How will the UK economy compare to other countries in 2024?

- Published

Rising prices, stagnant incomes, and flatlining growth raising fears of recession: 2023 was tough.

But with a pre-Christmas surprise drop in inflation, will the dawning of 2024 - likely to be an all-important election year - ring in a brighter, less pressured phase?

And how does the UK experience compare to elsewhere?

Inflation

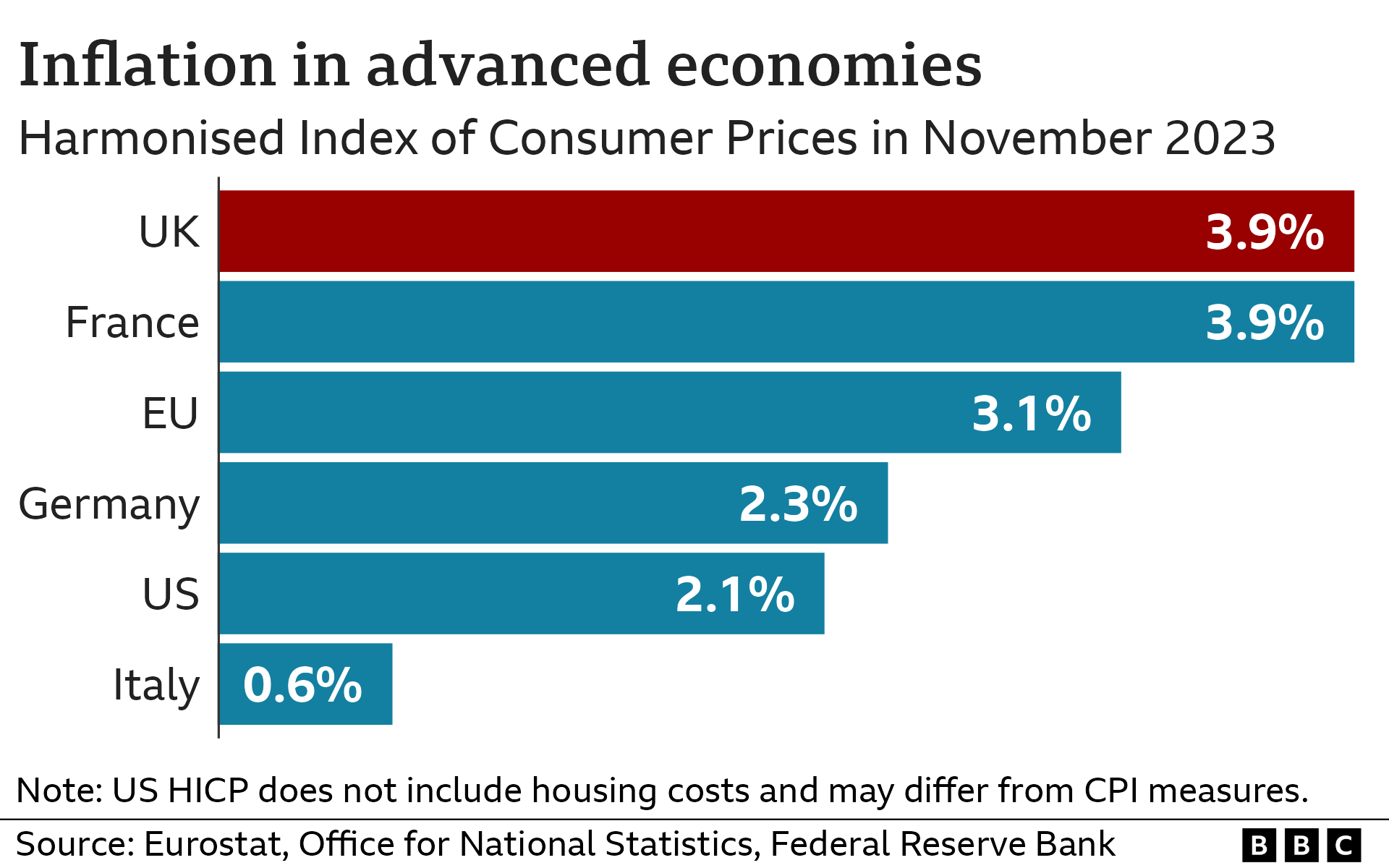

The worst of the cost-of-living crisis appears behind us - but prices were still 3.9% higher in the UK than a year ago in November.

Inflation's the same in France but above the EU's 3.1% inflation rate, looking at the most comparable figures. It's even lower in the US.

Britain had particularly stubborn inflation due to experiencing the worst of both sources of price shocks affecting rich countries - 2022's spike in energy and food costs prompted by the war in Ukraine, and a post-pandemic shortage of workers.

But as those pressures retreat, the inflation gap is narrowing.

Core inflation, which strips out food and energy, has also been more stubborn in the UK, suggesting a greater willingness and ability by consumers to spend. That might have been funded by pay rises or pandemic-era savings - but that's easing too.

Interest rates

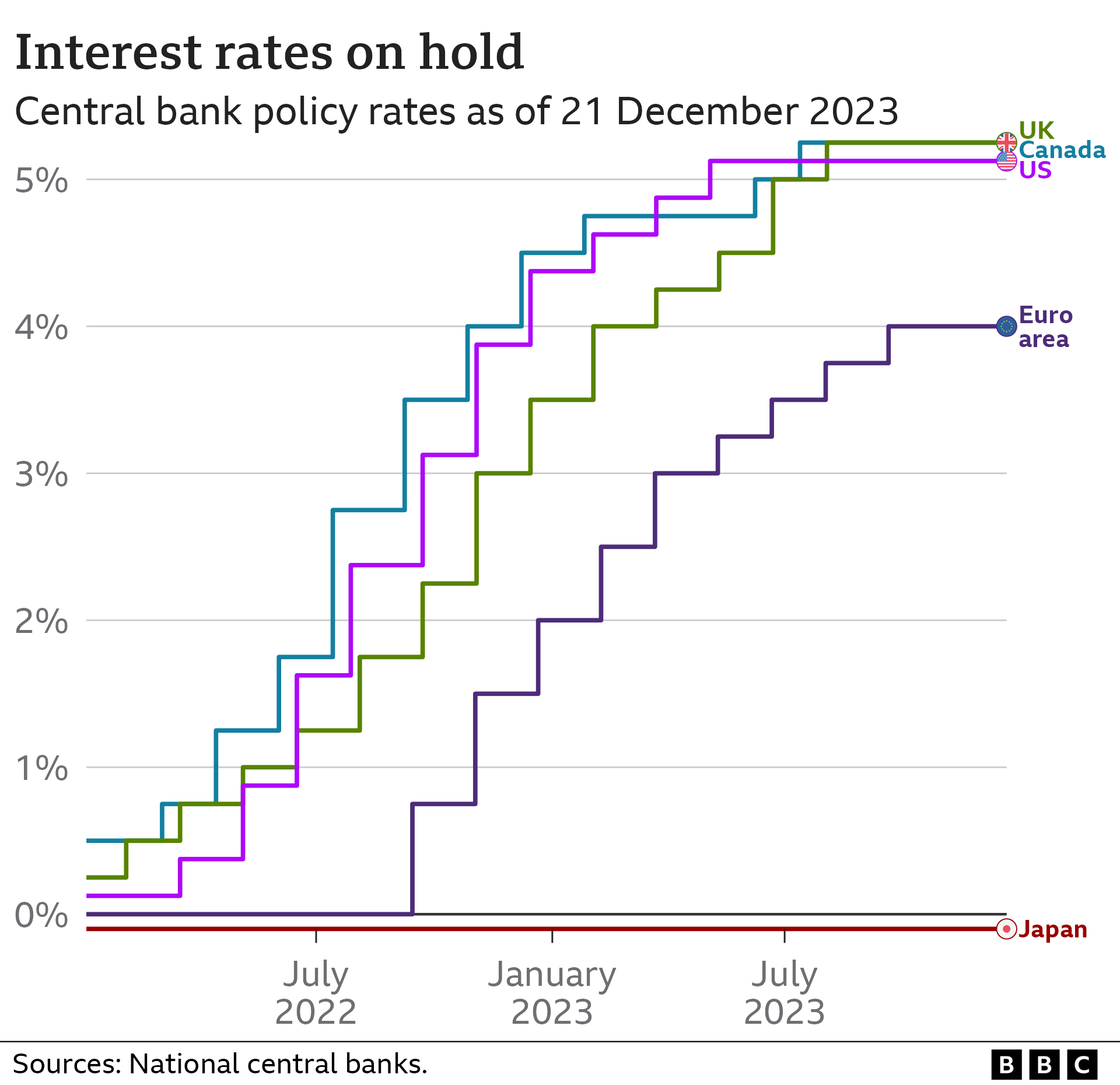

Barring a new inflation shock, the Bank of England's rate-raising spree - 14 hikes over the last two years - may be over. But the pain lingers.

That's been true of many countries. Central bank rates - and the rates on new mortgage deals have generally shot up over the last couple of years.

However, the impact differs. In the US and some of Europe, fixed-rate mortgage deals tend to typically run for 25 or 30 years and homeowners may be able to switch deals with minimal penalty. The French government also effectively caps rates, so a new 30-year mortgage deal may cost 3.5% while in America those rates peaked at over 7%.

So, borrowers in those countries may be more shielded from rate hikes than in the UK, where the majority are on two- or five-year fixed rate deals. Millions have seen a jump in repayments as they renewed deals, hundreds of thousands more will follow in 2024.

But the blow for the latter may be softened somewhat. If the latest fall in UK inflation is sustained, some economists reckon the Bank of England may cut rates as soon as the spring, around the same time as those other central banks. Fixed rate mortgage deals are already falling as financial markets grow more hopeful of cuts.

Growth

The previous couple of years turned out to be a bit better than originally thought - but in recent months, activity has stalled.

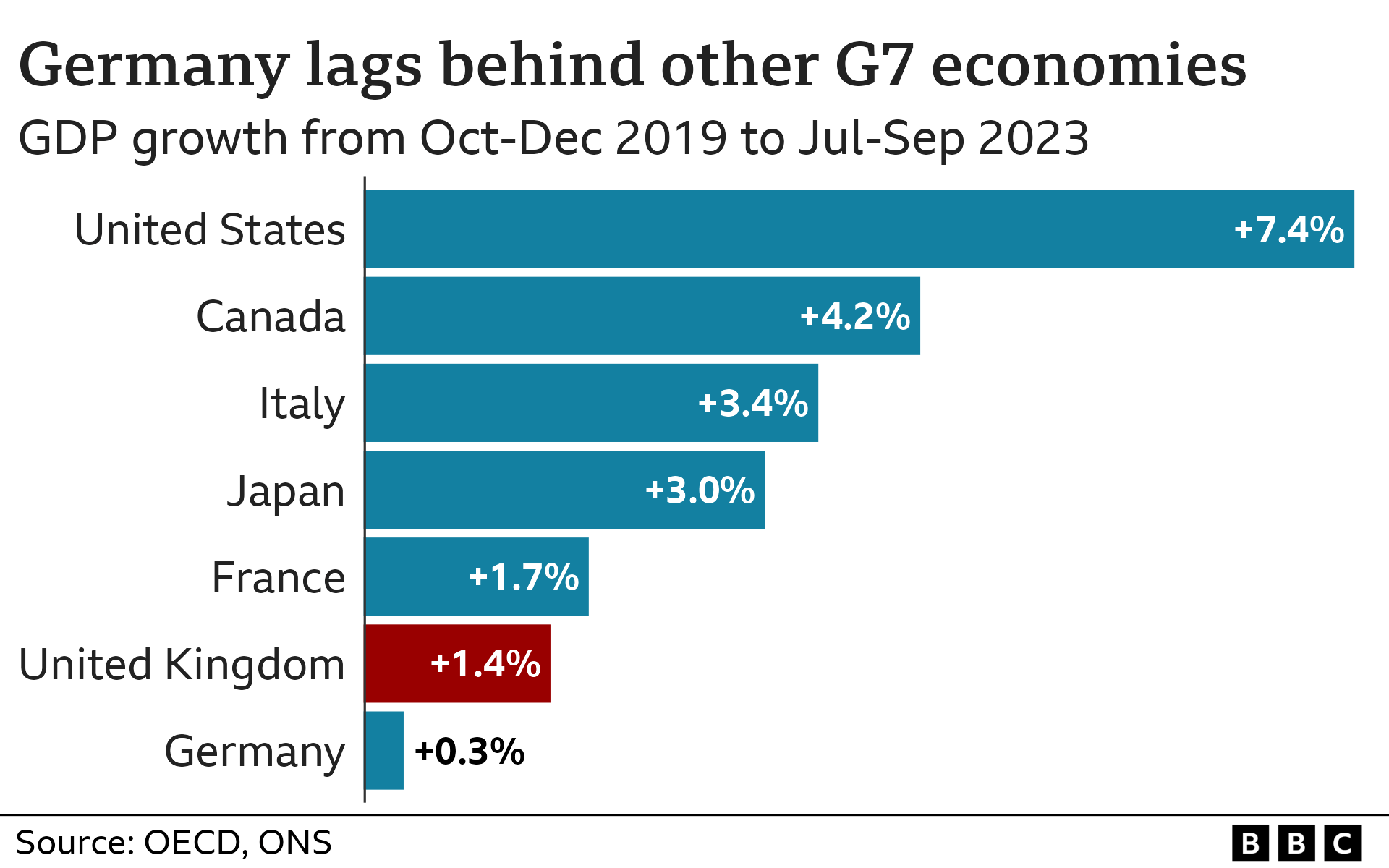

Revised official statistics in September showed that the UK economy wasn't, contrary to earlier estimates, still smaller than prior to the pandemic.

While the UK still lags behind the US on that score, and did slightly worse than France - it fared better than Germany. The latter has struggled, the manufacturing prowess it has been renowned for making it vulnerable to weaker demand from other countries and supply chain issues, in particular as it tried to wean itself off energy imported from Russia.

Economists remain downbeat about Germany's near-term prospects. But those may not be much brighter in the UK.

The latest official figures suggest the UK's economy stalled and then slipped into reverse over the summer, raising the risk that it edged into recession at the end of 2023. Many parts of the service sector that cater to households remain smaller than prior to the pandemic.

As the impact of the recent rate rises continue to filter through to incomes, profits and spending, the Bank of England is expecting virtually no growth over the next couple of years. The IMF is only a bit more optimistic.

UK growth over the past 15 years has typically been a fraction of what it averaged before the 2008 financial crisis. Add in rising inequality and researchers at the Resolution Foundation say the typical British household is more than £8,000 worse off than it would have been had it echoed competitors' track records.

That's why politicians of all parties have put higher growth on the priority list.

Unemployment

Despite Covid and higher rates, our jobs market has been resilient so far. The latest comparable unemployment rate shows the UK at 4.2%. That's in line with the G7 average. It's higher than in Germany and the US but below France's rate of 7%.

But the widespread skills shortages of 2022 have gone. As those interest rates bite, employers are curbing hiring. Unemployment too could rise - by less than one percentage point according to official estimates - but that could see over a hundred thousand jobs to go.

But there's more. To count as unemployed, people have to be available for work and seeking a job - or they count as inactive. The UK is one of few rich countries in which there are more inactive people than prior to the pandemic. Hundreds of thousands more. The number of long-term sick has soared.

Helping more people back to work is seen by some policymakers as crucial to boosting growth and incomes. The Autumn Statement contained many measures - from occupational health support to benefit sanctions, both carrot and stick - towards that.

Tax

It's not just jobs, inflation and rates affecting fortunes.

Millions of workers will benefit from a New Year National Insurance cut - but they've also seen tax bills via their pay packets rise as the thresholds at which higher rates of taxes on incomes become applicable fail to rise with inflation.

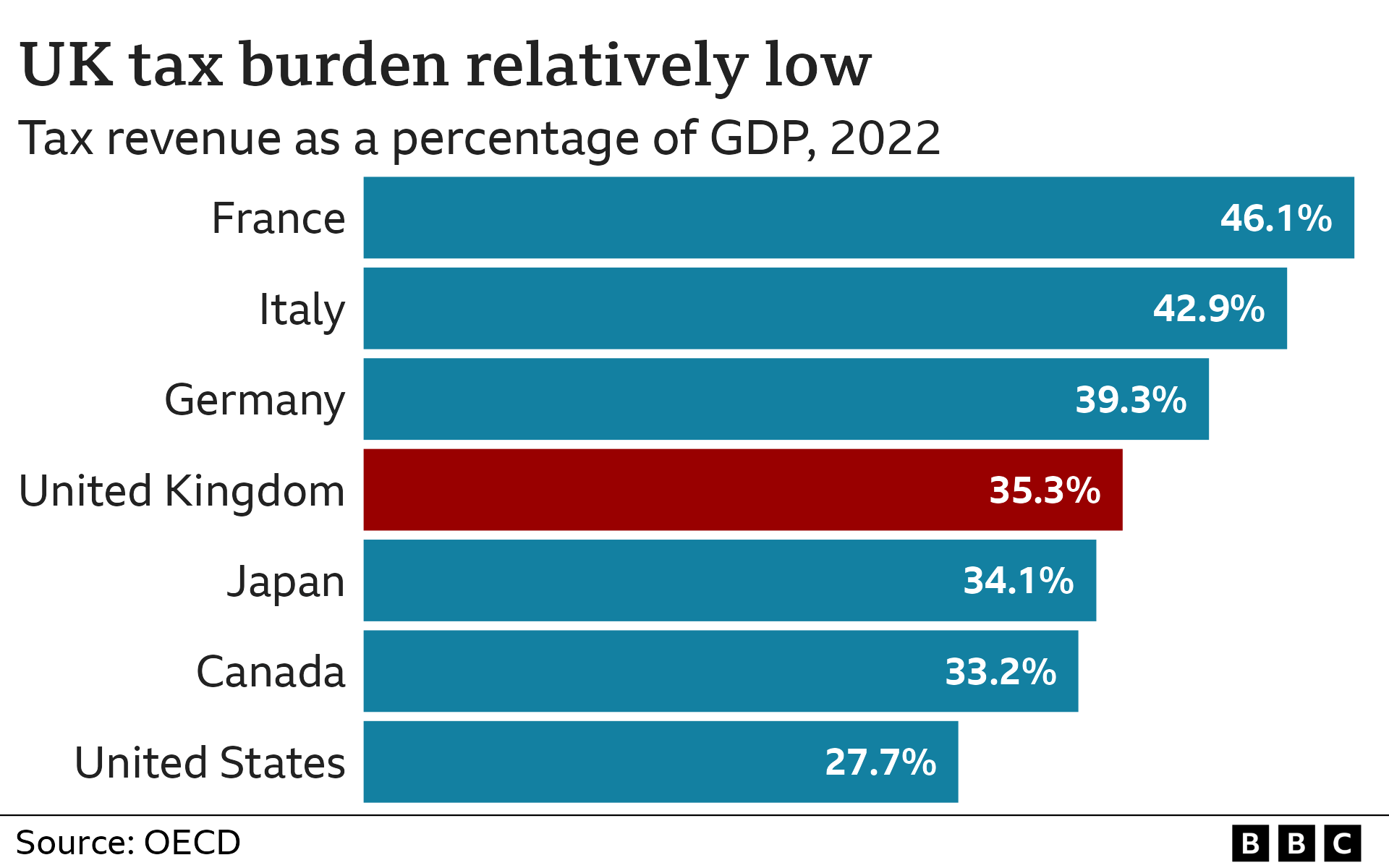

So the UK's tax burden, the proportion of the nation's income, GDP, paid to the tax man, is still set to reach a post-war record.

But our tax burden was actually lower than the EU average, although above that in the US on the latest comparable numbers. The taxman in France already receives 46 cents for every euro generated in the economy there.

However most nations will face increased pressures on their public purse, thanks to an ageing population and existing debts.

2023 has had its challenges but going into 2024, there are some areas to feeling cheery about - and others that will mean some households continuing to struggle.

There'll be plenty to keep politicians busy as they draft manifesto pledges and debate on doorsteps.

The economy is one of the most crucial election battlegrounds, a sign of these challenging times.

Everyone wants to turbo-boost prosperity - the question for politicians and policymakers is how to do so.