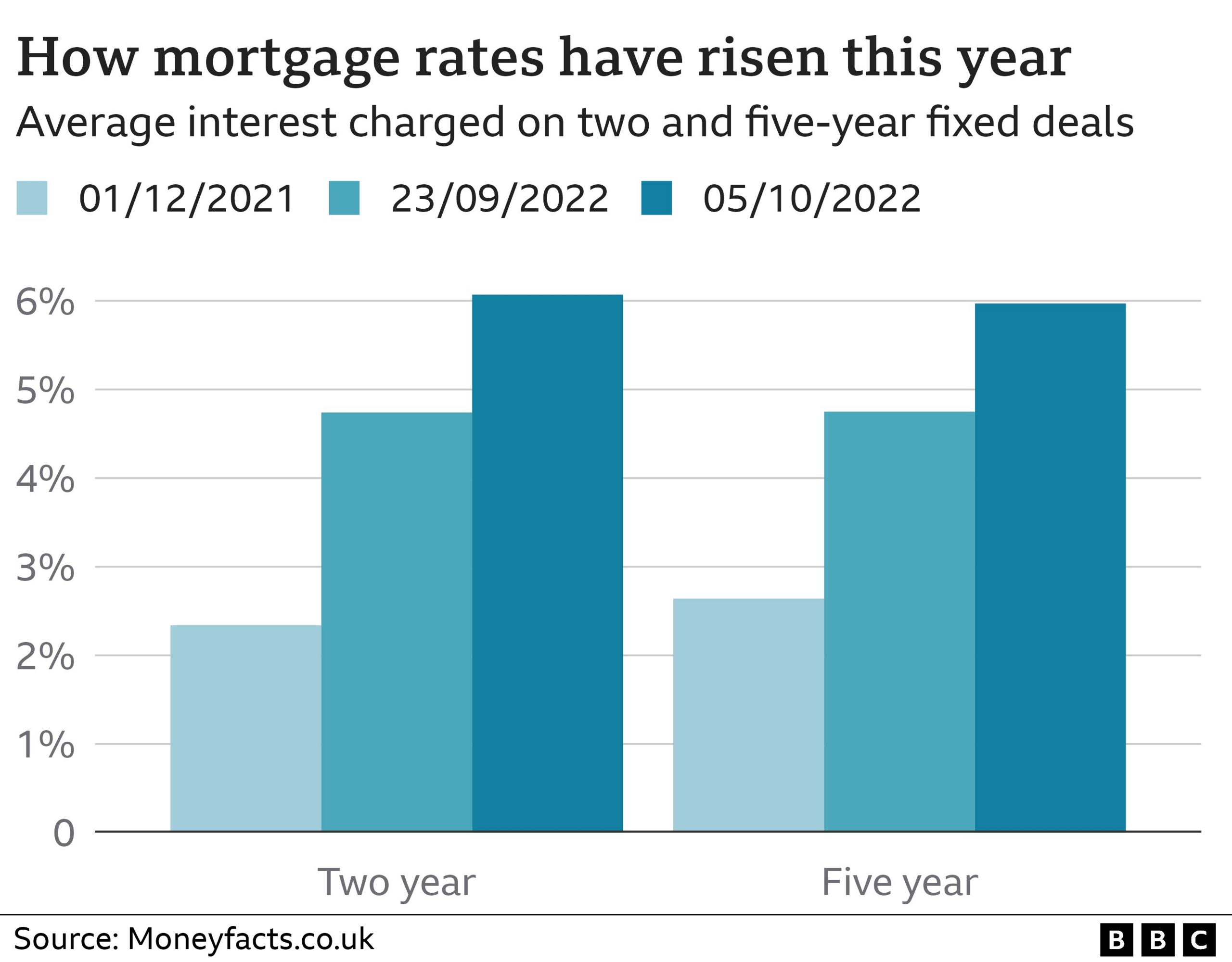

The interest rate on a typical two-year fixed rate mortgage has breached 6% for the first time in 14 years.

The typical deal has a rate of 6.07%, the financial information service Moneyfacts says, a level not seen since the financial crisis in November 2008.

Mortgage rates have been going up for months, but recorded a sharp increase in response to the fall-out from the mini-budget nearly two weeks ago.

First-time buyers and those looking to remortgage are affected.

An average of at least 100,000 people a month are coming to the end of their current mortgage, and face a significant rise in their monthly repayments.

"Borrowers may well be concerned about the rise to fixed mortgage rates but it is essential they seek advice to assess the deals that are available to them right now," said Rachel Springall from Moneyfacts.

"Fixing for longer may seem more appealing, particularly as both the average two- and five-year fixed rates rise to levels not seen in over a decade. Consumers must carefully consider whether now is the right time to buy a home or to wait and see how things change in the coming weeks."

Brokers say lenders are "playing safe" with rates amid current economic uncertainty, but costs could eventually start to dip.

Uncertainty over future interest rates after the mini-budget led lenders to pull more than a thousand deals from the market.

They are slowly starting to return - there were 3,961 products a fortnight ago, now there are 2,371 - but have become more expensive on average.

Representatives from High Street banks and mortgage lenders are meeting Chancellor Kwasi Kwarteng on Thursday, with the current situation facing borrowers on the agenda. It is understood that this is the latest in a regular series of discussions.

Bosses from Barclays, Natwest and Lloyds Banking Group are expected to attend.

The interest rate on a new, average two-year fixed deal on the morning of the speech was 4.74%, compared with 6.07% now. That is a difference of about £170 a month on repayments for somebody borrowing £200,000 on a 30-year mortgage.

A five-year fixed deal has typically risen from 4.75% to 5.97% over the same period.

That leap will be much greater when compared to a borrower's previous deal taken out two or five years ago.

Some more specialist lenders, whose customers may include those with a chequered credit history or the recently self-employed, have been raising rates to 6.5-7% or more.

In the meantime, the average standards variable rate - which by nature are changeable and are paid by 900,000 homeowners - has gone up from 4.41% at the start of the year to 5.63% at the start of October.

During her speech at the Conservative Party conference, Prime Minister Liz Truss said that the government "will do what we can" to support homeowners. However, she said that the benchmark interest rate was set independently by the Bank of England.

Related topics

- Published4 October 2022

- Published3 October 2022

- Published28 September 2022