Energy bills extra support ruled out by chancellor

- Published

- comments

Watch: "We need to be responsible with public finances", says Jeremy Hunt

Households are unlikely to get extra support with energy bills from April, Chancellor Jeremy Hunt has said.

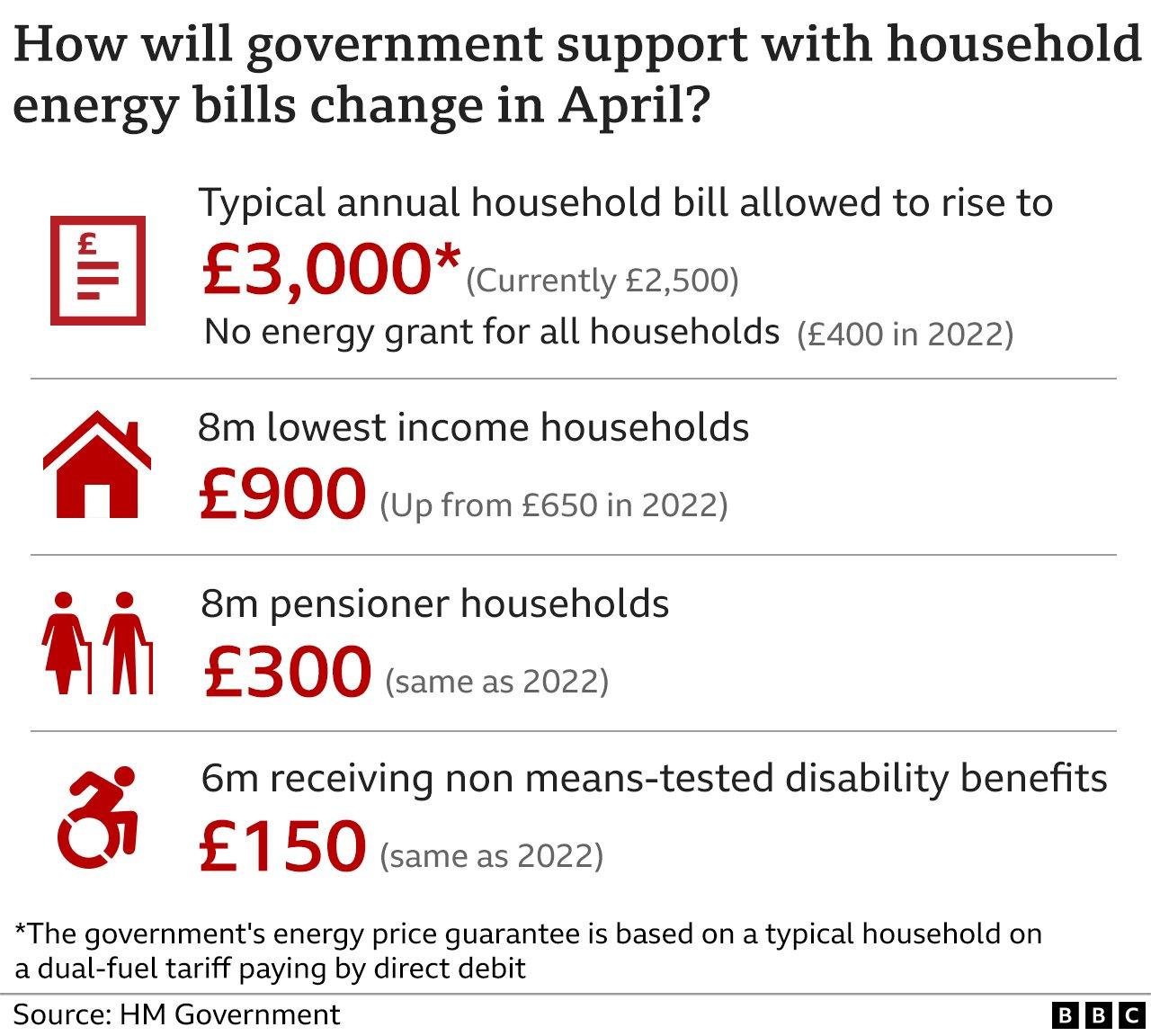

Energy bills for a typical household are set to rise from £2,500 to £3,000 a year and a £400 discount will also end.

The government has been under pressure to offer additional help for people to cope with high gas and electricity costs.

Consumer finance expert Martin Lewis said that allowing the bill increase would be a "national act of harm".

The government's energy price guarantee reduces what households pay per unit of energy they use.

From April, the typical household bill will be allowed to rise to £3,000 per year, from £2,500. The scheme will run until April 2024.

A £400 discount applied to most households' energy bills from October is also due to end at the beginning of April.

Some groups will get extra cash payments to help with energy costs, including households on means-tested benefits, pensioners and some people on disability benefits.

Meanwhile, most working-age benefits will increase in April, rising by 10.1% in line with last September's rate of inflation.

Mr Lewis, founder of Moneysavingexpert, has written to the chancellor, warning him an increase in the price cap would mean another 1.7 million people will enter fuel poverty, taking the total to 8.4 million.

There are various definitions of fuel poverty, but generally a household is considered to fall into that category if it spends 10% or more of its income on energy.

Mr Hunt told the BBC that the Treasury kept all support "under review" but he did not think the government had the "headroom to make a major new initiative to help people".

The National Audit Office recently published a report saying the energy price guarantee will now cost less than £40bn and this was a way to help bring down inflation and avoid a recession.

Mr Hunt said: "We always look at what else we can do. But we also have to be responsible with public finances, because if we're not, we'll just see interest rates go up, and people will face a different kind of cost, and that's why we have to get that balance right."

How your bill is calculated

At present, almost every household is protected by the government guarantee which limits the price per unit of their energy.

This means the bill for a household using a typical amount of gas and electricity is £2,500 a year. There is also a universal £400 discount, effectively bringing that typical annual bill down to £2,100.

Monthly direct debit payments smooth out the bill for the year, rather than paying more in winter - when energy use is higher - and less in summer.

This universal discount is expected to end, and the government guarantee is becoming less generous - pushing the typical annual bill up to £3,000 in April.

A relatively warm winter and energy saving by households, may mean some direct debits may not rise that much, or at all, because billpayers have built up credit on their accounts.

Another likelihood by the summer is that falling wholesale prices - which are paid by suppliers - may lead to prices for consumers falling.

Forecasters say that will bring the typical bill down below £3,000 a year.

Although bills are affected by all these variables, the government remains under pressure from campaigners and charities to help households whose bills are still likely to be double that of a year ago.

Prepayment meters

Price changes are critical for anyone on prepayment meters because there is no opportunity to smooth out bills - homes pay for energy as they use it. There are four million UK households on prepayment meters.

When customers have struggled to pay, some have been forcibly switched from regular meters to prepayment but this should not happen if they are vulnerable.

An investigation by The Times found, external debt agents for British Gas had broken into vulnerable people's homes to fit meters.

This prompted the regulator Ofgem to urge suppliers to stop the practice, and Energy Security Secretary Grant Shapps demanded answers from firms to explain how they will act in response to complaints from customers who have been wrongfully force-fitted these meters.

On Friday, he said the responses from suppliers were inadequate.

"I am angered by the fact some have so freely moved vulnerable customers onto prepayment meters, without a proper plan to take remedial action where there has been a breach of the rules," he said.

"So, I have only received half the picture as it still does not include enough action to offer redress to those who have been so appallingly treated."

Among those affected was David Ford, who had debt agents arrive at his home in Brighton in June threatening to use a locksmith to break in and install a prepayment meter.

"I said that I didn't want this to happen but the [agent] said he would call the police if we didn't accept the warrant. I was shocked," the 51-year-old said.

Despite calling his supplier - E.On - he did not get a call back and the meter was installed.

Although he was in debt, Mr Ford and his partner have disabilities and are on the Priority Services Register.

"We felt discriminated against as we are in a vulnerable position because of our disabilities, and we shouldn't have had a prepayment meter forced on us against our will," he said, adding that it has affected his and his partner's mental health.

In September the couple had a standard credit meter put back in but their bills still say they have a prepayment meter, and Mr Ford made a complaint to the ombudsman.

An E.On spokesman said the issue went back to September 2020, which was the last time Mr Ford made a payment. While fitting a prepayment meter was a "last resort", the company also accepted it was wrong to do so.

"We accept that we should not have fitted a prepayment meter in the summer of last year because of Mr Ford's vulnerabilities, this was an error on our part and for which we apologise," the spokesman said.

"We know these are incredibly difficult times and we continue to urge any customer who is struggling to get in touch as there are ways we can help."

Related topics

- Published10 February 2023

- Published15 February 2024