Cost of living: Rents and house prices continue to rise

- Published

House prices and rents continued to rise late last year, official data shows, but experts predict a slowdown.

Rent in properties owned by private landlords increased at the highest level since comparable records began seven years ago.

And while house prices were still rising in the year to November, the Office for National Statistics (ONS) said the pace of growth slowed.

Property values rose the slowest in Scotland, it said.

Tenants facing rises

Private rental prices, external paid by tenants in the UK rose by 4.2% in the year to December.

That is a slight acceleration from the 4% average annual rise in November, continuing a trend which shows it as the largest annual percentage change since comparable records started in January 2016. Landlords have been hit by tax and mortgage rate rises, adding to their own costs.

Renters proportionally spend more on housing costs than owners do.

What can you do about rent increases? Watch the BBC's Lora Jones tell you, in a minute.

In separate figures, the ONS said property prices, external increased by 10.3% in the year to November, slowing from 12.4% in October 2022.

There was a 10.9% annual increase in England, a 10.7% rise in Wales, a 5.5% jump in Scotland and 10.7% growth in Northern Ireland.

Within England, prices rose by the fastest in the north west, up 13.5% over the year, and the slowest in London, a 6.3% increase.

The typical UK house price in November was £295,000, which was £28,000 higher than a year earlier but a slight decrease from the previous month's record high of £296,000.

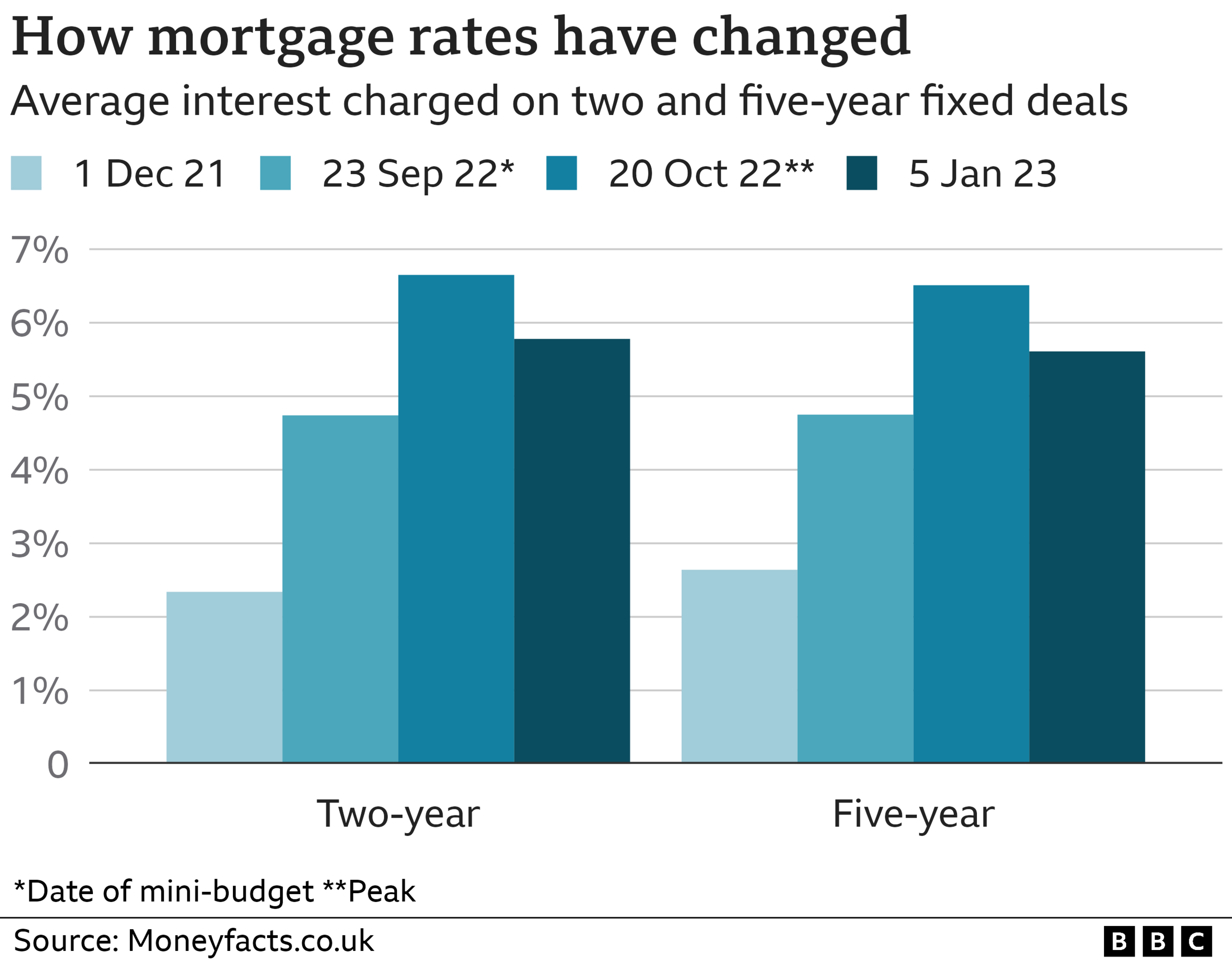

Potential buyers were hit by a steep rise in mortgage costs in 2022, driven in part by the doomed mini-budget during the premiership of Liz Truss.

Rates surged as the markets reacted unfavourably to promises of tax cuts without an explanation of how they would be funded.

The average cost of a new, two-year fixed-rate mortgage has fallen slowly since markets stabilised but is still much higher than it was at the start of last year.

"Home prices have risen far more quickly than incomes, creating an affordability squeeze, and mortgage rates have risen to levels not seen since the financial crash," said Myron Jobson, senior personal finance analyst at Interactive Investor.

"The likelihood of higher interest rates to combat high inflation means that affordability is likely to remain the top challenge for potential homebuyers - with fast-rising rents and the ongoing cost of living crisis scuppering deposit building efforts."

The ONS recently said that many thousands of homeowners face sharply higher mortgage costs when their current fixed-rate deal expires.

The ONS said that more than 1.4 million households would be renewing their fixed-rate mortgage this year, with 57% of them currently paying an interest rate of less than 2%. This renewal peak will come between April and June when 371,000 deals expire.

Related topics

- Published9 January 2023

- Published19 November 2022

- Published6 January 2023

- Published17 October 2022

- Published9 January 2024

- Published1 August 2023

- Published4 January 2023

- Published6 January 2023