Warning of 'scary' spending cuts after tax U-turns

- Published

- comments

Jeremy Hunt faces "scary" decisions on spending after undoing swathes of his predecessor's tax cuts, analysts warn.

The new chancellor reversed £32bn of cuts from the mini-budget to try to balance the government's books but must find billions more in savings.

The Institute for Fiscal Studies (IFS), an economics think tank, said deep spending cuts were inevitable.

The Resolution Foundation, which focuses on those on low incomes, said the "toughest choices" lie ahead.

Mr Hunt has admitted "decisions of eye-watering difficulty" lie ahead. The government is expected to give some indication of where spending cuts will fall on 31 October, but on Sunday Mr Hunt said he would ask all government departments to find efficiencies within their budgets.

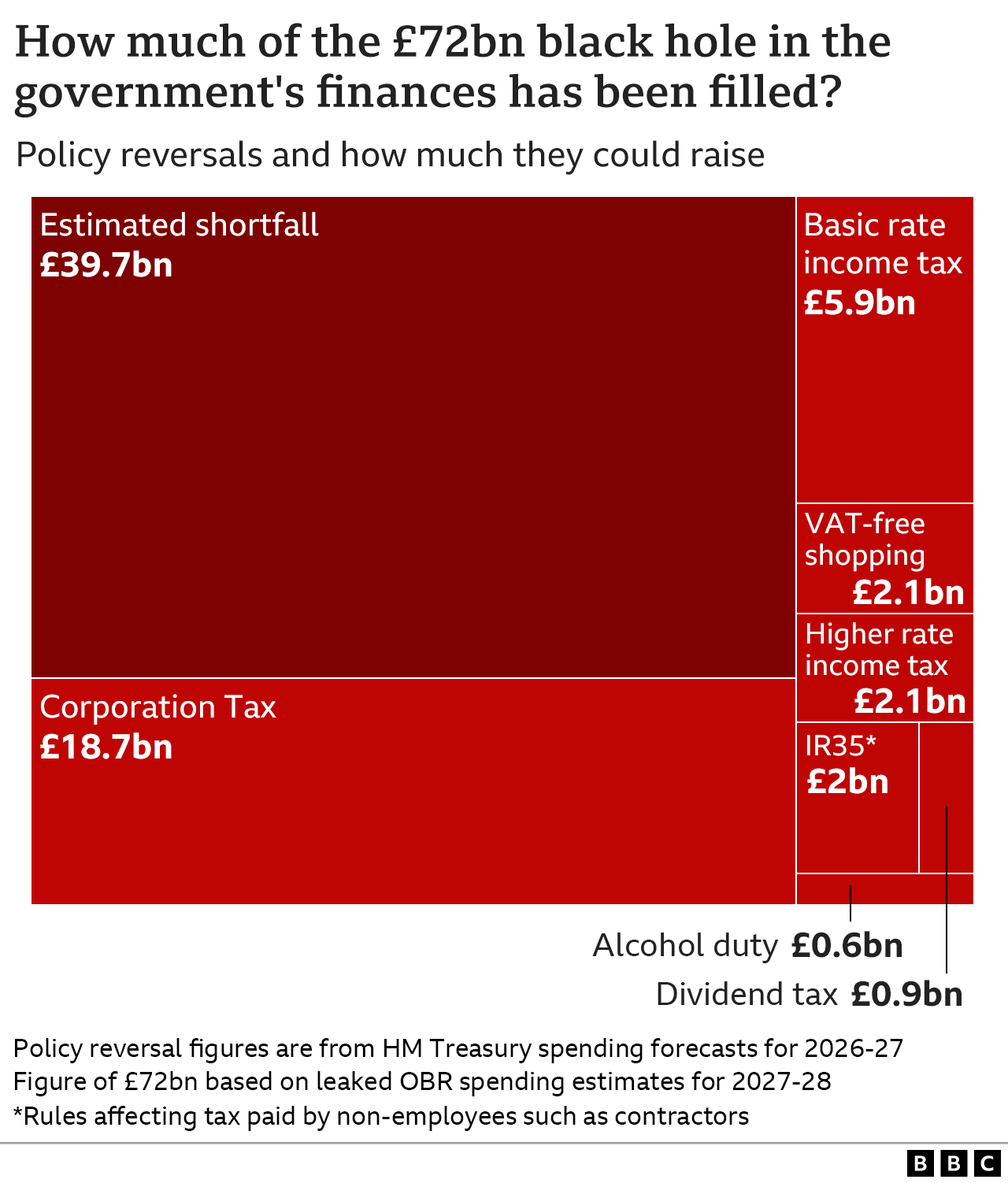

Mr Hunt's strategy, which includes keeping income tax at current levels, comes after reports suggest the government faces a black hole of up to £72bn in the public finances following last month's mini-budget

The former chancellor, Kwasi Kwarteng, had announced huge subsidies to energy prices and big tax cuts, prompting turmoil in the financial markets.

Investors were alarmed that there was no independent assessment of the impact on the economy and no explanation of how the package would be paid for.

On Monday, Mr Hunt shelved almost all of Mr Kwarteng's tax changes and said he would scale back support for household energy bills. But experts believe there is still a black hole of up to £40bn in the public finances to fill.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said there were no "easy options" and Mr Hunt would still have to make "scary decisions" by either raising taxes or cutting spending in his economic statement on 31 October.

"It is hard to see which of the big chunks of spending - health, pensions, welfare, education and defence - can be cut," he added.

The Resolution Foundation warned spending cuts could be as deep as those after the 2008 financial crisis when lending ground to a halt and the country went into a deep recession.

What is the black hole in the public finances?

Mr Kwarteng planned to pay for the huge tax cuts in September's mini-budget by borrowing. But this threatened to leave a large shortfall in the government's budget, dubbed by some a "black hole".

Governments do borrow from investors to fund spending in difficult times. But budget shortfalls can make investors nervous if it is unclear how that shortfall will be filled - in other words there is no credible plan to get debt falling in the long term.

Rising borrowing also comes with a price tag attached - interest bills that rise as inflation does too.

Why did Mr Hunt have to act?

Immediately after Mr Kwarteng's mini-budget, rates of interest for government borrowing shot up to worrying levels as the UK was deemed a higher risk to lend to.

Between the soaring cost of living and higher borrowing rates, the government faced paying interest of over £100bn on existing debt next financial year - twice what was expected just a few months ago.

That is equivalent to over a fifth of departments' budgets for day-to-day provision of public services - it is money that could be used for schools or hospitals in theory instead.

It also pushed up borrowing costs for businesses and individuals, including for mortgages. And it sent financial markets into a tailspin as the value of government bonds plummeted, forcing the Bank of England to step in to protect pension funds.

What is the plan?

Mr Hunt's new strategy will mean more money coming into the Treasury's coffers, reducing the need for severe cuts to spending on services such as the NHS, education and defence.

The government's stated aim is to not be spending any more than it is receiving in tax receipts by the 2026-27 tax year, in order to keep the overall burden of debt at current levels.

The chancellor said savings of £32bn would be made by 2026-27 by:

Keeping plans to raise corporation tax to 25% (raising £18.7bn)

Keeping the basic rate of income tax at 20p, rather than cutting it to 19p next year (£5.9bn)

Keeping a planned increase to the tax on dividends (£0.9bn)

Shelving changes to IR35 rules for freelance workers (£2bn)

Cancelling a plan to offer tax-free shopping to tourists (£2.1bn)

Allowing alcohol duties to rise instead of being frozen (£0.6bn)

But it still leaves a big shortfall if the government is to meet its commitment to balance the books over the next three years.

Mr Hunt also announced that support for every household's energy bills, which will cost an estimated £60bn over this winter, will remain in place until April but after that be scaled back to save money.

Mr Hunt also said he was forming an Economic Advisory Council to provide him with "independent expert advice" as he tries to rebuild investor confidence.

Related topics

- Published17 October 2022

- Published17 October 2022