'We are chasing never-ending debt to pay for basics'

- Published

David says his grocery bill has shot up

David McGinley and his wife Ashlie are both working, but the rising cost of living means they are struggling financially.

"It angers me," says Mr McGinley, from Bamber Bridge, Lancashire. "We feel like we are doing the right thing but are being punished."

He says the family are in emergency credit on the electricity meter "every other day", their grocery bill has risen by 50%, and sometimes a meal is beans on toast. That is adding to the pressure of existing debts.

"Once you start falling behind, you are chasing a never-ending debt," he says.

People like Mr McGinley are slipping further into debt to pay for basics like rent and bills, Citizens Advice has warned.

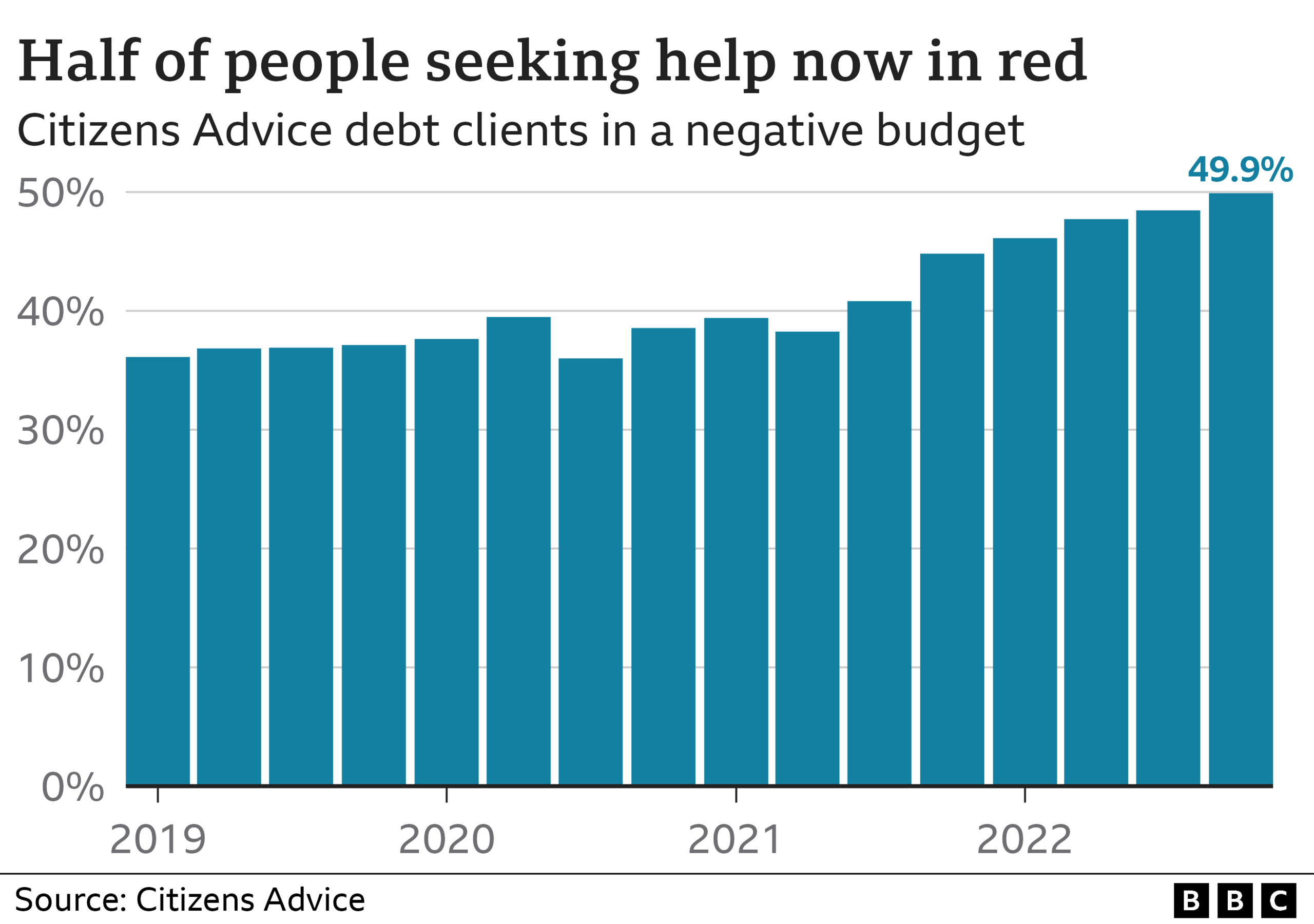

Half of the charity's debt assessment clients have a negative budget - meaning they are left in the red after paying for essentials. This is up from 36% in early 2019, it says.

Groups who rarely asked the charity for help, like homeowners and pensioners, are now seeking debt advice.

The soaring cost of living seems to be changing the nature of problem debt. Whereas once ballooning credit card bills were the norm, now more and more people face long-term financial issues because they do not have enough for the basics such as heating, food and council tax bills.

Dame Clare Moriarty, chief executive of Citizens Advice, says: "With costs skyrocketing, we are seeing people who are saddled with debt sinking further into hardship. More people are seeking debt support who have never had to turn to us before - like homeowners who are living in one room to save on heating costs.

"This alarming trend is creating a ticking time bomb. Every day our advisers hear from people left with less than zero each month, unable to repay debts and slipping further into the red to afford the basics."

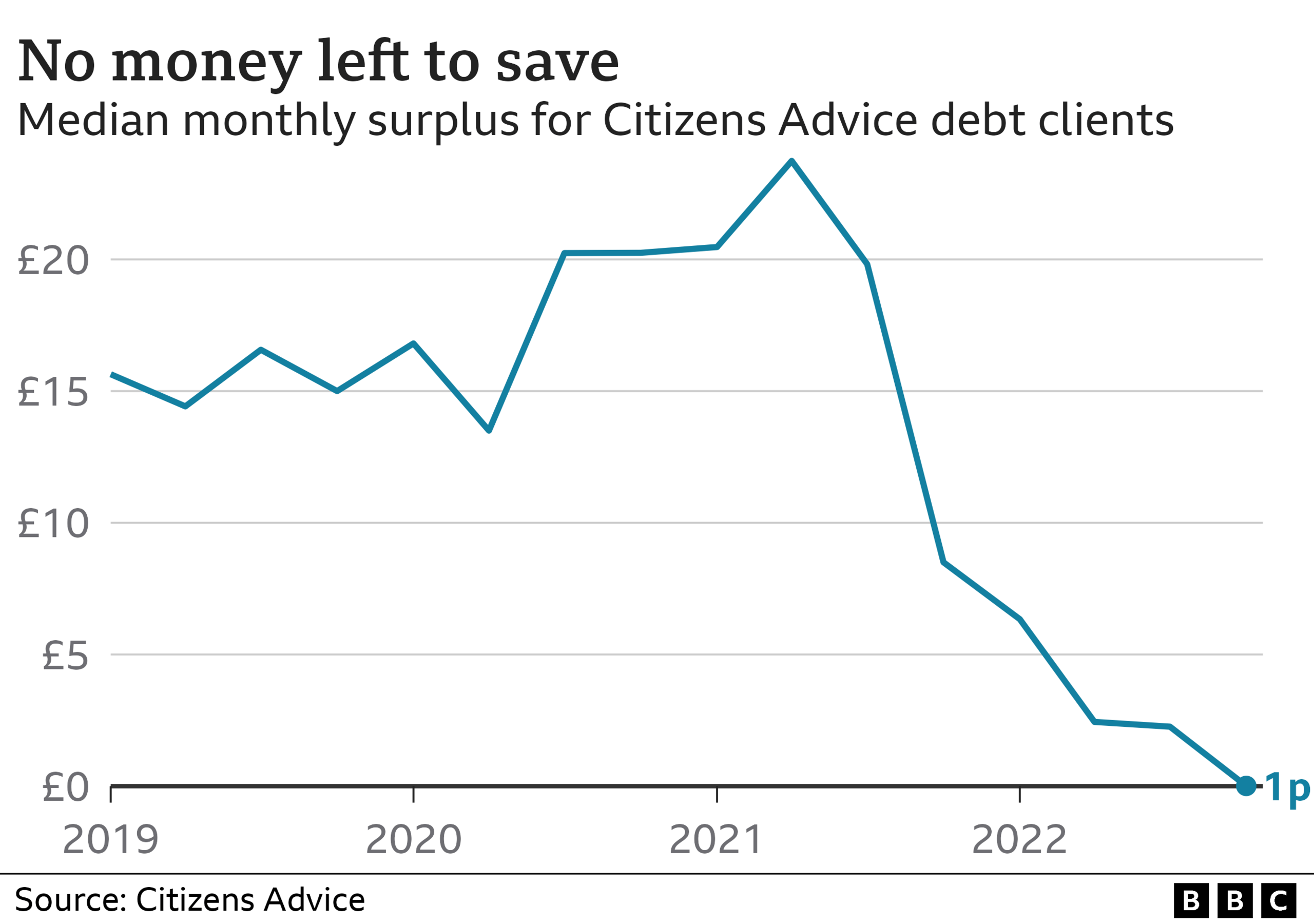

Citizens Advice carries out debt assessments for people seeking help from the charity. Data from these cases shows that the amounts people owe are less than the past, but an increasing proportion are in the red after covering their basic outgoings, known as a negative budget.

Groups already in debt - primarily renters, single parents and the self-employed - are now less likely to be able to pay that off.

As a whole, those going through debt assessments typically have 1p left at the end of the month after essential spending, reflecting the impact of rising prices and bills.

That may cause extra issues at this time of year. Mr McGinley says he is "feeling guilty" about Christmas.

The government has stepped in to help millions of people like him on universal credit and other benefits with a huge package of cost-of-living payments, as well as a cap on energy bills.

These payments will be repeated and, in some cases, extended next year, although the cap will become less generous.

Debt charity StepChange says the support has been reflected in a fall in the proportion of new clients who had gas and electricity bill arrears.

It says soaring prices meant next year is "looking precarious for millions of households".

Guide to dealing with debts

Work out how much you owe, who to, and how much you need to pay each month

Identify your most urgent debts. Rent or mortgage, energy and council tax are called priority debts as there can be serious consequences if you do not pay them, and so they should be paid first

Calculate how much you can cover in debt repayments. Create a budget by adding up your essential living costs like food and housing, and taking these away from any income such as your wage or benefits you receive

See how you could boost your income, primarily by checking what benefits you are entitled to, and whether you are eligible for a council tax reduction or a lower tariff on your broadband or TV package

If you think you cannot pay your debts or are finding dealing with them overwhelming, seek support straightaway. You are not alone and there is help available. A trained debt adviser can talk you through the options available

Source: Citizens Advice

StepChange says a fifth of new clients are still citing the cost of living as their main reason for debt, and seven in 10 of them are women.

Credit report company Clearscore says that its data suggests use of overdrafts has increased by 7.1% since August 2021, as people dip into this debt to pay for everyday costs.

Meanwhile, charity National Energy Action estimates that the number of UK households in fuel poverty will increase from 4.5 million last October to 8.4 million in April.

Related topics

- Published22 October 2022

- Published29 November 2023

- Published29 November 2022