Why do I pay tax on my pension, and more Budget 2024 questions answered

- Published

BBC News has been taking your questions after Chancellor Jeremy Hunt's Budget.

A panel of BBC experts helps explain what it means for your finances:

Robert Cuffe - head of statistics

Dharshini David - chief economics correspondent

Hannah Miller - political correspondent

Kevin Peachey - cost of living correspondent

My state pension increase takes me over the basic personal allowance for tax purposes, which means that I now have to pay income tax on my state pension "benefit" due to the freezing of tax thresholds. Am I alone? Trev in Eastbourne

Kevin Peachey: Far from it. Economists at the Institute for Fiscal Studies - an independent think tank - point out that well over 60% of pensioners pay income tax.

At the moment you can earn up to £12,570 before you have to start paying tax.

Trev is correct to point out that some have been dragged into paying tax since the tax thresholds were frozen in 2021.

The IFS says most tax-paying pensioners will typically be £650 a year worse off by 2027 as a result.

Ministers say this shouldn't be taken in isolation, because pensioners have benefitted from extra help like cost-of-living payments.

Why is the vaping tax delayed until October 2026? - Carrie

Kevin Peachey: As Carrie says, the new duty on vaping is not immediate. The chancellor announced it would start in October 2026.

The government says the duty will raise £120m in its first year, rising to £445m in 2028-9.

The process starts with a 12-week consultation into how the duty will work, external, which the government will then need to respond to before deciding on the final details. All that takes time.

A wider, key point is that not everything announced in the Budget takes effect immediately - which is why we take a close look at the paperwork published after the chancellor's speech.

Is the increase in the threshold for child benefit from £50,000 to £60,000 for any individual parent, or is it worked out on both parents' income added together? - Ian

Kevin Peachey: The threshold is based on one parent, not the combined income of two parents.

So, from April, two parents earning £59,000 each (£118,000 in total) will still get full child benefit. A single parent, or single earner, on £80,000 won't receive anything.

That's considered unfair, and is why the chancellor said he wanted to change to a system of household income by April 2026.

But, in the meantime, the threshold at which child benefit starts to be withdrawn has been raised from £50,000 to £60,000.

In other words, if one parent earns more than £60,000, then they have to pay back some of the child benefit they receive.

More is taken as you earn more above that level. So, if one parent earns more than £80,000 a year from April, you have to pay it all back. At the moment you lose all your child benefit once you earn more than £60,000,

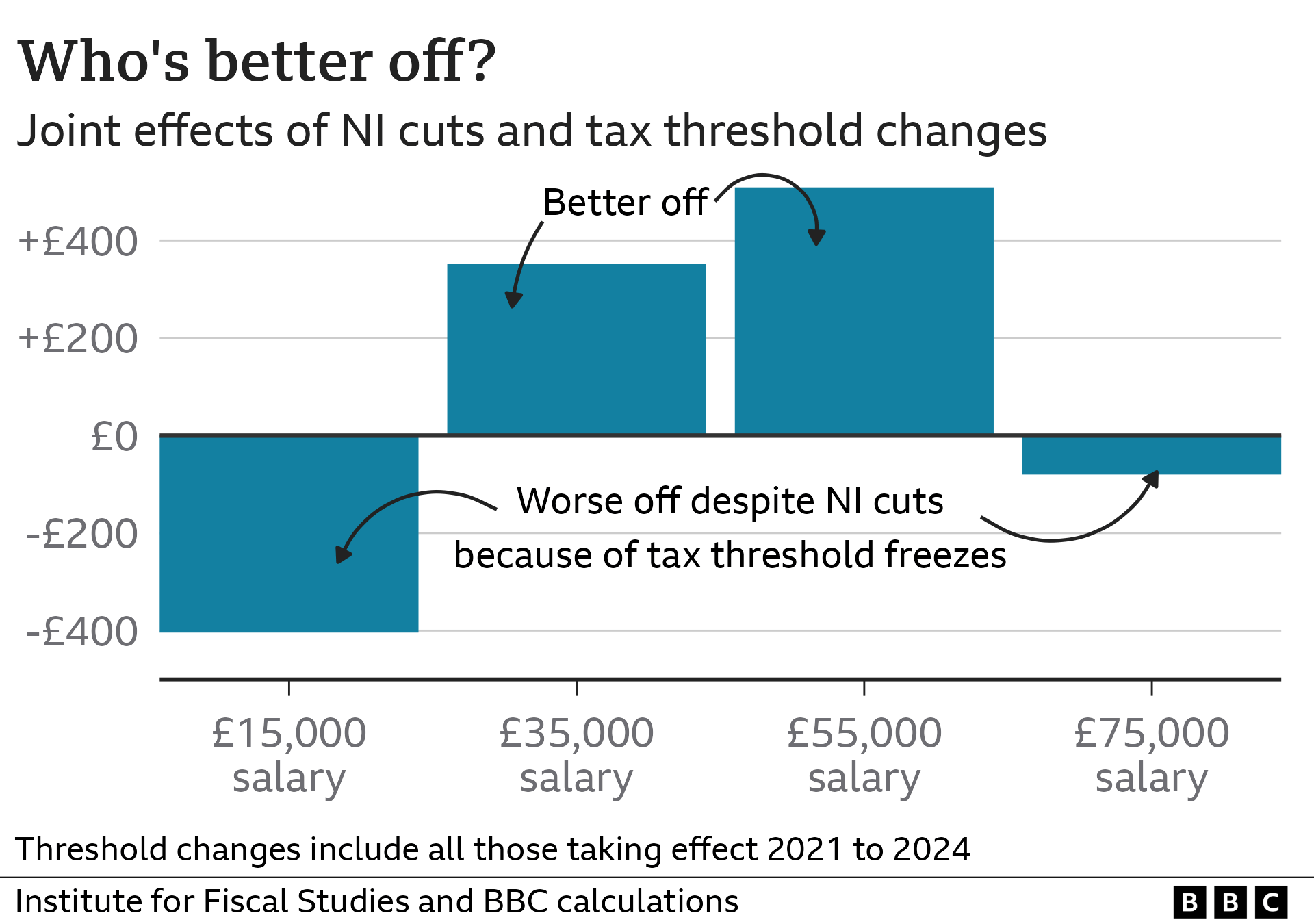

Why are the lowest earners worse off? - Sue

Robert Cuffe: Low earners are worse off due to the tax threshold freeze, which has a big effect on the first few thousand pounds on which you pay tax.

The cut in National Insurance, however, have a smaller effect on the first £40,000 on which you pay tax.

Let's see how those two effects play out.

Someone earning £16,000 would be about £500 a year worse off due to the threshold freeze. And so would everyone earning up to about £50,000.

The NI cut saves the lower earner about £100. But it saves our higher earner £1,500 a year.

So cut to NI doesn't make up for the extra tax being paid on the first few thousand pounds above the lower tax threshold.

And so our lower earner is worse off. But if you're earning a lot more than that you work out better off.

We have had two cuts to the rate of National Insurance, which is good for the workers on the receiving end. But I would like to know how this affects contributions to the NHS and pensions? - Len

Dharshini David: The money from National Insurance isn't actually earmarked for certain purposes - rather, it goes into the general "pot" of money the government uses to fund services.

A reduction in the rate doesn't impact your eligibility for NHS services or pensions. It is effectively, for employees and the self-employed, another form of tax on income.

But it's worth remembering that it is one of the biggest money earners for government - that 2p cut in rates means the Treasury will ultimately forego around £11bn a year, and that could affect some of the government's spending plans.

However, the budget for health is ringfenced, or protected, so a fall in the tax take won't impact that.

Why does the Office for Budget Responsibility, according to the chancellor, say that the 2% cut in employee National Insurance will lead to an increase of 200,000 people in work? - Elizabeth A

Robert Cuffe: The answer is nerdy - but I think really interesting.

The OBR believes, on balance, that cutting National Insurance will encourage people to work more hours or take new jobs.

And when you add both those effects together you get about 200,000 full-time workers' worth of extra hours worked.

When cutting tax, some people might choose to work less because they get the same take-home pay for fewer hours.

Others, however, might choose to work longer hours or get a new job because take-home pay is suddenly worth more.

The OBR believes the second effect is stronger, therefore increasing the incentive to work. You can read its workings here.

Will the chancellor raise the personal tax allowance? - David

Hannah Miller: The personal allowance is the amount of money you can earn before any tax starts to be paid. For most people, it is currently set at £12,570.

The government isn't intending to increase the personal allowance. Along with other tax thresholds it has been frozen until 2028.

This means that more people start paying tax and National Insurance as their wages increase. The Office for Budget Responsibility believes this will create 3.2 million additional taxpayers by 2028.

It's worth adding that your personal allowance is smaller if you earn over £100,000 - and bigger if you get marriage allowance or blind person's allowance.

What is going to happen to the state pension if no National Insurance contributions from workers are being made? If National Insurance is abolished, how do people then qualify? - Elizabeth G

Kevin Peachey: Although both the PM and the chancellor have said they would like to get rid of National Insurance completely at some point, it is still only an ambition. It hasn't happened yet.

At the moment, you need a minimum of 10 years of NI contributions, or credits, to qualify for the new state pension.

To get the full amount, you need 35 years of contributions. You can check your record NI online, external.

If employees' NI contributions are eventually abolished, then a new qualification regime would be needed - perhaps via HM Revenue and Customs.

The state pension would still be paid (funded by general taxation), but the administrative workings under the bonnet would change.

What does non-dom mean? - Robbie

Hannah Miller: The phrase "non-dom" describes a UK resident whose permanent home (their "domicile") for tax purposes is outside the UK.

At the moment, a non-dom only pays UK tax on the money they earn in the UK.

They do not have to pay tax to the UK government on money made elsewhere in the world (unless they pay that money into a UK bank account).

Changes announced in the Budget mean, that from April 2025, people who move to the UK will not have to pay tax on money they earn overseas for the first four years.

After that period, if they continue to live in the UK, they will pay the same tax as everyone else.

The government is still consulting on the finer details of this policy.

How do you calculate personal gain/loss from the Budget? Do you include a "cost" for not raising tax thresholds? - Anonymous

Robert Cuffe: Yes. When analysing the Budget, the freezing of thresholds is treated as a cost because they reduce your standard of living.

Let's say you earned £12,500 last year. You didn't need to pay any tax on that.

If you get a salary increase this year that just about keeps pace with rising prices, your living standard is exactly the same, even though your paycheque is bigger.

The trouble is your pay rise now puts you over the top for tax-free earnings - you're going to have to start paying taxes.

And so your take-home pay has not kept pace with rising prices. You're worse off.

The government used to move the point at which you started paying tax in line with inflation to prevent this from happening. But they haven't done that for three years.

Official forecasters call it a tax rise, as do independent economists.