IMF warns UK government against further tax cuts

- Published

- comments

Jeremy Hunt has hinted at more tax cuts in the upcoming Budget

The International Monetary Fund (IMF) has "advised the UK against further tax cuts", as it launched its latest assessment of the world economy.

It said preserving public services and investment implied higher spending than was reflected in the government's current plans.

The IMF suggested the Treasury's pencilled-in spending cuts from this year were unrealistic.

Chancellor Jeremy Hunt said tax cuts could be a big help in boosting growth.

Mr Hunt has hinted heavily about more tax cuts in his upcoming Budget in March.

The IMF is an international organisation with 190 member countries, including the UK. They work together to try to stabilise the global economy.

One of the Fund's jobs is to advise its members on how to improve their economies.

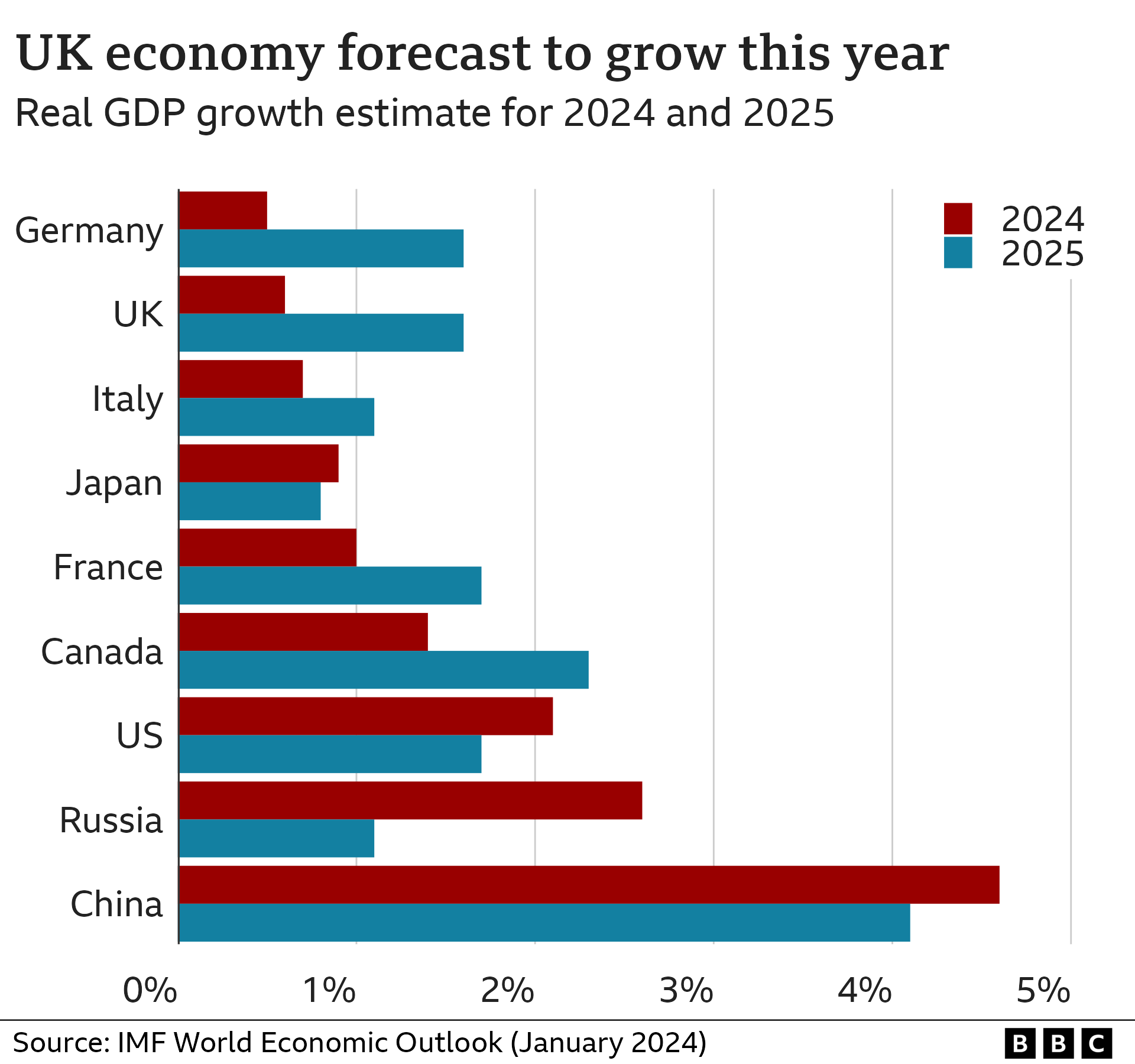

The latest comments from the IMF came as it downgraded its forecasts for UK growth next year from 2% to 1.6%, partly as a statistical consequence of growth having been revised higher during the pandemic years. This better performance leaves less room for growth to catch up in later years.

The UK's growth last year and this year is expected to remain sluggish at below 0.5% and 0.6% respectively, the second-slowest in the G7 major economies, behind Germany.

The IMF also assumes fewer Bank of England rate cuts than in financial markets, calculating that rates will remain at 5.25% in the first half of this year. The Bank is then expected to cut by half a per cent over the second half of the year.

Treasury sources said the government was slapping down the IMF for its advice on tax cuts, which derives from the organisation's research for its annual in-depth health check of the UK economy.

It comes at a sensitive time ahead of the Budget and a general election where the chancellor hopes to mark out a key dividing line with the opposition on a smaller state, with lower public spending and lower taxes. The Treasury sources said that the improvement in UK growth prospects arose because of the chancellor's targeted business investment tax cuts.

On Tuesday, Mr Hunt receives the first draft of the numbers on the public finances from the Office for Budget Responsibility (OBR) - the government's independent forecaster - including an indication of the room for manoeuvre that might be used for tax cuts or spending increase.

OBR head Richard Hughes recently said a description of the government's pencilled-in post-election spending plans as a "work of fiction" was "generous" because the "government hasn't even bothered to write down" its plans for individual departments.

If the government sticks to its spending plans, then lower interest rates, and a stronger economy could increase the chancellor's room for manoeuvre against his self-imposed borrowing targets by as much as £20bn per year.

The Institute for Fiscal Studies (IFS) said last week that promises of tax cuts during general election campaigns may have to be rolled back as the UK economy faces some of its worst problems since the 1950s.

Politicians need to be honest about tough economic trade-offs, it said.

Following the IMF's forecast, Carl Emmerson, deputy director of the IFS, told the BBC the chancellor was "only barely on track to meet his own central objective of having government debt on a downward trajectory in five years' time".

"[Tax cuts should] at least wait until we have debt more securely on a downward trajectory, and much more clarity about where planned spending cuts will bite," he said.

Commenting on the IMF's advice, Mr Hunt said: "The IMF expect growth to strengthen over the next few years, supported by our introduction of the biggest capital investment tax reliefs anywhere in the world, alongside National Insurance cuts to improve work incentives.

"It is too early to know whether further reductions in tax will be affordable in the Budget, but we continue to believe that smart tax reductions can make a big difference in boosting growth."

But Labour's Darren Jones, shadow chief secretary, said the IMF's forecast was "yet more evidence of 14 years of Conservative economic failure".

"The Tories have left Britain with high debt, flatlining growth, high taxes and working people worse off," he said.

The IMF and UK government have disagreed over previous forecasts. In October last year, the IMF rejected government suggestions that its assessment of the UK back then was too gloomy.

But economic forecasters are not always right when it comes to predicting the future. The IMF has previously stated its forecasts for most advanced economies, such as the UK's, have more often than not been within about 1.5 percentage points of what actually happens.

Global outlook

Elsewhere, the IMF predicted that the world economy could be on the path to a "soft landing" with lower inflation and more resilient growth.

It now expects growth of 3.1% this year, rather than the 2.9% it predicted in October, because of the resilience of the US and a strong performance from developing economies such as Mexico and India.

There was a notably large upgrade to its forecast for growth in Russia, which is now expected to expand 2.6% this year, ahead of an earlier 1.1% prediction. The expansion comes despite sanctions facing the country after its invasion of Ukraine, as high military spending boosts growth.

China grew 5.2% last year and while it is not expected to do as well this year, the IMF's outlook on the country has brightened since October. It is now forecasting growth of 4.6%.

However, the IMF cautioned that much depends on its deeply troubled property sector and how much support it gets from the Chinese government.

This week's ordered liquidation of property giant Evergrande with $300bn (£236bn) of debt shows the scale of the problems it is now causing.

Tensions in the Middle East represent another significant cause for concern, the IMF said. It said recent attacks on commercial shipping in the Red Sea and the ongoing war in Ukraine could damage global trade.

Amid these challenges, the IMF urged the world's central banks to focus on stabilising prices.

Over the last year central banks have increased interest rates to try to slow inflation, the pace at which prices are rising.

The IMF said it expected global inflation to fall from 6.8% last year to 5.8% this year, with advanced economies seeing the biggest drops.

As well as higher rates, the organisation said lower energy prices would help to drive down inflation. It said slower wage growth, as companies find it easier to recruit new staff, would also help to ease price rises.

- Published10 October 2023

- Published31 December 2023

- Published22 December 2023