IMF defends gloomy UK forecast after government criticism

- Published

- comments

The International Monetary Fund has rejected government suggestions that its latest assessment of the UK economy is too gloomy.

The influential global group forecasts the UK will have the highest inflation and slowest growth next year of any G7 economy, falling behind the US, France, Germany, Canada, Italy and Japan.

The Treasury said recent revisions to UK growth had not been factored in to the IMF's report.

But the group denied being pessimistic.

IMF chief economist Pierre Olivier Gourinchas told the BBC: "We're above the Bank of England estimate [for growth] for next year, so I don't think we are particularly pessimistic. I think we're trying to be honest interpreters of the data here."

Forecasts are never perfect given the many factors that affect economic growth - from geopolitics to the weather. But such reports can point in the right direction, especially where they align with other predictions.

The IMF, an international organisation with 190 member countries, has said the forecasts it makes for growth the following year in most advanced economies have, more often than not, been within about 1.5 percentage points of what actually happens.

In July last year, it forecast that the UK economy would grow by 3.2% in 2022. It revised that upwards to 4.1% at the start of this year.

But official UK figures released last month estimated that the country's economy expanded by 4.3%, external in 2022 - considerably more than the IMF's initial estimate.

According to the group's latest forecast, which it produces every six months, it expects the UK to grow more quickly than Germany in 2023, keeping the UK out of bottom place for growth among the G7.

But it downgraded the UK's prospects for next year, estimating the economy will grow by 0.6%, making it the slowest growing developed country in 2024 - widely predicted to be a general election year.

The IMF says the UK's immediate prospects are being weighed down by the need to keep interest rates high to control inflation, which has been falling but remains stubbornly above target.

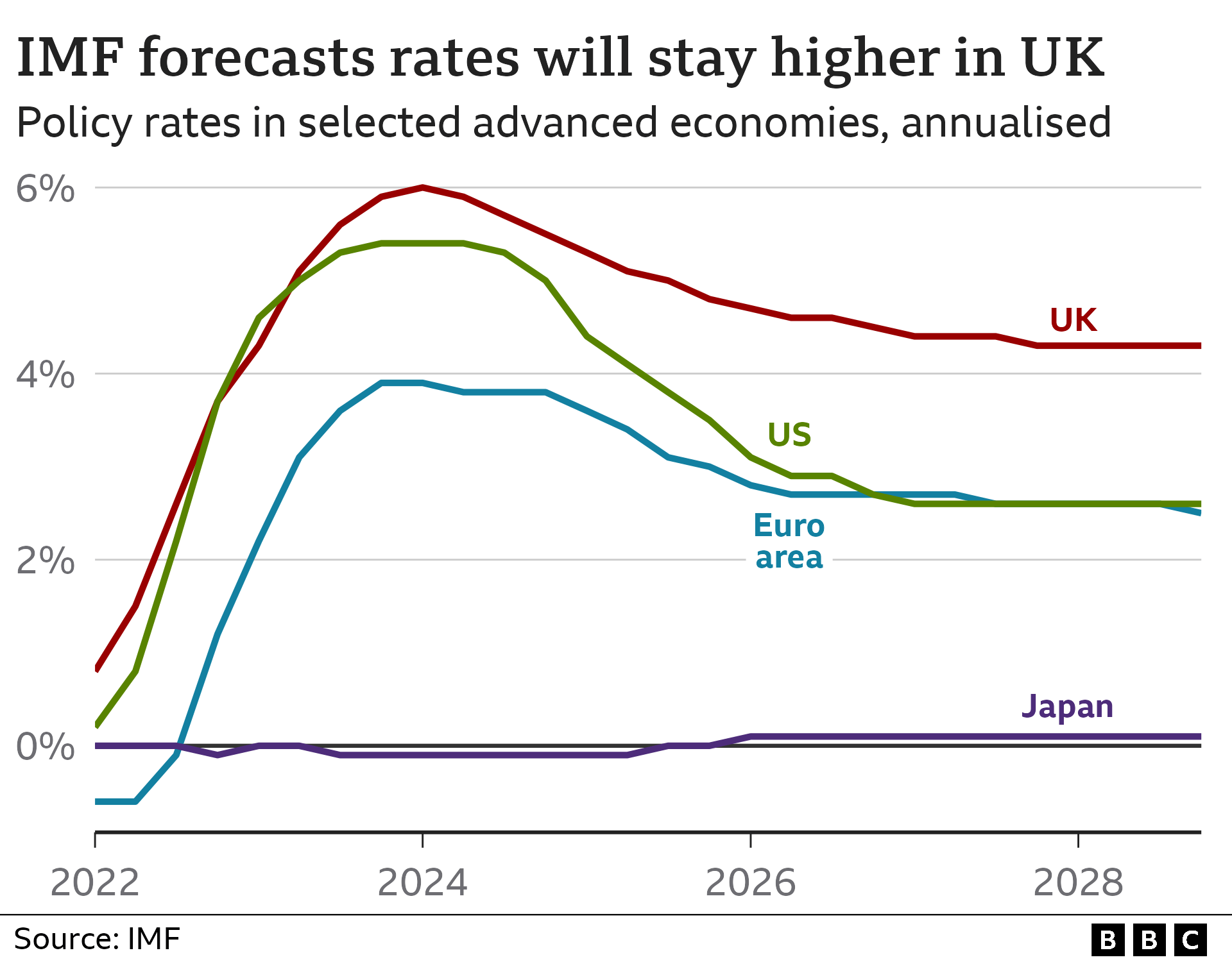

It warned Bank of England rates would peak at 6% and stay around 5% until 2028. Rates are currently 5.25%.

"The decline in [UK] growth reflects tighter monetary policies to curb still-high inflation and lingering impacts of the terms-of-trade shock from high energy prices," the report said.

The IMF's forecast has come at a bad time for the UK government, which is keen to promote the idea that the economy is at a turning point with inflation falling decisively and interest rates likely to have peaked.

Government sources suggested the IMF had not taken into account the fact that expectations for market interest rates had fallen in recent weeks, and that the Office for National Statistics (ONS) had upgraded its assessment of the UK's post-pandemic recovery.

However, Mr Gourinchas rejected that, telling the BBC that the IMF had "absolutely" factored in interest rates peaking late last month and that "there is no discrepancy".

He added that a "preliminary read" of the ONS's revised data had changed the picture for 2021, but "probably not much" for the current forecasts.

"If anything," he said, past upgrades for 2021 would mean "there is less room to grow and catch up, so it might not lead to a big change upwards in terms of the growth performance."

Responding to the IMF's report earlier, Chancellor Jeremy Hunt said: "The IMF has upgraded growth for this year and downgraded it for next - but longer term they say our growth will be higher than France, Germany or Italy.

"To get there we need to deal with inflation and do more to unlock growth."

On Tuesday, the Bank of England's Financial Policy Committee (FPC), which monitors the stability of the UK financial system, also warned on the UK's high interest rates, external.

It said financial markets expected rates would "have to stay high for a long time", putting pressure on household finances.

"The full impact of higher interest rates has not yet passed through to all borrowers," it added.

The IMF is already warning of signs of a slowdown in the world economy after what appeared to be a resilient start to the year.

For example, tourism had recovered following the pandemic, boosting economies with large travel and tourism sectors such as Italy, Mexico and Spain.

But a slowdown in interest-rate-sensitive manufacturing sectors was dragging on growth and there were signs that China's momentum was fading following its "reopening surge" at the start of 2023.

The IMF predicts global growth will fall from 3.5% in 2022 to 3% in 2023 and 2.9% in 2024.

"The global economy continues to recover from the pandemic and Russia's invasion of Ukraine, showing remarkable resilience," Mr Gourinchas said.

"Yet, growth remains slow and uneven. The global economy is limping along, not sprinting."

Sign up for our morning newsletter and get BBC News in your inbox.

Related topics

- Published18 September 2023

- Published10 October 2023