Christmas cutbacks cause shock drop in shop sales

- Published

- comments

Shop sales fell by record numbers both in December and across the whole of last year as consumers cut spending.

Retail sales had been expected to rise last month in what is a key season for shops because of Christmas.

However, the volume of goods people bought in December fell by 1% from November, and by a record 5.8% compared with December 2021.

The Office for National Statistics (ONS) also confirmed retail sales for last year recorded the worst-ever fall.

They fell by 3% between 2021 and 2022, which is the biggest decline since ONS records began in 1997.

Prices have been rising sharply since last year, mainly due to soaring energy costs, which has put pressure on millions of households.

While the rate of inflation is starting to ease, at 10.5% it remains close to a 40-year high.

The ONS said retailers had indicated that "consumers are cutting back on spending because of increased prices and affordability concerns".

While the amount of goods and food bought fell in December, rising prices mean a large number of retailers have reported strong sales figures based on value over the Christmas period.

"It's worth noting that sales growth has been driven by customers spending more due to inflation rather than buying more," said Silvia Rindone, UK and Ireland retail strategy leader at accountancy firm EY.

John Adams, managing director at Jarrold, a department store in Norwich, said that Christmas sales had risen by 13%. However, it appeared people were spending more on fewer items.

Jarrold's John Adams said more people shopped in-store as postal strikes threatened deliveries

"I think from our perspective they were probably being more considered about what they were buying so we saw the average unit transaction actually increase," he said. "People tended to be buying quality and investing in things rather than buying perhaps frivolous things."

Stocking up early

There was a sharp drop in volume at non-food stores, but food stores also reported a fall in sales in December, according to the ONS.

It said the drop in food sales during December reinforced the view that people stocked up for Christmas earlier. In November, the volume of retail sales at food stores rose by 1%.

"After last month's boost as shoppers stocked up early, food sales fell back again in December with supermarkets reporting this was due to increased food prices and the rising cost of living," said Heather Bovill, deputy director for surveys and economic indicators at the ONS.

Bill Grimsey, the former boss of Iceland and Wickes, told the BBC's Today programme: "Christmas is the key trading time for retailers to often make a difference between profit and loss, particularly in the food sector where volumes are so very important."

Online sales also fell between November and December. The proportion of online sales dipped to 25.4% from 25.9% in the previous month.

Ms Bovill said feedback from retailers indicated "postal strikes were leading people towards purchasing more goods instore".

Mr Adams said: "Our footfall was ahead of 2019, so ahead of pandemic levels. I think particularly in the run-up to Christmas people were worried about delivery disruption with the strikes that were happening so there was definitely a swing back to in-store experience."

Looking ahead, John Allan, chairman of the UK's biggest supermarket chain Tesco, said that while there is a hope inflation will drop sharply in the middle of the year, "that doesn't mean prices are going to fall".

He said: "I think it means the increase in prices, we hope, will be much less sharp in the second half of this year and it is probably going to be into 2024 and beyond before we see the normal level of inflation we've enjoyed in previous years."

Mr Allan called on the government to provide a detailed plan to help boost economic growth.

"What we'd love to see from government is a really serious, thought-through, long-term growth plan," he said. "Long-term growth is the only way in which we're actually going to be able to raise standards of living for our fellow citizens."

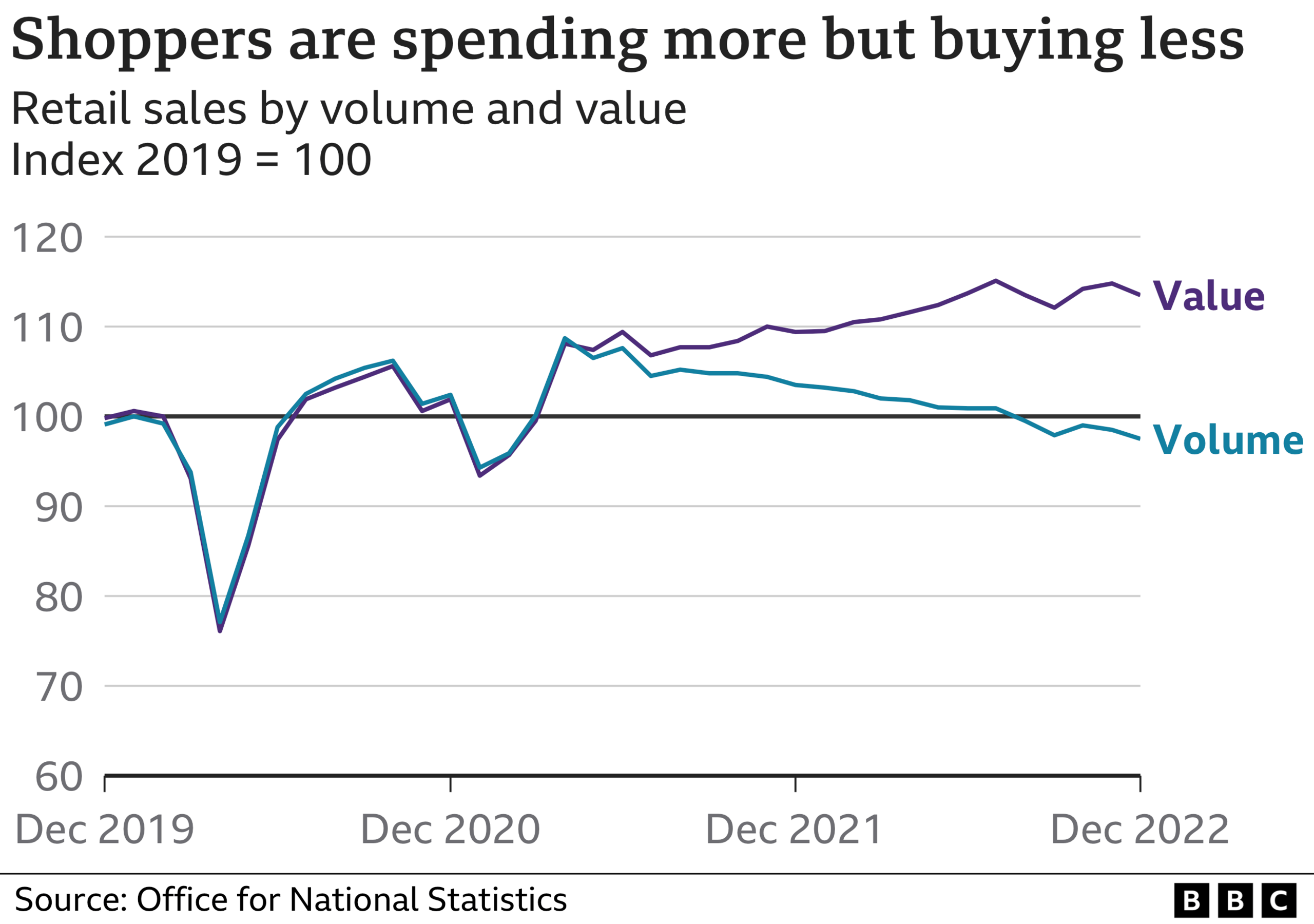

We've had a host of big retailers reporting better-than-expected Christmas trading but these ONS figures are a bit of a reality check on what's really going on.

We've been spending more but getting less for our money. And that's the overall story of retail in 2022 as inflation has taken a huge bite out of our spending power.

This year's festive figures are also flattered by easier comparatives from the previous year which was disrupted by the Omicron variant of Covid and supply chain problems leading to less available stock.

There had been fears that retail would be a wipe-out this Christmas. Consumers did still spend but this all-important season didn't deliver much festive cheer.

And it seems inevitable spending will be reined back in the first half of this year with higher bills coming down the tracks including all those purchases put on credit cards.

The ONS also revised down figures for November. It said that sales volumes fell by 0.5% instead of the original estimate of a 0.4% drop.

Capital Economics said the figures for December showed a "disappointing end to a difficult year".

"Today's retail sales release suggests that some of the resilience in the economy towards the end of last year appeared to peter out in December," said Olivia Cross, an economist at Capital Economics.

Related topics

- Published24 January 2023

- Published17 January 2023

- Published10 January 2023

- Published5 January 2023