Poorest graduates 'will owe £53,000' after grants cut

- Published

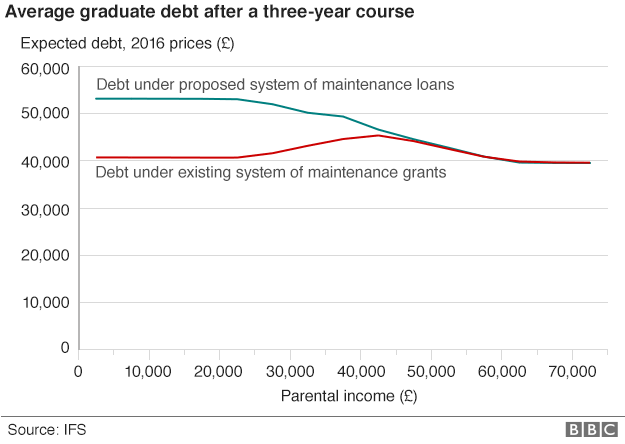

The scrapping of maintenance grants could push up poorer students' debts by an extra £12,500

Students from the poorest backgrounds in England will graduate owing up to £53,000 after maintenance grants are replaced by loans, a think tank says.

Changes to student finance announced in the Budget will mean an initial £2bn annual saving for the government, says the Institute for Fiscal Studies (IFS)., external

But the IFS estimates only a quarter of these loans will be repaid and the long-term annual saving will be £270m.

The government says it is committed to "widening access in higher education".

More than half a million students from poorer backgrounds currently receive a maintenance grant, at a cost to the taxpayer of about £1.57bn a year.

From 2016, these will be replaced with loans, which they will be expected to repay in addition to loans for their tuition fees.

The IFS says the new loans will mean up to £550 more "cash in pocket" per year for those students, but they will graduate owing up to £53,000 in total, compared with £40,500 before maintenance grants were scrapped.

In the short term, government borrowing will fall by £2bn a year, because spending on grants counts towards the government's borrowing, while spending on loans does not count in the same way, the IFS says.

However in the longer term the IFS says savings will be much less than this, because it estimates that only a quarter of students borrowing an additional loan will be able to pay if off in their working lifetime, when they earn over £21,000.

IFS breakdown of maximum costs for poorest students

Maximum cost of fees - £9,000 per year

Maximum maintenance loan - £8,200 per year

Real interest rate of 3% on their loan while studying

Chancellor George Osborne is consulting on how much a graduate must earn before paying back their loans.

If repayments were fixed at the present level of £21,000 for five years, not rising with inflation, the IFS estimates overall graduate loan repayments would increase on average by a further £3,800 per student.

Middle income students are forecast to be hit the hardest, costing them an extra £6,000 over the repayment of their loan.

Jack Britton, research economist at the IFS said: "It is the freezing of the repayment threshold which will do more to raise loan repayments, and hence increase the cost of higher education."

University and College Union general secretary Sally Hunt said: "It is little more than a tax on aspiration and exposes this government as certainly not being on the side of the strivers."

A Department of Business, Innovation and Skills spokesman said: "Anyone with the ability to succeed should have the opportunity to participate, regardless of their background or ability to pay.

"The changes announced in the Budget provide students with more money in their pockets to help with living costs while studying.

"Lifting the cap on student numbers also means that more people will be able to benefit from higher education than ever before."

- Published8 July 2015