Rents rising at fastest rate for seven years

- Published

- comments

Tenants in properties owned by private landlords have faced the highest rise in rent since comparable records began seven years ago, official data shows.

Rents rose 4% last year as landlords, who face their own squeeze from higher mortgage rates, passed on those costs.

A quarter of tenants surveyed in December said their rent had risen in the past six months, the Office for National Statistics (ONS) said.

Renters proportionally spend more on housing costs than owners do.

On average, they pay 24% of their weekly expenditure on housing compared with 16% by those with a mortgage, the ONS said, based on the latest figures from 2021.

Myron Jobson, senior personal finance analyst at Interactive Investor, said: "Higher rents have been accompanied by higher energy bills which continues to squeeze budgets.

"It is a tricky situation if you are looking for a new tenancy. Many renters could decide to remain in existing tenancy agreements with fixed rents, rather than risk a move and spend more on rent."

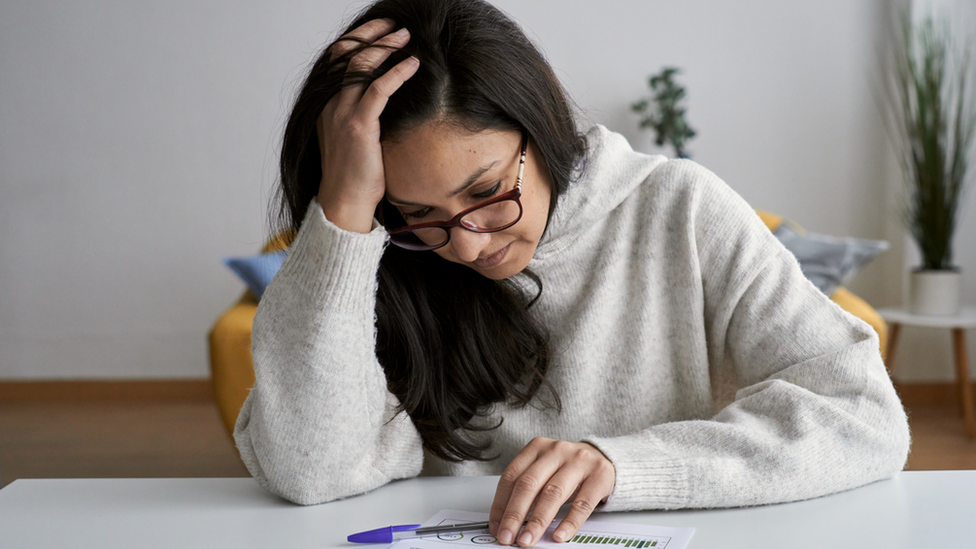

A growing proportion of people said they were finding it difficult to afford their rent or mortgage payments, rising from 27% in late September to 31% in mid-December.

What can you do about rent increases? Watch the BBC's Lora Jones tell you, in a minute.

A higher proportion (45%) of adults with mortgages reported being worried about the changes in mortgage interest rates.

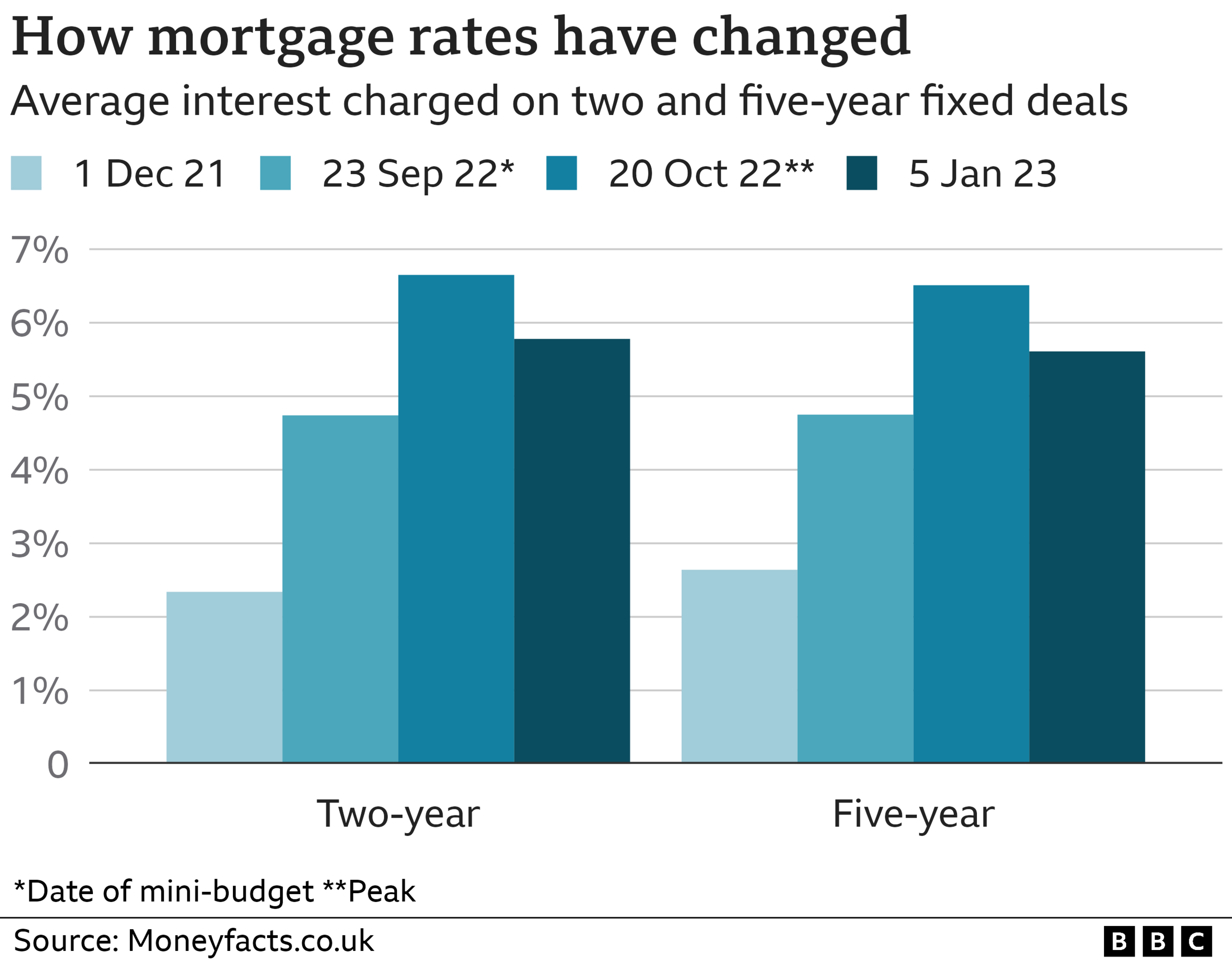

There has been a steep rise in mortgage costs in 2022, driven in part by the doomed mini-budget during the premiership of Liz Truss. Rates surged as the markets reacted unfavourably to promises of tax cuts without an explanation of how they would be funded.

The average cost of a new, two-year fixed-rate mortgage has fallen slowly since markets stabilised, but is still much higher than it was last year at 5.78%.

The ONS points out that many thousands of homeowners face sharply higher mortgage costs when their current fixed-rate deal expires.

The ONS said that more than 1.4 million households would be renewing their fixed-rate mortgage this year, with 57% of them currently paying an interest rate of less than 2%. This renewal peak will come between April and June when 371,000 deals expire.

Should the interest rate on a £100,000 capital and repayment mortgage, borrowed over 25 years, increase from 2% to 6%, then the monthly repayment would jump by £220, the ONS said.

The same increase on a £300,000 mortgage would see monthly repayments rise by £661.

The impact of higher mortgage rates is not only hitting those who are re-mortgaging, but also the prospects of first-time buyers.

One young family told the BBC how they had put their home-buying plans on hold, despite having two good jobs and having saved for a deposit for five years.

Kathryn Yabsley and her husband David saw their potential mortgage bill soar in the second half of the year.

"We had that excitement and thrill. So to just be shot down, I was in bits and my husband was disappointed too. It burst our bubble," said 29-year-old Mrs Yabsley, an NHS therapy assistant from Pembrokeshire.

"We're holding off to see if the rates go down and we're going to rent instead.

"I don't want to just survive, I want to live as well."

- Published19 November 2022

- Published6 January 2023

- Published17 October 2022

- Published9 January 2024

- Published1 August 2023

- Published4 January 2023

- Published6 January 2023