Prices of pasta, tea, chips and cooking oil soar

- Published

- comments

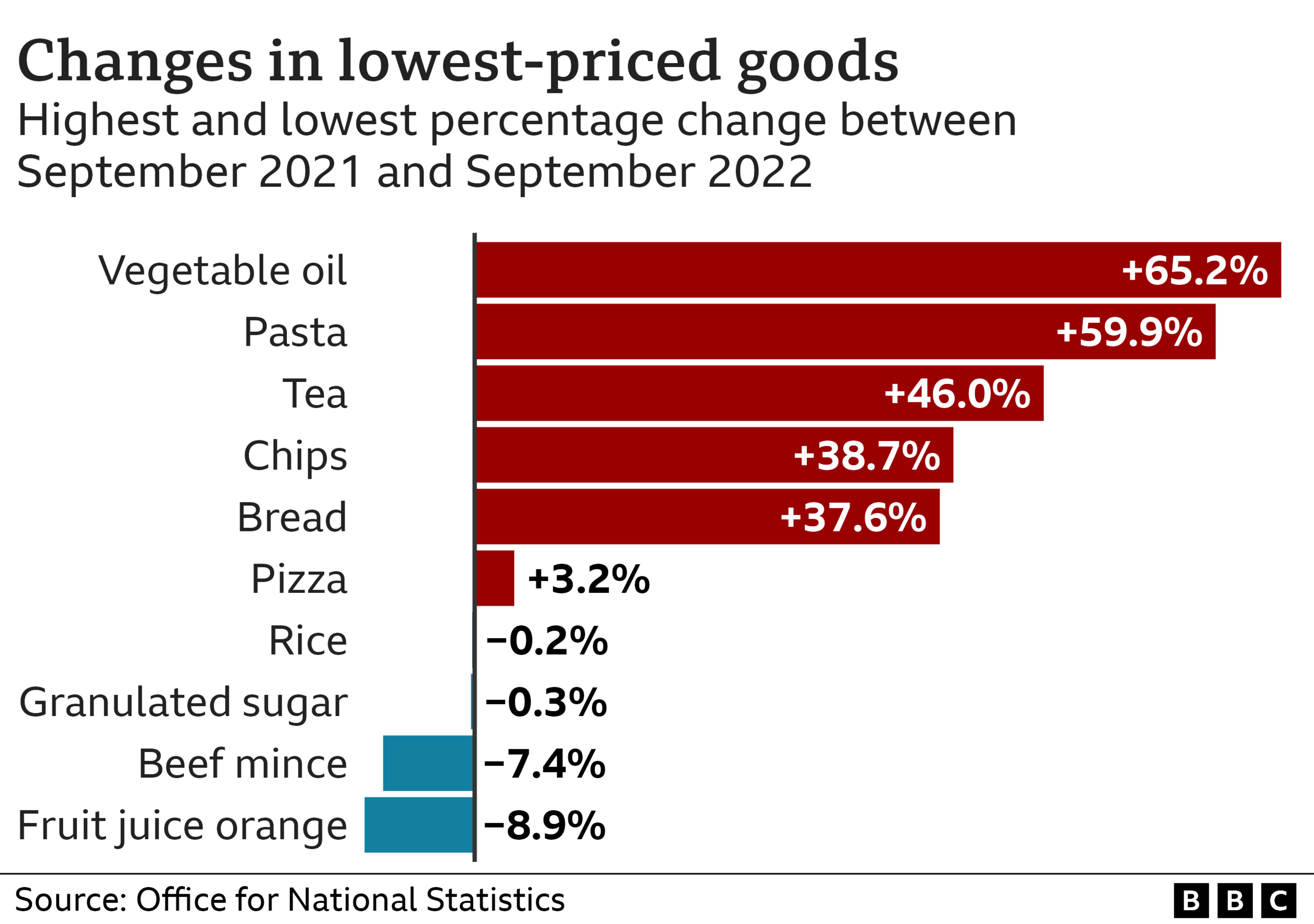

The price of pasta, tea, chips and cooking oil has soared, according to new data, with vegetable oil going up by 65% in a year.

Overall, the price of budget food in supermarkets rose by 17% in the year to September, the Office for National Statistics (ONS) said, external.

It comes as a separate ONS report, external sheds light on the cost of living crisis.

Almost half of adults who pay energy bills and 30% paying rent or mortgages say these are difficult to afford.

Inflation - the rate at which prices are rising - is at a 40-year high.

Food prices drove the latest rise in living costs in September, along with energy bills and transport costs.

Earlier this year, anti-poverty campaigner Jack Monroe criticised the way that the rate of inflation was calculated stating that it "grossly" underestimates "the true cost of living crisis".

The official inflation data measures the prices of 700 goods, but since May this year the ONS has started releasing a new data set, which measures the change in price of 30 everyday grocery items across seven supermarkets.

This is the second time it has released this data.

It found sharp increases in the price of some household staples in supermarkets. Pasta prices rose by 60% in the year to September 2022, while tea prices went up by almost 50%.

Other everyday items such as chips, bread, biscuits and milk also recorded large increases.

But some other items fell in price during the period, including orange juice and beef mince.

The rise in the cost of groceries has been accelerated by the war in Ukraine, which has disrupted grain, oil and fertiliser supplies from the region.

For many families doing a weekly shopping trip has turned into sticker shock, that dismay you feel when you find out just how expensive products are.

No wonder we're turning, in droves, to cheaper own label products to try to save money. The major supermarkets have been investing heavily to match the discounters, trying to keep a lid on inflation for hundreds of the cheapest, most popular, everyday staples.

But these figures show even these products are going up in price.

Some of the percentage changes are eye watering. The supply of vegetable oil, for instance, has been seriously disrupted by the war in Ukraine and the price has soared.

Rising food prices have a bigger impact on those with the lowest incomes and these figures lay bare the challenges facing Rishi Sunak over the cost of living crisis.

"What we are seeing is that the price of low-cost goods is going up at the same rate as food across the piece with some real highlights... cooking oil and pasta, I would add tea, chips and bread to that - really going up and very, very few things going down at all," the chief executive of the UK Statistics Authority, Prof Sir Ian Diamond, told the BBC.

"We are really seeing that the squeeze on people who buy the lowest cost things is pretty hard at the moment."

When asked whether things are getting worse, he said: "I think things are tight. I think we are not seeing much of a getting worse at all but we are seeing things remaining really tight."

Your device may not support this visualisation

Find out why food prices are also on the rise.

Watch now on BBC iPlayer (UK only).

How have you been affected by the rising cost of food? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Struggling with bills

The rising cost of living continues to put pressure on household budgets.

A new report by the ONS on Tuesday suggested the proportion of all adults finding it difficult to afford their energy bills, rent or mortgage payments rose during the June to September period.

Around 45% of adults who paid energy bills, and close to a third of those paying rent or mortgages said these were difficult to afford.

The figures also suggested disabled people were more likely to have difficulty affording their energy bills, rent or mortgage payments.

Last week, a BBC survey also uncovered growing concern about the squeeze on finances. Some 85% of those asked are now worried about the rising cost of living, up from 69% in a similar poll in January.

In September, the government announced a new Energy Price Guarantee to limit the price that suppliers can charge for each unit of energy.

However, last week, the new chancellor Jeremy Hunt said the support - which limits a typical household bill to £2,500 - will be cut from April. It had originally been planned for two years.

Laura Suter, head of personal finance at AJ Bell, said the latest figures from the ONS were "a source of alarm".

"It's inevitable that more and more people will miss energy, rent and mortgage payments as we get further into winter and the continuing cost of living rises really start to hit more homes," she said.

"These figures are the tip of the iceberg and the landscape in April, when we are the other side of the coldest season, will surely look more bleak."

A Treasury spokesperson said: "The government's Energy Price Guarantee will save the typical household around £700 this winter, based on what energy prices would have been under the current price cap - reducing bills by roughly a third.

"In addition, we have provided at least an extra £1,200 of cost-of-living support to 8 million of the most vulnerable households.

"We've also reversed the rise in national insurance contributions and made changes to Universal Credit to help working households keep more of what they earn."

- Published25 October 2022

- Published20 October 2022

- Published19 October 2022

- Published4 October 2022