Jacob Rees-Mogg says market turmoil not due to mini-budget

- Published

Jacob Rees-Mogg blames interest rates rather than the mini-budget for fall in pound and market turmoil

Jacob Rees-Mogg has claimed market turmoil is not linked to the mini-budget in which the chancellor announced big tax cuts without the usual analysis of the economic impact.

The business secretary said volatility was "more to do with interest rates than a minor part of fiscal policy."

He said the Bank of England had not raised rates as fast as the US.

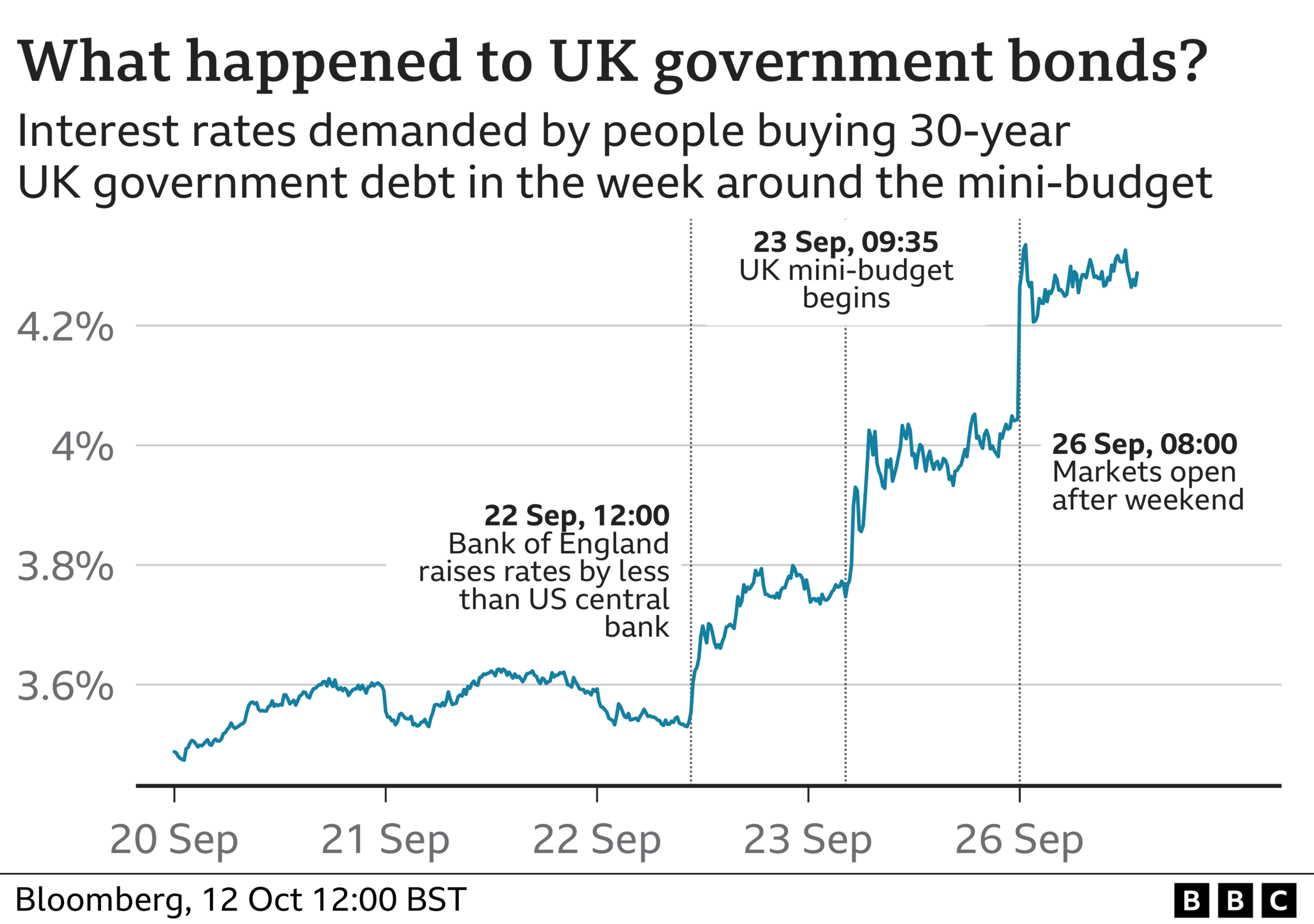

But economists and some MPs said the plans had worried investors, pointing to the surge in borrowing costs.

Investors are often wary of putting money into countries that are increasing their debt.

And if a country raises its interest rates it means investors will get a bigger return on their money if they put it into that country's banks and assets.

After the mini-budget, the pound plunged and government borrowing costs surged.

"What has caused the effect in pension funds... is not necessarily the mini-budget. It could just as easily be the fact that the day before the Bank of England did not raise interest rates as much as the (US) Federal Reserve did," he said.

"Jumping to conclusions about causality is not meeting the BBC's requirement for impartiality" he said, after a suggestion the chancellor's actions had been the trigger for the fluctuations in the value of the pound and government bonds.

At the first PMQs since the mini-budget, Labour leader Sir Keir Starmer accused Prime Minister Liz Truss of "ducking the question" when asked whether she agreed with the business secretary.

Ms Truss said the government had taken "decisive action", adding "as a result of our action... we will see higher growth and lower inflation."

Separately, speaking at the Treasury Select Committee on Wednesday Deutsche Bank's chief UK economist Sanjay Raja said the mini-budget on 23 September was the "straw that broke the camel's back".

He said the "trade shock" because of Brexit is a factor, and added: "You throw on the 23 September event, you've got a side-lined financial watchdog, you've got lack of a medium-term fiscal plan, one of the largest unfunded tax cuts we've seen since the early 1970s, it was kind of the straw that broke the camel's back."

The Resolution Foundation's Torsten Bell said it was clear the huge package of cuts, which was downgraded to £43bn after Mr Kwarteng's U-turn on the top rate of income tax, should not have happened in the current financial climate.

He said the sacking of the Treasury's top civil servant Sir Tom Scholar and the lack of a report on the economic impact from independent forecaster the Office for Budget Responsibility (OBR) had contributed to investor unease.

"It was no surprise to any of us that this is where you end up".

"This is what happens if you aren't paying attention," he said. "It was always going to be hard but it was exactly because it was always going to be hard that you don't do this."

The latest official statistics showed the economy unexpectedly shrank in August, strengthening predictions that it will fall into a recession.

Professor Jagjit Chadha, director of National Institute of Economic and Social Research (Niesr) told the Commons Treasury Committee that the "real danger" seen after the mini-budget was "obviously on the back of what can only be described as guerrilla tactics against our independent economic institutions over the summer - the Treasury, the Bank of England and the Office for Budget Responsibility".

Gerard Lyons, an economist who advised Liz Truss and Kwasi Kwarteng during the leadership contest, speaking on the BBC's World at One programme admitted that the mini-budget "misread" the country's financial situation.

However, he argued that everything that has happened was not "solely due to the mini-budget" but also down to parts of the financial system that were vulnerable to interest rates going up.

The Bank of England has warned interest rates could rise again after the value of the pound plummeted, following the government's decision to cut taxes and borrow more.

After the market turmoil, it stepped in with an emergency bond-buying intervention designed to stabilise the economy but said this scheme would end on Friday.

Deputy Governor Ramsden said he was "acutely" aware that millions of households and businesses were experiencing "real hardship", noting that "many" of the policy actions were "adding to the difficulties caused by the current situation".

Prime Minister Liz Truss has said the promised tax cuts will boost UK economic growth and therefore help pay for themselves.

The chancellor has committed to fast tracking the independent forecast by the OBR, the independent budget watchdog, at the same time as his economic plan detailing how he will pay for the planned tax cuts - which is now due to be announced on 31 October.

Related topics

- Published12 October 2022

- Published12 October 2022

- Published11 October 2022