Soft drink sugar tax starts, but will it work?

- Published

- comments

The "ground-breaking" sugar tax on soft drinks has come into force in the UK.

From Friday manufacturers have to pay a levy on the high-sugar drinks they sell.

Ministers and campaigners believe it has already proved to be a success with many firms reducing sugar content ahead of the change. But others say it is still too early to judge the impact.

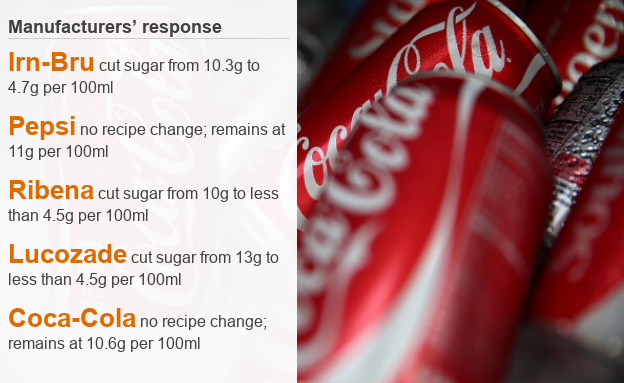

Leading brands such as Fanta, Ribena and Lucozade have cut the sugar content of drinks, but Coca-Cola has not.

The introduction of the levy means the UK joins a small handful of nations, including Mexico, France and Norway, which have introduced similar taxes.

How will it work?

The levy is being applied to manufacturers - whether they pass it on to consumers or not is up to them.

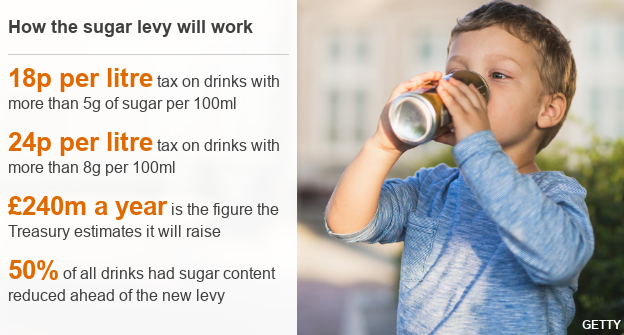

Drinks with more than 8g per 100ml will face a tax rate equivalent to 24p per litre.

Those containing 5-8g of sugar per 100ml will face a slightly lower rate of tax, of 18p per litre.

Pure fruit juices will be exempt as they do not carry added sugar, while drinks with a high milk content will also be exempt due to their calcium content.

Originally, the Treasury forecast it would raise more than £500m a year, but that has now been reduced to £240m because some manufacturers have reduced the sugar content in their products.

In England that income is being invested in schools sports and breakfast clubs.

Products such as cakes, biscuits and other foods are not covered by the tax, although a separate initiative is encouraging manufacturers to reduce the sugar content of those items voluntarily.

'Too much stick, not enough carrot'

But will it work? The jury is still out.

University of Bedfordshire nutrition expert Dr Daniel Bailey said that while the levy is a "positive step" in tackling obesity and had led to a "notable" reaction by the industry, the response by consumers is uncertain.

"The increase in tax placed on soft drinks will make products more expensive, but will this actually discourage people from buying them?

"We could just end up with consumers buying the same amount but paying more."

Polling suggests this may be the case for many people.

Research by Mintel found just under half of Britons say taxing unhealthy products would encourage them to cut back.

By comparison easier-to-understand nutritional information would alter the purchasing habits of three-quarters of people, the survey of 2,000 people showed.

Mintel's associate director of food and drink Emma Clifford said it suggested "carrot" rather than "stick" may be a better approach.

How have consumers reacted?

Reaction to the new tax has been mixed with many consumers arguing that government should not interfere in what they consider to be a personal choice.

Twitter user @IAmNeesha wrote: "The #sugartax is a total joke. Can people really not just say no? If I fancy a Coke after work or after the gym, why am I being taxed for it?"

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

@sammyyjadee tweeted: "If you educate people that sugary drinks should only be drunk in moderation, and should not be part of a child's diet, all would be fine! #nannystate."

However, not everyone views the tax with pessimism.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Among the readers' comments on this story, TheJags wrote: "I'm generally against the government interfering in our lives, but the simple fact of the matter is that the NHS is struggling under the weight of unhealthy people in this country, and either we all pay for it or they do."

Twitter user @GregoryJSpeakman added: "Fully support the #sugartax. If we're to tackle obesity in this country then we need to take it seriously.

"We've tried education and ad campaigns, this is the next logical step."

Teens consume huge amounts of sugar drinks

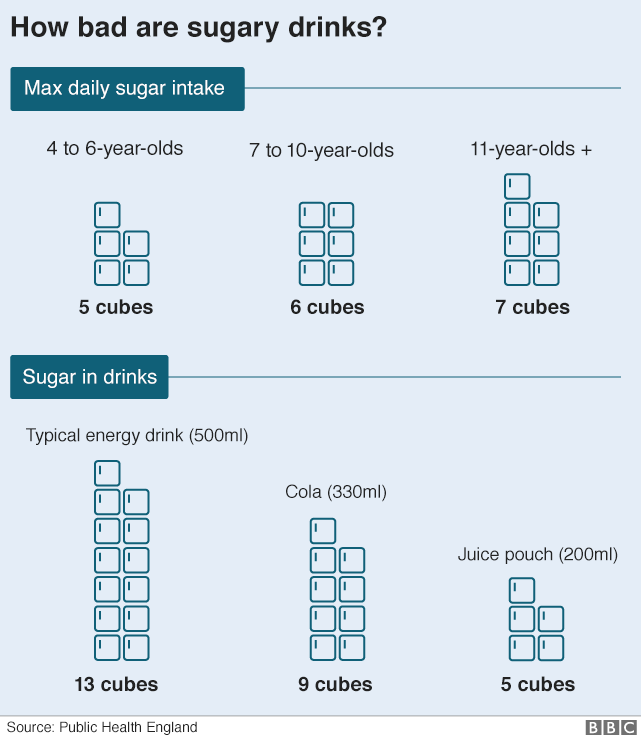

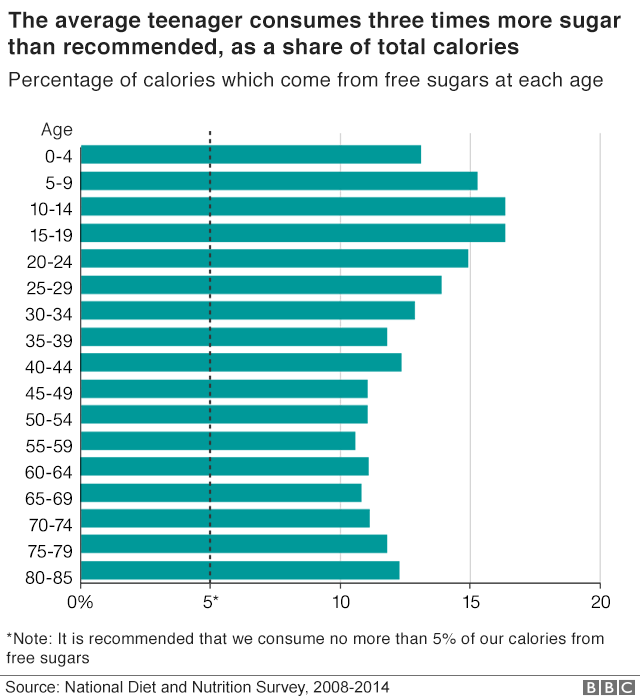

All age groups are consuming too much sugar, with teenagers the worst offenders.

They get a quarter of their sugar intake from soft drinks.

Public Health Minister Steve Brine said: "Our teenagers consume nearly a bathtub of sugary drinks each year on average, fuelling a worrying obesity trend.

"The levy is a ground-breaking policy that will help to reduce sugar intake."

Public Health England also hopes it will improve the oral health of children.

To coincide with the introduction of the levy, the agency released figures showing a child in England has a tooth removed in hospital every 10 minutes due to preventable decay.

PHE's Dr Sandra White said: "It's upsetting to see so many children admitted to hospital with tooth decay."

She is urging families to skip soft drinks altogether and to consume water and lower-fat milks.

How has industry reacted?

Estimates by the Treasury based on market data suggest 50% of manufacturers have reduced the sugar content of their drinks.

Fanta has cut it by nearly a third, Ribena and Irn-Bru by half and Lucozade by nearly two-thirds.

Tesco has said none of its own-brand drinks will fall foul of the levy, although the process of reformulation started before the sugar tax was announced.

Head of soft drinks Phil Banks, believes about 85% of products purchased at the company's stores will be below the levy threshold.

"At Tesco, things won't be so very different," he said.

But he conceded customers could see some of the branded drinks becoming more expensive or being served in smaller containers.

Earlier this year Coca-Cola announced it will cut the size of its 1.75l bottle to 1.5l and put up the price by 20p.

The company said it had decided not to change its classic recipe because "people love the taste and have told us not to change".

Coca-Cola Zero Sugar and Diet Coke are not affected by the levy.

Sugar tax: Drinks becoming pricier and in smaller bottles

Reality Check: Did the sugar tax work in Mexico?

Mexico introduced a tax on sugary drinks on 1 January 2014, which operates in a similar way to the UK's.

By the end of its first full year, Mexicans were consuming 12% fewer sugary beverages than in the year leading up to the tax's introduction.

The biggest reductions were among the poorest households.

Researchers also looked at what happened to other drinks and found there was an increase in sales of drinks that did not come under the tax. This was mainly driven by a rise in popularity of bottled water.

There is no evidence yet that this has led to a reduction in obesity - but it may well still be too soon to tell what the longer-term effects will be on the population's weight.