Nationwide latest lender to raise mortgage rates again

- Published

- comments

Nationwide will become the latest lender to raise mortgage rates again, with increases of up to 0.7 percentage points taking effect on Friday.

The building society, one of the UK's biggest lenders, said that the changes were being made to ensure it could serve all its customers.

Another lender, Clydesdale Bank, said it was withdrawing deals via brokers later on Thursday owing to high demand.

One broker said the market was in a "vicious circle".

Andrew Montlake, of Coreco, said that lenders were putting up rates at short-notice, then borrowers were grabbing deals, leaving lenders inundated and having to pull or raise rates again.

"It is massively hard to navigate for everyone, especially clients, who need to make quick decisions in these circumstances, whilst brokers are working round the clock to try to lock in to these rates," he said.

Nationwide is the latest major to repeat rate rises. On Friday, it will increase the rates on a variety of fixed-rate mortgages sold via brokers. Among them is a 0.7 percentage point hike in interest on new deals for existing customers moving home.

A spokesperson for the building society said lenders' costs were rising, and competitors were also putting up rates.

"This ensures that, as a building society, we can continue lending to all types of borrowers. Despite the changes in rates, our full mortgage range continues to remain available," he said.

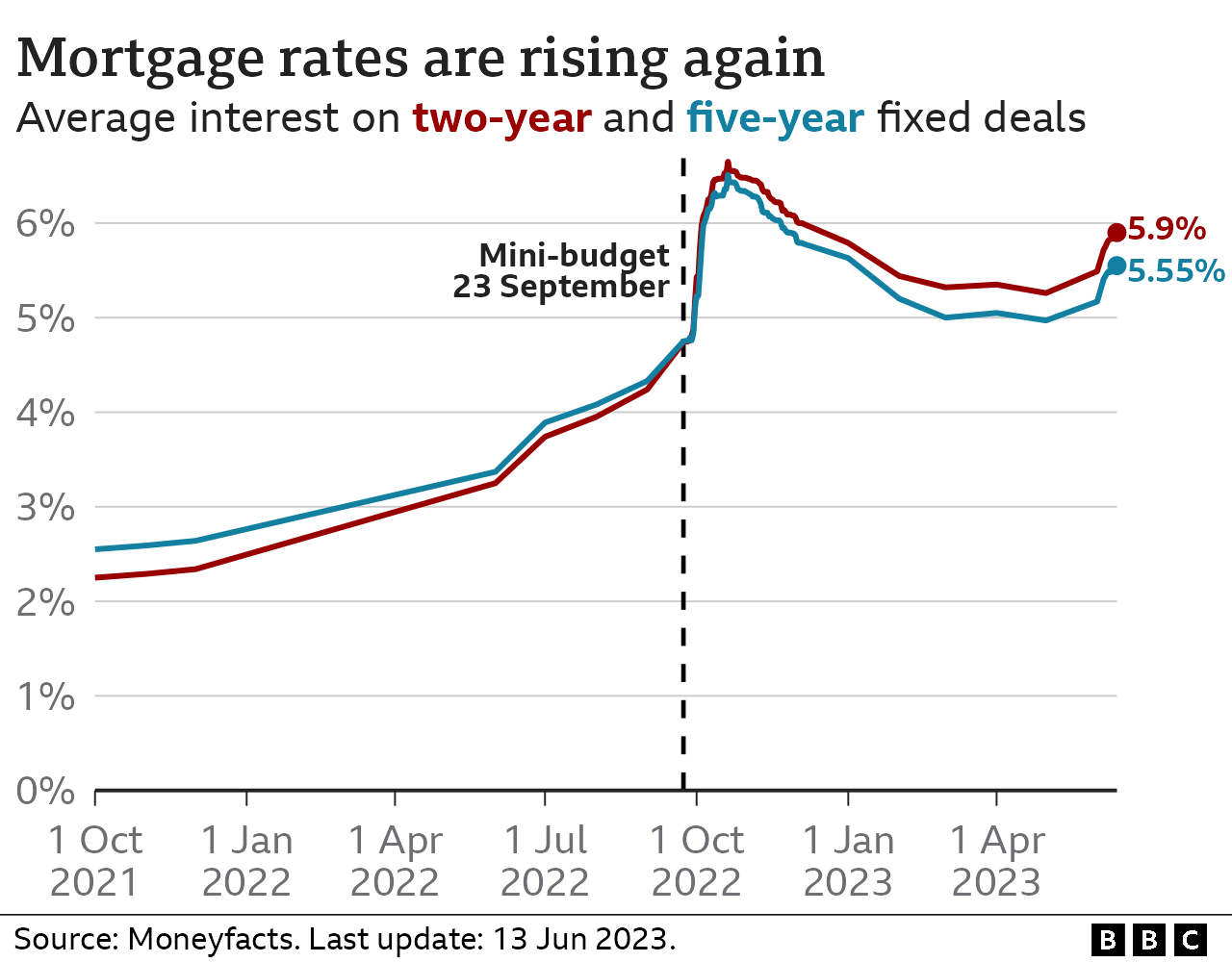

Data on wages and rising prices mean markets anticipate inflation and interest rates to stay higher for longer than previously expected.

This has led to government borrowing costs - which directly impact mortgage rates - rising to levels as high as last year's mini-budget.

The base rate, set by the Bank of England's Monetary Policy Committee and currently at 4.5%, will be reviewed next week and is widely expected to go up for the 13th time in a row.

"It is important that everyone does not panic, and that includes the Bank of England," Mr Montlake said.

"Questions need to be asked as to whether they really do need to increase rates beyond 5% before previous rate changes have had an effect, and they risk causing more problems than they are trying to solve."

Related topics

- Published11 June 2023

- Published5 January 2024

- Published13 June 2023

- Published12 June 2023