Young drivers face £3,000 cost for car insurance

- Published

- comments

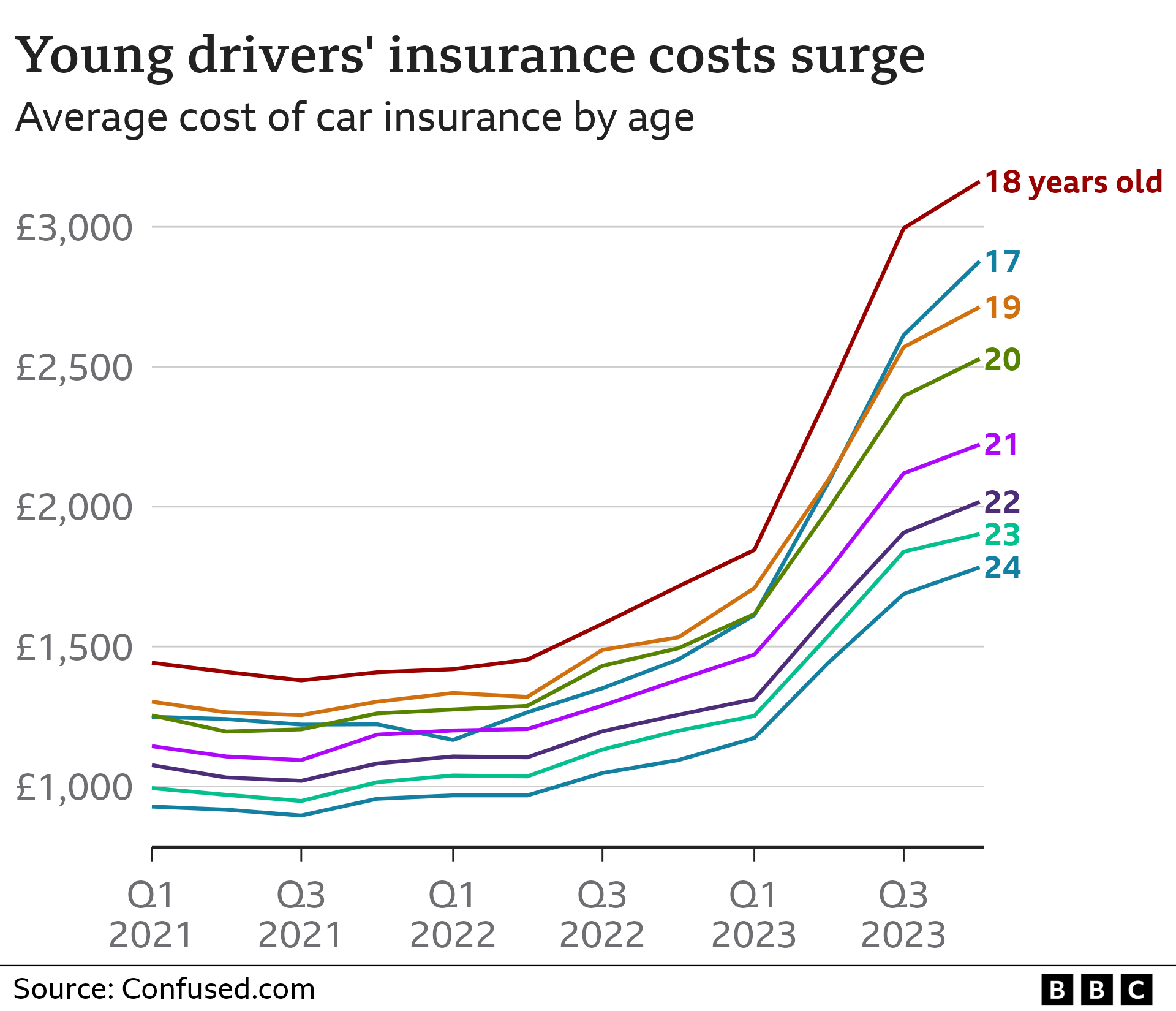

Young drivers have been hit hardest by the highest car insurance costs on record, with some facing premiums of nearly £3,000, according to data.

Confused.com, the price comparison firm, said on average 17-20-year-olds had seen insurance rise by more than £1,000 from the same time last year.

Overall, on average drivers face paying 58% more on car insurance compared with last January.

Confused.com blamed a post-Covid increase in claims and higher costs.

Steve Dukes, chief executive of Confused.com, told BBC Radio 4's Today programme: "The frequency in claims is up in the last couple of years, since the pandemic, but also the cost of them.

"The cost of second-hand cars is higher than they used to be, the cost of parts, the cost of labour to make repairs - and that's all being passed onto consumers."

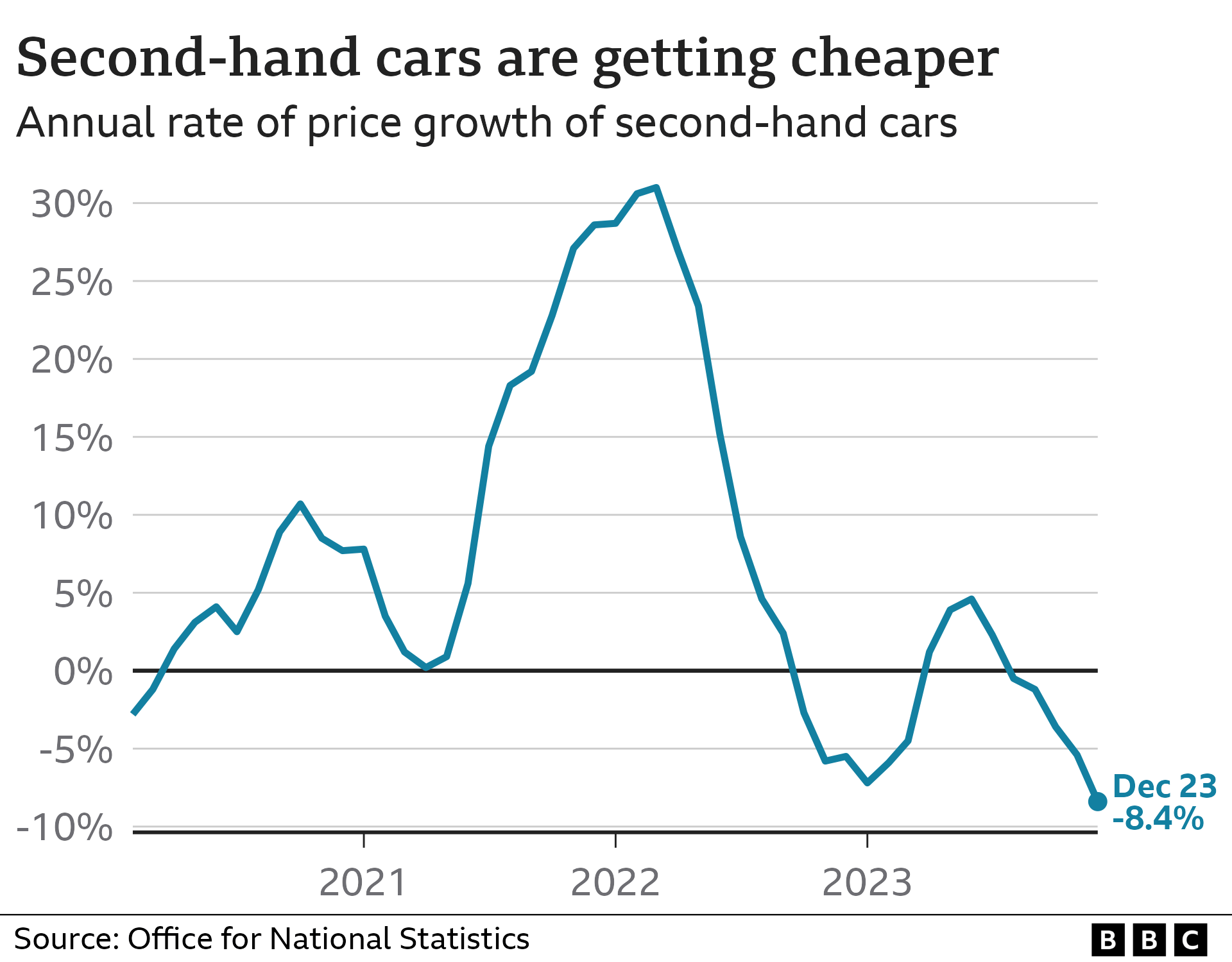

Prices for second-hand cars - the usual first vehicle for a newly-qualified young driver - have been volatile since a few months into the Covid pandemic. Demand for used cars spiked as production of new vehicles fell because of a global shortage of computer chips and other materials needed manufacturing.

In March 2022, prices increases in the used car market peaked at 31%, according to the Office for National Statistics. They have since fallen back sharply.

However, Confused.com said it was a "really tough time" for motorists.

Average price rises for car insurance across all drivers rose by £366 to £995.

But younger drivers faced the sharpest jump. For 17-year-olds, premiums surged by an average £1,423, to £2,877. For 18-year-old drivers, the average policy price reached £3,162.

The data is calculated on an average of the best five quotes received on Confused.com, rather than prices actually paid for policies.

Mr Dukes said there are ways to reduce premiums. "Where they can legitimately share the driving with an older driver with more experience and add that person as a named driver, that can have a really significant effect and bring the price down by hundreds of pounds, that's really worth looking at," he said.

Mr Dukes also suggested younger motorists explore the use of telematics, external, or "pay how you drive" insurance, where their behaviour on the road is shared with the underlying insurance provider or occasional drivers insurance.

But he said with the price rises for 17-20-year-olds many young drivers would be looking at whether they can afford to drive at all.

"The industry has to be careful not to push younger drivers into other modes of transport and that's a real risk when prices get this high," he said.

The Association of British Insurers (ABI) said while car insurance could be expensive there were ways to bring costs down. , external

It added that it was important that motorists never drove without cover and urged anyone struggling with costs to speak to their insurers.

However, the ABI said insurance is always based on risk and its data showed the average cost and frequency of claims is higher for younger drivers, which can impact premiums.

According to the ABI's own analysis of 28 million policies, drivers' insurance costs rose between July and September by an average £561, up 29% compared with the same time in 2022.

The association said the figures were based on the price customers paid for their cover rather than what they were quoted.

Are you struggling with the cost of car insurance? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published11 January 2024

- Published11 August 2023