How safe is my pension?

- Published

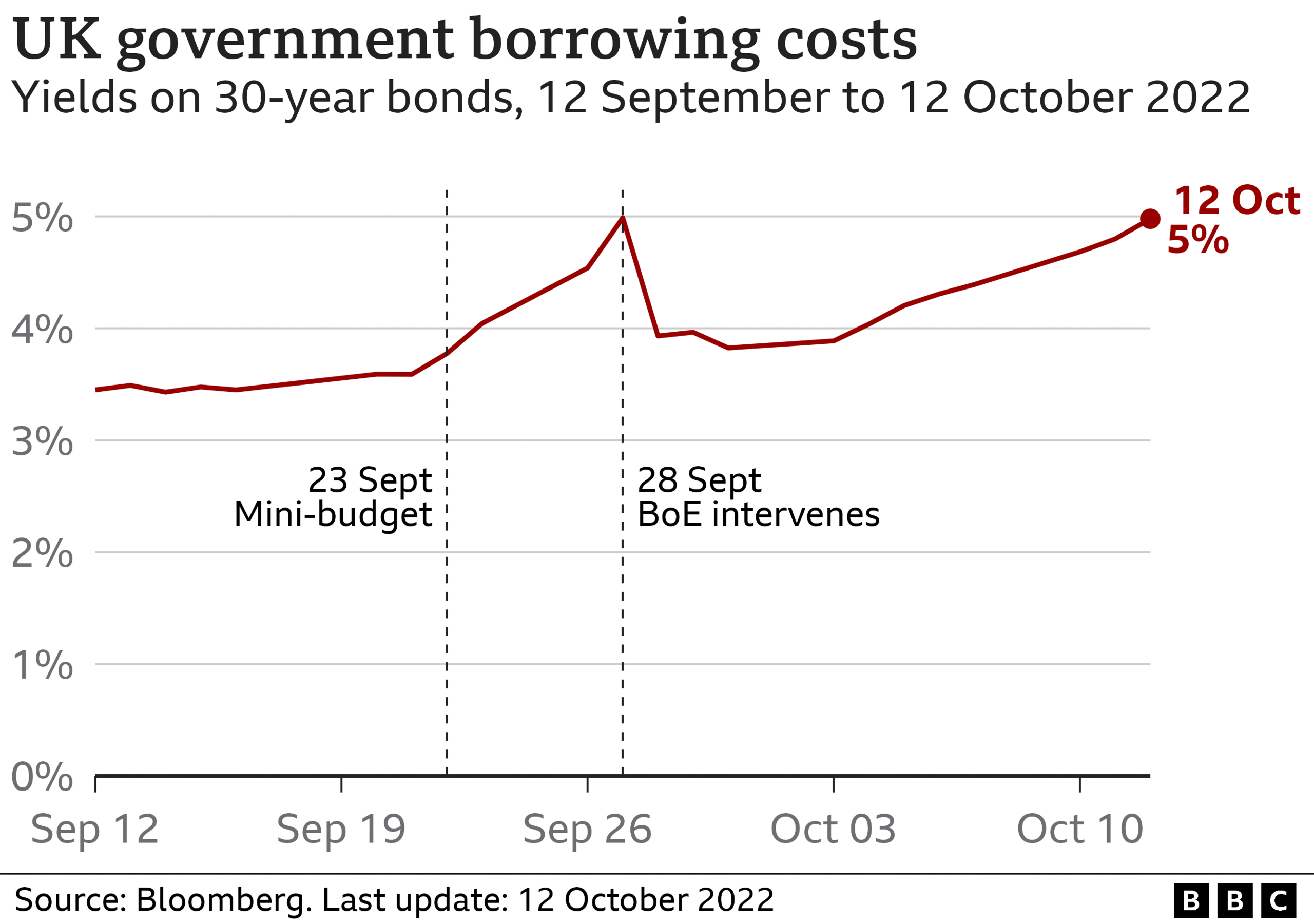

Financial markets were thrown into turmoil in September, after the government's mini-budget promised huge tax cuts without saying how it would pay for them.

The value of the pound fell and the cost of government borrowing climbed, leading to fears for the financial stability of some pension funds.

However, there is very strong protection for pension schemes - and you should be reassured that you're not about to lose your pension payouts.

How have pension funds been affected?

A sell-off in government bonds, known as gilts, was sparked by the government's mini-budget.

Gilts are like IOUs from the government, which sells them to raise money for public spending.

The government agrees to repay the investor on a certain date in the future, and pays interest in the meantime.

However, the mini-budget hit confidence in the bonds, and investors started demanding a much higher rate of interest in return for buying them.

That caused problems for pension funds, which often buy bonds because they are typically seen as safe investments.

The pension funds affected are so-called "defined benefit" schemes. Often known as final-salary schemes, these pensions pay a proportion of people's salary at the point they retire.

However, most people are now in "defined contribution" schemes, where the value of the pension depends on how much money people pay in, and how well the scheme's investments perform over the long term.

These schemes normally don't invest as much in government bonds, and so have been less affected.

What has the Bank of England done?

To stabilise the situation, the Bank of England has been buying government bonds from pension funds.

It said it would purchase up to £65bn of bonds as a temporary measure.

The cost of government bonds fell when the plan was first announced, but began rising again.

As a result, the Bank expanded the scheme, although it has reconfirmed that this will end on Friday, as originally planned.

So far the Bank has spent more than £10bn.

How does the bond-buying scheme help pension funds?

As well as investing in government bonds, pension funds also buy a form of insurance to protect their value.

As government borrowing costs increased, the insurance providers demanded extra payments.

The pension funds were forced to sell some of their bonds to fund these.

What does a billion pounds look like... and what can it buy?

But the more they sold, the more the cost of government borrowing went up, which in turn increased the price of the insurance payments - which led to yet more bond sales.

If this spiral had continued, there was a risk that some pension funds might have reached a position where they could not pay their debts.

The Bank of England programme was designed to stop the prices of government bonds falling further, limiting the need for pension funds to sell any more.

Are pensions at risk?

The Bank's bond-buying intervention does appear to have worked, and the immediate threat to the financial stability of some defined benefit schemes has passed.

Governor Andrew Bailey told the BBC the Bank of England is doing "everything" it can to ensure financial stability

But it's worth noting that companies which offer defined benefit pension schemes have a legal responsibility to shore them up if necessary.

And in the unlikely event of a company going bust, the schemes themselves are protected.

If you're in a defined contribution scheme, your pension is less likely to been have affected by the recent crisis. These schemes normally only have a small amount of their investments in government bonds.

However, if you are close to retirement, it's possible that more of your pension fund has been switched to bonds.

That's because they normally represent a less risky investment than stocks and shares.

If you are planning to retire soon, it might be useful to talk to an independent financial adviser, external about your options. You may wish to consider delaying taking your pension, if you can.

Are pension schemes protected?

Pension schemes have very strong protection.

For those in defined benefit schemes, one of the biggest risks is that their employer or ex-employer goes bust.

Such schemes would be protected by the Pension Protection Fund (PPF), external. The PPF was set up in 2005 after some firms collapsed without enough money to pay their former employees the pension they were owed.

The PPF provides 100% of the pension owed to retired members of a scheme that has become insolvent. Anyone who hadn't reached retirement age at the point of insolvency gets 90% of their pension.

The maximum annual pension allowed under the PPF is £41,461.07, which affects around 0.5% of pension scheme members.

If you have a defined contribution scheme your pension provider is authorised by the financial regulator, the Financial Conduct Authority, external.

If your provider gets into difficulty, you may be able to claim compensation from the Financial Services Compensation Scheme, external.

The government's Money and Pension Service also offers information about saving for retirement on its website, external or through its helpline 0800 138 7777.

Update 24 October: This article was edited to replace a link to a commercial website specialising in financial advice with a link to the Government's Money Helper website.