My student loan was mis-sold, says graduate

- Published

Simon Crowther says he never expected his student debt to be so high

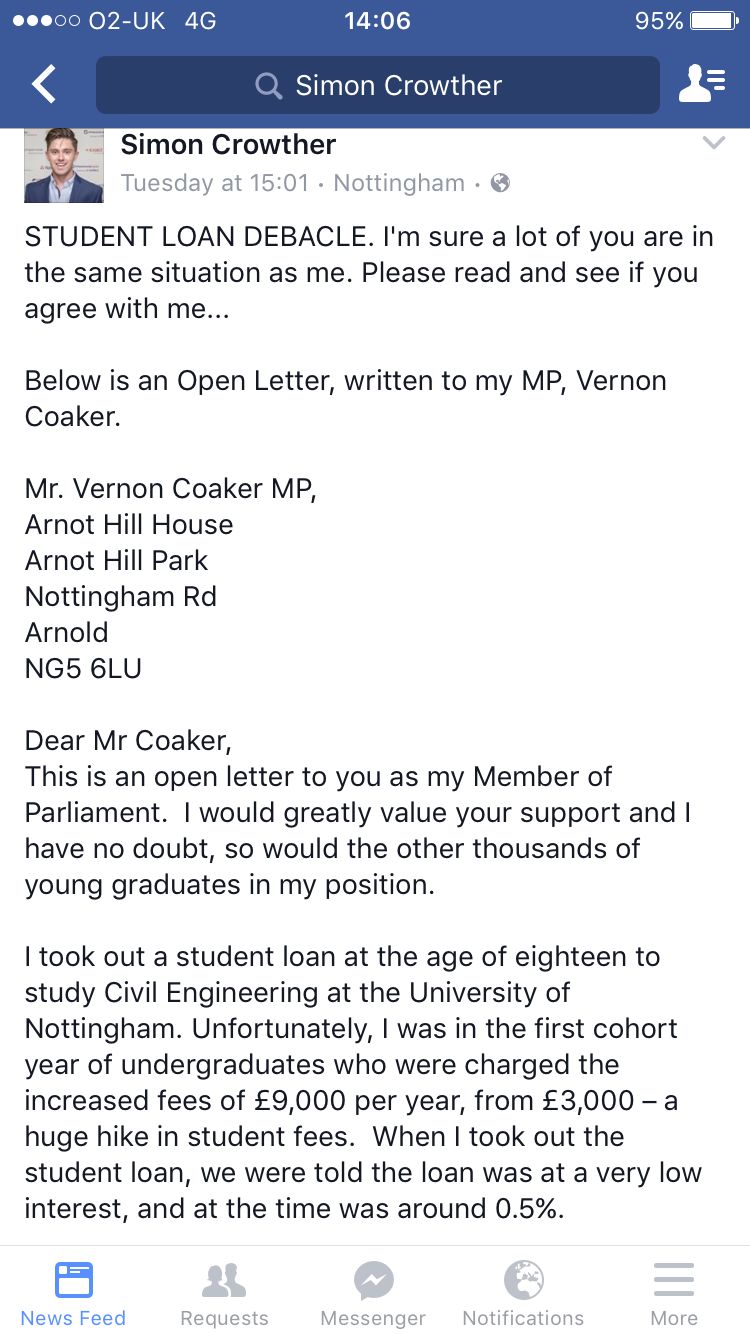

An open letter from a graduate to his MP, showing how interest on his student loan has increased his debt by £1,800 in the year since he left university, has gone viral online.

Simon Crowther was in the first wave of students faced with £9,000 tuition fees and says he did not understand what he was doing when he took the loan at 18.

His letter to Vernon Coaker MP has been shared 38,000 times on Facebook.

The Student Loans Company says the interest rates were clearly set out.

Mr Crowther started a civil engineering degree at Nottingham University in 2012.

In the letter,, external also copied to the prime minister, he says that when he took out the loan he understood it would be at a very low interest rate of about 0.5%.

'No experience'

"I was still in the sixth form at school when I agreed to the student loan.

"I had no experience of loans, credit cards or mortgages.

"Like all the other thousands of students in the UK, we trusted the government that the interest rate would remain low."

He says he graduated last year "with a huge debt".

And since he graduated it has accrued interest at the rate of inflation - which is currently 0.9% - plus 3%.

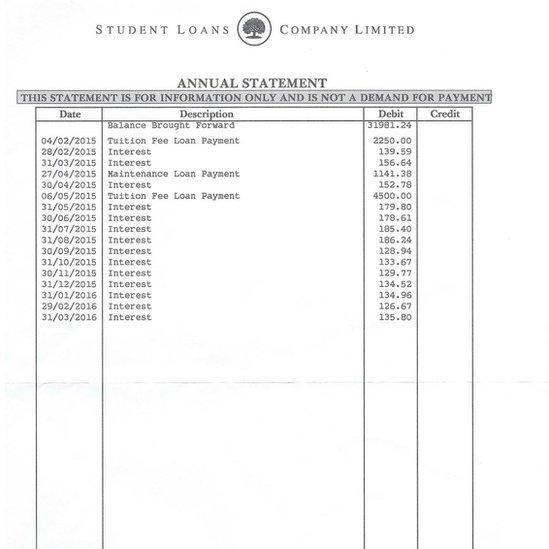

He says that in some months since then the interest has been more than £180, amounting to £1,828 in the year to March, with the total debt rising to £41,976.

"I feel we have been mis-sold the loan," he says in the letter.

The letter says that he believes the interest rates were hiked after the loans were sold to a private company - though this turns out to be incorrect.

Mr Crowther's loan statement shows monthly interest is sometimes over £180

It has attracted almost 50,000 Facebook "likes" since it was posted on Tuesday.

One graduate said she had "nearly passed out" when her statement came through.

One comment suggested the possibility of a class action on the issue in the courts.

'Fair and sustainable'

But the government and Student Loans Company say the variable rate of interest, of inflation plus up to 3%, was made clear when the students first took out their loans.

"It is not the case that this individual's interest rate has increased or that their loan has been sold," said a Student Loans Company spokesman.

"The variable interest rates that would apply to his student loan are unchanged from those in force at the time of his application in 2012.

"All students that take out a loan must sign a declaration confirming that they have read the terms and conditions of the loan before it will be paid.

"These terms and conditions clearly set out the interest rates that the student will be charged, when they will start repaying and when interest starts accruing."

Student loan repayment guide

While studying, students in England and Wales are charged interest at inflation plus 3%, until the April after graduation

Graduates earning under £21,000 are charged interest at the rate of inflation

For those earning between £21,000 and £41,000 interest is inflation plus up to 3%, depending on income

And for those on over £41,000 it is inflation plus 3% maximum

Interest is set by governments and varies between administrations

Students repay loans at 9% of earnings above £21,000, a threshold frozen by the government last year

Loans are written off after 30 years

Students do not start paying off their loans until they earn £21,000 a year

The Department for Business, Innovation and Skills said the system was fair and sustainable "as the OECD has recognised".

"It removes financial barriers for anyone hoping to study and is backed by the taxpayer, with outstanding debt written off after 30 years.

"Graduates only pay back at 9% on earnings above £21,000 and enjoy a considerable wage premium of £9,500 per year over non-graduates," said the spokesman.

- Published13 May 2016

- Published15 December 2015

- Published22 July 2014