Bank makes history as it reverses quantitative easing

- Published

In an historic milestone, the Bank of England has begun to unwind the key emergency support it brought in after the 2008 financial crisis.

The bank sold off a tranche of government bonds on Tuesday, as it started to reverse the process known as "quantitative easing" or QE.

QE has been credited with helping the UK through shocks such as Covid.

But it has also been blamed for bringing in an era of "cheap money" which benefited some but not others.

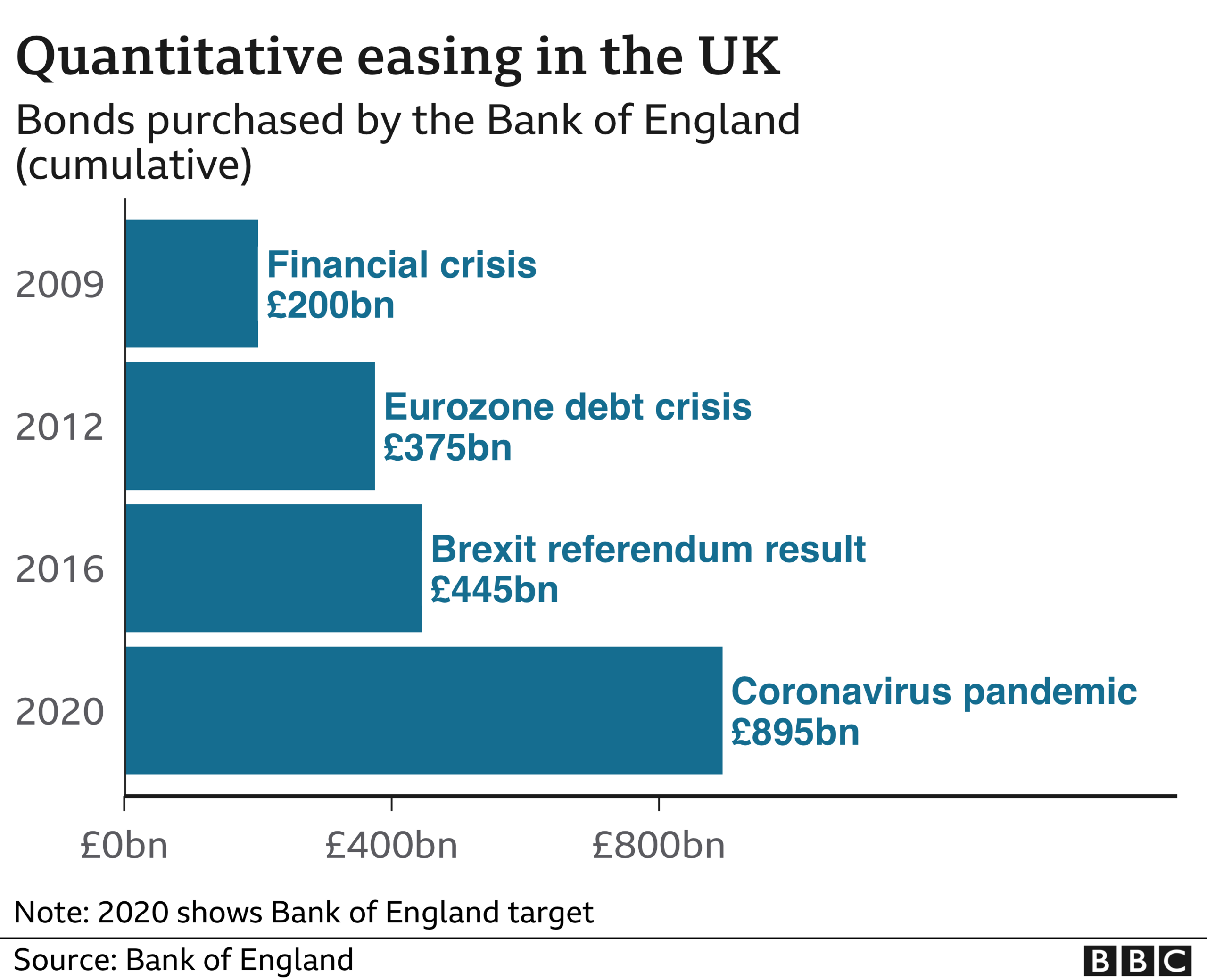

The Bank began QE in March 2009, to prop up the UK economy after banks stopped lending to each other and the country fell into a deep recession.

To do this it electronically created new money, which it used to buy government bonds - effectively IOUs issued by the Treasury to fund government spending.

Along with other measures, QE helped to keep market interest rates at historic lows. The idea was this would encourage consumers and businesses to keep borrowing and spending - supporting the economy in the process.

However, it was always meant to be a temporary measure and the Bank of England has long discussed when it would begin to unwind QE.

On Tuesday, it became the first central bank among the G7 developed economies to start selling off its bond holdings.

It successfully sold the relatively small sum of £750m worth of bonds, out of a total holding of over £838bn.

When QE was tried for the first time, it was a new policy, and no-one knew quite how the Bank would go about unwinding it, which helps to explain why the bank is proceeding gradually.

"We don't quite know what the impact is going to be on bond markets, so it makes sense to proceed cautiously, " says Andrew Sentance, a member of the Bank's Monetary Policy Committee who voted in favour of the first round of QE in 2009.

But unwinding QE is an important part of the Bank's fight against inflation, which is currently running at over 10 per cent, rather than the 2% target.

"If we want to get on top of inflation we need to get on top of this. It's not the whole part of the equation, there is interest rates, there is fiscal policy [government tax and spending decisions], as well as reversing QE - they are all pushing in the same direction."

The bonds are being sold for less than the Bank paid for them, so it is making a loss on the sales, which will be paid by the Treasury.

The Bank has already been reducing its QE holdings by not replacing bonds which come to the end of their term and are repaid. But it has said it wants to reduce its holdings by £80bn by next September.

The first sales were postponed from September following the market turmoil following the mini-Budget.

- Published1 November 2022