NatWest, Lloyds, Barclays and HSBC among banks quizzed over savings rates

- Published

- comments

The bosses of nine major banks and building societies have been told to be more open with their customers over savings rates.

The bosses of Lloyds, HSBC, NatWest and Barclays were among those quizzed by the regulator over concerns that interest rates on savings are too low.

Interest rate rises have led lenders to hike mortgage costs, but savings rates have not been rising as fast.

The meeting was "constructive", the Financial Conduct Authority (FCA) said.

Sheldon Mills, from the FCA, said that bank customers were getting value from banking services in general, despite wider criticism that banks could be making excess profits.

But, after the meeting with nine of the biggest savings providers, he said that banks and building societies needed to find the best ways to communicate with customers over the products on offer.

He said rates on longer-term savings deals had improved, and there had been "some movement" over instant access accounts, and the progress should now accelerate.

"We have challenged firms where their decision making has been slow," the regulator said.

It was not the regulator's role to set interest rates, Mr Mills added, as this was a commercial decision. However, he said that banks needed to be open to speaking to customers, they needed to provide fair value, and put customers "at the heart of their pricing conditions".

Rates gap

Chancellor Jeremy Hunt recently claimed that banks have been "too slow" to pass on increases in interest rates to savers, arguing it is an "issue that needs solving", particularly for people with instant access accounts.

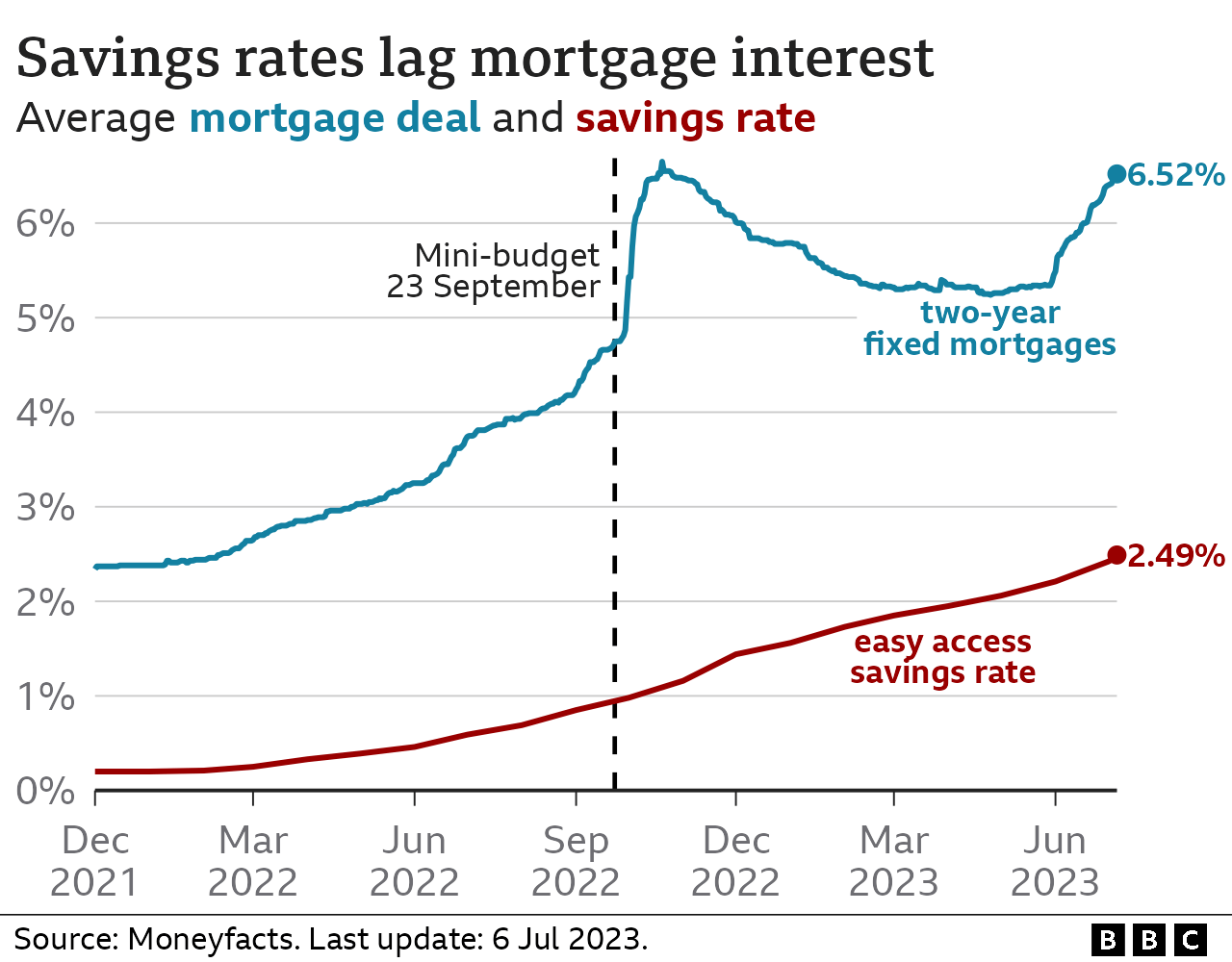

Figures released on Thursday showed the average two-year fixed mortgage rate was 6.52%, while the average, and most common, easy access savings account rate based on £10,000 of savings, was 2.49%.

The gap, of 4.03 percentage points, is almost double what it was in December 2021 (2.19 percentage points), when the Bank of England first started increasing interest rates in an attempt to slow the speed of rising consumer prices.

Philip Augar, a former non-executive director of TSB, told the BBC's Today programme that he thought the meeting was like "the early stages of a dance" between the banks and regulator.

Bank profits have been rising so "it's certainly a sensitive issue right now", Mr Augar said, and he thought the banks "in general will be in apologetic mode".

"I think they need to get on well with the regulator [and] they need to stay in the government's good books."

He said the banks would fear any compulsory measures being imposed on them, such as a special tax on banking profits or more rules and regulations.

What are my savings options?

As a saver, you can shop around for the best account for you

Loyalty often doesn't pay, because old savings accounts have among the worst interest rates

Savings products are offered by a range of providers, not just the big banks. The best deal is not the same for everyone - it depends on your circumstances

Higher interest rates are offered if you lock your money away for longer, but that will not suit everyone's lifestyle

Charities say it is important to try to keep some savings, however tight your budget, to help cover any unexpected costs

There is a guide to different savings accounts, and what to think about on the government-backed, independent MoneyHelper website, external.

Are you benefitting or not from higher savings rates? Get in touch.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

The Bank has been increasing interest rates to make it more expensive for people to borrow money, and more worthwhile for them to save - the theory being that consumers will spend less and price increases will slow down.

Its base rate - which influences the mortgage and savings rates set by High Street banks - is now at 5%.

Analysis from banking giant JP Morgan has suggested interest rates in the UK could reach 5.75% by November, and be at a higher level for some time.

However, it warned that in a worst-case scenario, if inflation failed to come down, a base rate of 7% "might be required".

Banks' profits generally rise in line with interest rates, but lenders argue that savers have access to a host of competitive deals.

UK Finance, the trade body for the banking sector, has previously said savings and mortgage rates "aren't directly linked and therefore move at different times and by different amounts".

Following the meeting, its chief executive David Postings said: "The savings market is competitive, with a wide range of different accounts available to help people with their individual saving needs. We always encourage customers to shop around for the type of account that best suits them."

Lloyds and NatWest have not responded to the BBC's request for comment, but Barclays has said it "regularly" reviews its savings rates.

HSBC has said it has increased its savings rates "more than a dozen times since the beginning of last year".

- Published4 July 2023

- Published26 June 2023