Energy bill help drives record government borrowing

- Published

- comments

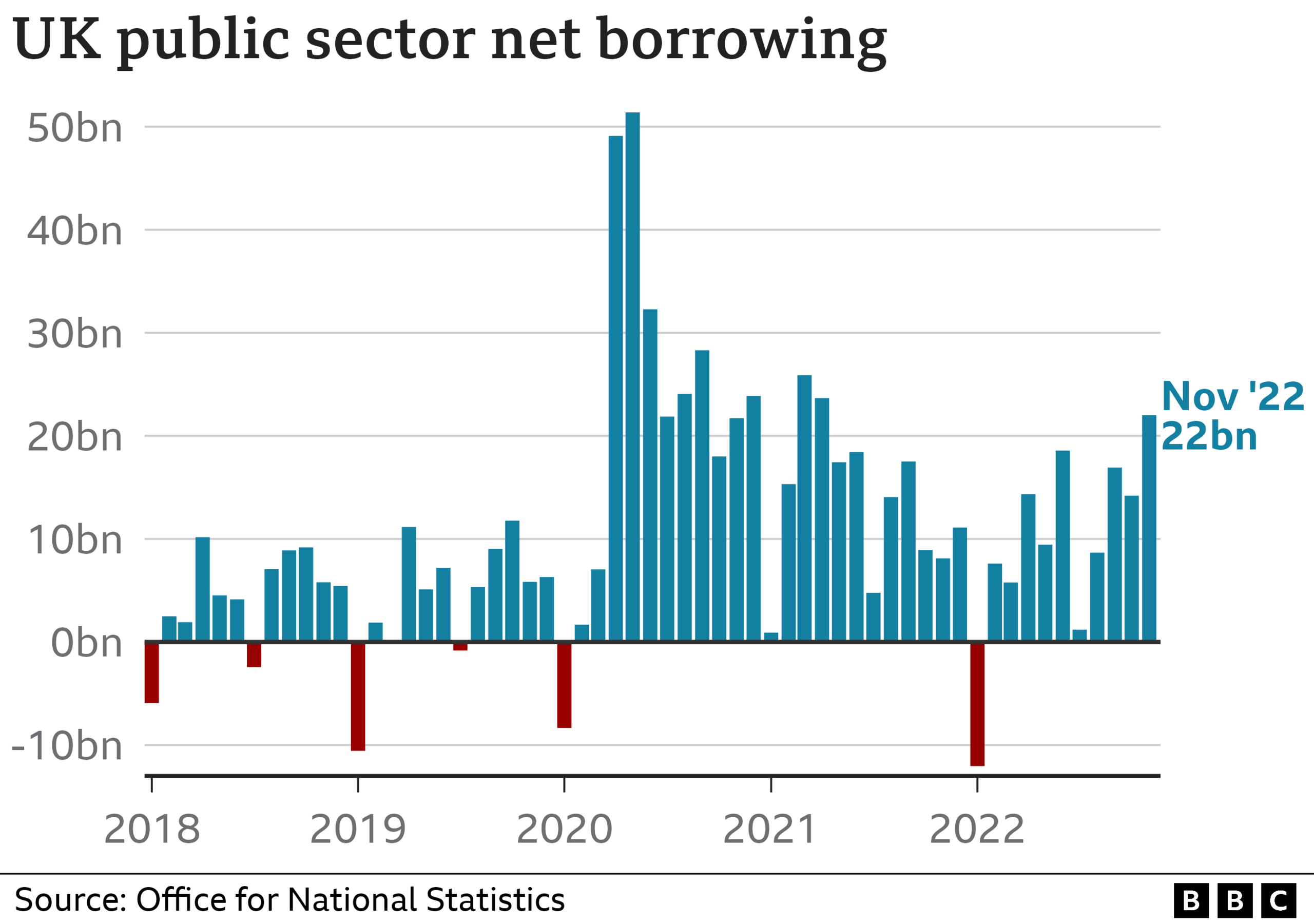

Government borrowing hit its highest November level on record last month, driven by the cost of supporting households with the rising cost of living and energy bills.

Borrowing, the difference between spending and tax income, reached £22bn, a rise of £13.9bn on November 2021.

Interest on government debt also surged by 50.1% to £7.3bn.

The Office for National Statistics (ONS) said inflation was the main factor behind the rise in borrowing.

As energy prices have soared, the government has stepped in with its Energy Bills Support Scheme, which provides a £400 non-repayable discount to all households in England, Scotland and Wales.

It has also launched the Energy Price Guarantee, which limits typical households' bills to £2,500 per year..

These costs were the main reason government borrowing had hit its highest level for the month since records began in 1993, ONS chief economist Grant Fitzner told the BBC's Today programme. The increase in borrowing came despite the government taking £2.2bn more in tax in November compared with the year before.

"Firstly, of course, as we know the cost of energy support for households and business, that's around £6.5bn extra spending a month," Mr Fitzner said.

"[It's also due to] higher debt interest payments, reflecting again, high inflation and interest rate payments and also higher pensions and benefits than a year ago."

UK inflation, the rate at which prices rise, eased to 10.7% in the year to November, but the cost of living is still rising at its fastest pace in 40 years.

It means the UK is facing its biggest drop in living standards on record as the surging cost of living eats into people's wages.

The UK is already thought to be in recession which is when the economy shrinks for two three-month periods in a row.

When a country is in recession, it's a sign that its economy is doing badly and companies typically make less money, the number of people unemployed rises and the government receives less money in tax to use on public services.

The government's decision to embark on much higher spending in the autumn as it subsidises energy bills is a big part of the explanation for the highest official borrowing figure in November since 1993.

But keep in mind it's a November figure - and is by no means the highest borrowing in a month. It's less than half what Rishi Sunak borrowed in March and April 2020 to support businesses and firms through lockdown in the onset of the pandemic.

When you look at the less volatile figures for the financial year to date, the amount the government was officially deemed to have to borrow in the eight months to November was £105.4bn - £7bn less than in the same period of 2021.

A big part of the reason borrowing came down was a surge in receipts from income tax and national insurance - up by £31.5bn to £251.4bn. As the wealth management firm Quilter points out, with tax thresholds frozen, this is likely to become a growing source of revenue for the chancellor as pay rises and millions are dragged over both the basic rate threshold and the one above for which you pay 40% income tax.

Consumer prices have been rising this year as energy, fuel and food costs soar due to the war in Ukraine and Covid. Food prices are up 16.5%.

But the recent easing of inflation has led some analysts to predict that a turning point may have been reached.

Commenting on the latest borrowing figures, Chancellor Jeremy Hunt blamed the "twin global emergencies of a pandemic and Putin's war in Ukraine" for driving up the government's costs.

"We have a clear plan to help halve inflation next year, but that requires some tough decisions to put our public finances back on a sustainable footing," he added.

The ONS said the government spent £1.9bn in November on the Energy Bills Support Scheme. Meanwhile, the Energy Price Guarantee helped drive a £4.7bn year-on-year rise in government spending on subsidies.

Total public sector spending struck £98.9bn in November, while day-to-day government expenditure increased by £13.5bn on the year to £82bn for November, the ONS said.

The increases were due to more cash being spent on helping households and businesses with the cost of living, but also because of higher interest rates, with the amount of interest on debt up 50.1% on the year.

Divya Sridhar, economist at PwC, said: "The latest data on the UK's public finances reflects the fiscal implications of continued energy bills support and higher inflation.

"Looking ahead, continued energy bills support and the ninth consecutive rise in interest rates announced by the Bank of England last week will continue to squeeze public finances."

Related topics

- Published15 February 2024