Mortgage rates: Fresh round of rises imposed by lenders

- Published

- comments

Major mortgage lenders have embarked on a fresh round of rate rises, with the interest rate on a typical five-year fixed deal now close to 6%.

The Halifax, part of Lloyds Banking Group - the UK's biggest lender, and the Nationwide Building Society have increased rates on new deals.

They are among a range of providers to have moved in recent days.

HSBC and TSB raised their rates on Wednesday, less than a week after the Bank of England put up the base rate.

Nationwide increased fixed rates, available through brokers, by up to 0.35% on Thursday, a day after HSBC raised its rates by up to 0.55%, and TSB by up to 0.35%.

On Thursday last week, the Bank of England surprised markets by raising its benchmark interest rate from 4.5% to 5%, as it tries to tackle the high rate of inflation.

A number of lenders have also raised buy-to-let mortgage rates, which could feed through to tenants in higher rents.

"[Changes] are certainly coming through now," said Aaron Strutt, of mortgage broker Trinity Financial.

"More of the big banks and building societies are increasing their prices again or pulling their mortgages, which means new borrowers and people looking to remortgage will face even higher repayments.

"We now seem to be in a pretty endless cycle where lenders keep raising rates as they struggle to price their mortgages."

He said that if someone seeking a mortgage saw a rate they liked, and thought it offered reasonable value for money, they should act quickly.

Some lenders were pulling rates, he said, because they were too busy, with others pointing to higher funding costs.

High Street banks raise money from the markets, which they then lend to customers in mortgages and other loans, but the costs they face are rising, reaching a similar level as after last year's mini-budget.

More than a million people rolling off fixed-rate mortgage deals this year may face paying hundreds of pounds more in monthly repayments because of the recent increases in interest rates.

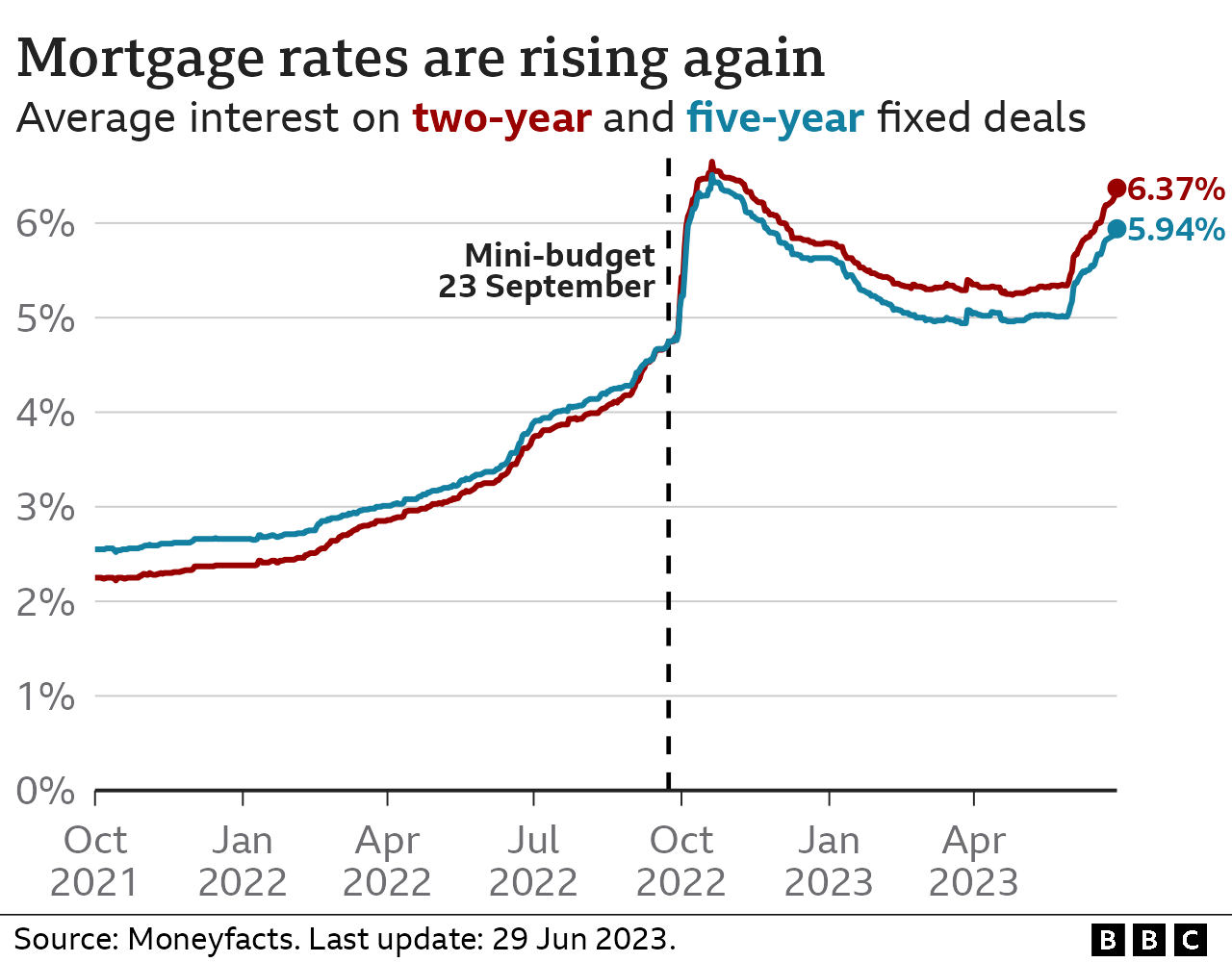

The latest rate rises mean that average rates on new deals continue to go up, as they have for months. An average two-year fixed rate mortgage is currently at 6.37%, while the five-year rate is 5.94%, according to financial data firm Moneyfacts. In June last year those rates were closer to 3%.

At their peak after the mini-budget, the average two-year rate was 6.65%, and the five-year was 6.51%.

On Sunday, Prime Minister Rishi Sunak urged homeowners and borrowers to "hold their nerve" over rising interest rates - a comment met with derision by opposition parties.

Following a summit with mortgage lenders, some limited extra protection has been agreed to assist those who struggle to make mortgage repayments. They include a timeframe to ensure forced repossessions do not happen quickly, and some flexibility for those who want to temporarily change the terms of their mortgage.

Anyone struggling is being urged to contact their lender, who is obliged to help and outline any potential options.

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future

Related topics

- Published5 January 2024

- Published9 January 2024

- Published8 January 2024

- Published23 June 2023

- Published26 June 2023