Cash popular again due to cost of living concerns, says Post Office

- Published

Post Office branches handled increased amounts of cash in August as banks close branches and the cost of living bites.

The Post Office handled £3.45bn in cash in August, the highest total since it began recording volumes five years ago.

It says it expects the trend to continue due to rising living costs and tighter budgets.

Some people say they find it easier to monitor spending by using notes and coins, rather than electronic payments.

People typically use less cash in August, the state-owned company said, but this year branches dealt with record-breaking amounts of cash.

During the worst of the pandemic all transactions fell, but cash use dropped particularly sharply as shopkeepers preferred contactless methods.

"We expect cash transactions to continue to exceed expectations in October and for the rest of the year," said Martin Kearsley, banking director at the Post Office.

Cash transactions include personal deposits and withdrawals from post office accounts, as well as business use.

People relied on the11,500 local Post Office branches around the country. Banks have been closing branches across the UK, leaving some communities with no access to banking services at all.

As part of efforts to ensure individuals and businesses can still access banking services, the Post Office is running pilots of shared banking hubs in two locations, with another 13 locations also earmarked for hubs.

Customers of most banks can already use post office counters for basic banking, but at the hubs there is a wider range of services and the banks taking part send representatives once a week to help customers.

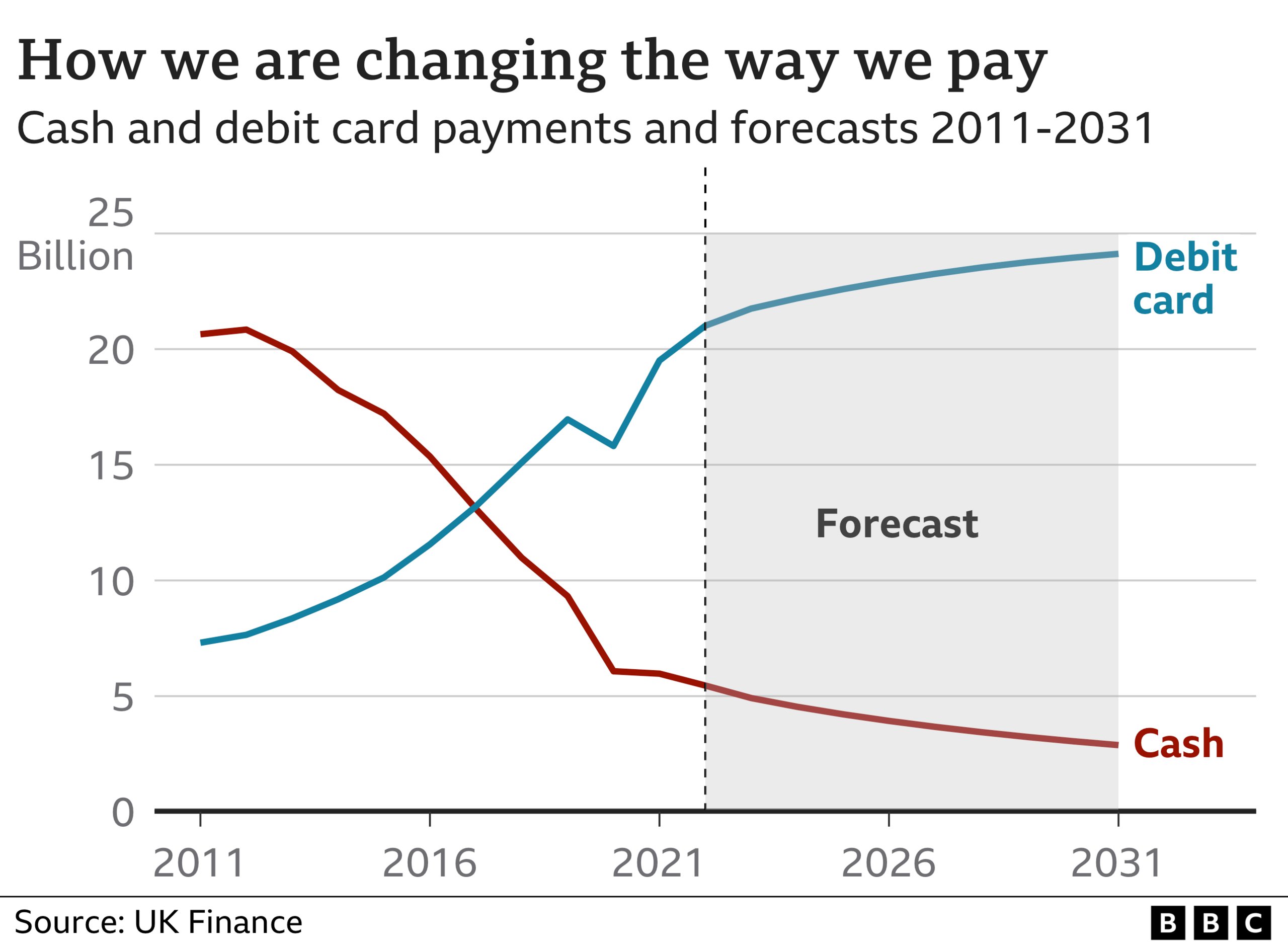

But while the Post Office is processing more cash transactions in the short term, over the longer-term, the trend away from cash is set to continue, with UK Finance, the body representing the banking industry, forecasting cash will account for only 6% of payments by 2031.

The use of notes and coins has already fallen dramatically over the last decade, from 55% of payments in 2011 to 15% last year.

The total for September was slightly lower at £3.35bn. It would have been even higher without the extra bank holiday for the Queen's funeral, said the Post Office.

The Post Office said personal cash withdrawals at its branches totalled £805m in August, up 0.5% compared to July, while personal cash deposits exceeded £1.4bn for the first time.

Are you using cash more than your card and if so, why? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published30 September 2022

- Published18 August 2022

- Published8 August 2022

- Published6 September 2022

- Published23 June 2021

- Published7 October 2022