Autumn Statement 2022: Key points at-a-glance

- Published

- comments

Chancellor Jeremy Hunt has unveiled the contents of his Autumn Statement in the House of Commons.

He has revealed tax rises and spending cuts worth billions of pounds aimed at mending the nation's finances.

Here is a summary of the main measures.

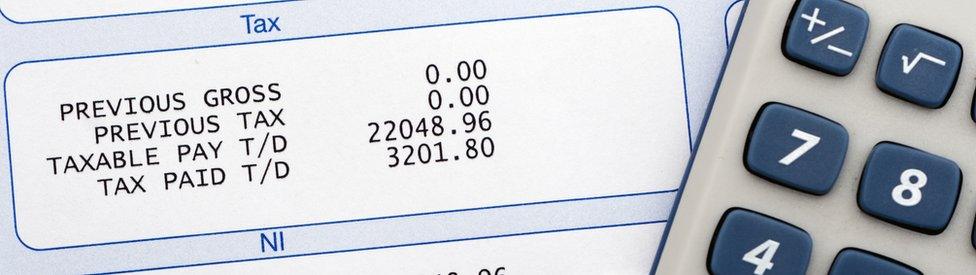

Taxation and wages

Legally-enforceable minimum wage for people aged over 23 to increase from £9.50 to £10.42 an hour from next April

State pension payments and means-tested and disability benefits to increase by 10.1%, in line with inflation

Apart from in Scotland, top 45% additional rate of income tax will be paid on earnings over £125,140, instead of £150,000

Income tax personal allowance and higher rate thresholds frozen for further two years, until April 2028

Main National Insurance and inheritance tax thresholds also frozen for further two years, until April 2028

Tax-free allowances for dividend and capital gains tax also due to be cut next year and in 2024

Local councils in England will be able to hike council tax up to 5% a year without a local vote, instead of 3% currently

Energy

Household energy price cap extended for one year beyond April but made less generous, with typical bills capped at £3,000 a year instead of £2,500

Households on means-tested benefits will get £900 support payments next year

£300 payments to pensioner households, and £150 for individuals on disability benefit

Windfall tax on profits of oil and gas firms increased from 25% to 35% and extended until March 2028

New 45% tax on companies that generate electricity, to apply from January

Economy and public finances

The Office for Budget Responsibility judges UK to be in recession, meaning the economy has slowed for two quarters in a row

It predicts growth for this year overall of 4.2%, but size of the economy will shrink by 1.4% in 2023

Growth of 1.3%, 2.6%, and 2.7% predicted for 2024, 2025 and 2026

UK's inflation rate predicted to be 9.1% this year and 7.4% next year

Unemployment expected to rise from 3.6% to 4.9% in 2024

Government will give itself five years to hit debt and spending targets, instead of three years currently

Government spending

Scheduled public spending will be maintained until 2025, but then grow more slowly than previously expected

In England, NHS budget will increase by £3.3bn a year for the next two years, and spending on schools by £2.3bn

It will mean larger payments to devolved governments in Scotland, Wales and Northern Ireland

Defence spending to be maintained at 2% of national income - a Nato target

Overseas aid spending kept at 0.5% for the next five years, below the official 0.7% target

Business and infrastructure

Support worth £13.6bn over next five years to help firms with business rates, including a mixture of freezes and reliefs

Import taxes removed on more than 100 goods, including some food products, for two years to reduce costs

Plans for a possible online sales tax scrapped - the government argues online retailers' warehouses will be hit harder than shops through business rate changes

Chief Scientific Adviser Sir Patrick Vallance to lead review into how post-Brexit regulation can support emerging technologies

Other measures

Lifetime cap on social care costs in England due in October 2023 delayed by two years

Social housing rent increases in England capped at 7% from next April - instead of 11% due to inflation

Electric cars, vans and motorcycles to pay road taxes from April 2025

Suffolk will get an elected mayor - with mayors for Cornwall, Norfolk and an area in north-east England to follow

- Published17 November 2022