Tax rise need to help pay for £20bn NHS boost, says PM

- Published

- comments

Theresa May says taxpayers will have to help fund the NHS funding boost

Tax rises will be needed to pay for the boost in NHS funding announced by the government, the prime minister says.

Theresa May conceded the public would pay more, but promised this would be done in a "fair and balanced" way.

The government also says economic growth and a "Brexit dividend" will help cover the costs of the increased spending, which will see NHS England's budget increase by £20bn by 2023.

Labour's John McDonnell called the funding model "not credible".

He - and others - have been critical about whether there will be the savings from Brexit that ministers are claiming.

But in a speech in London, Mrs May insisted it would free up money.

"Some of the extra funding I am promising will come from using the money we will no longer spend on our annual membership subscription to the European Union after we have left."

However, she added that "taxpayers will have to contribute a bit more in a fair and balanced way to support the NHS we all use".

In return, Mrs May said the NHS had to play its part to ensure "every penny is well spent".

She has asked NHS England boss Simon Stevens to work with senior doctors to come up with a 10-year plan, looking at productivity, staffing and key areas such as mental health and cancer survival.

"It must be a plan that tackles waste, reduces bureaucracy and eliminates unacceptable variation," Mrs May said.

What is the funding plan?

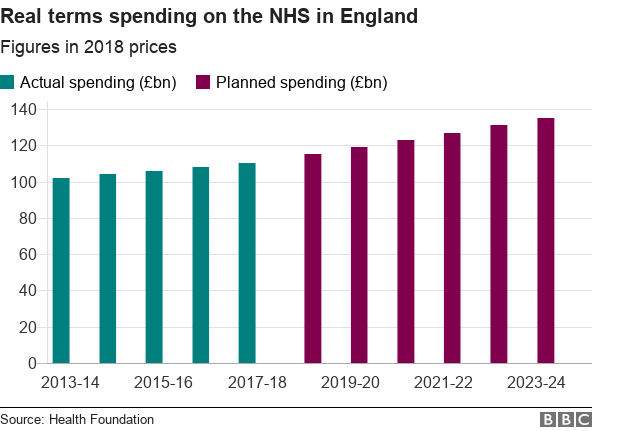

At the weekend, the government announced the NHS England budget would increase by 3.4% a year on average over the next five years.

That means by 2023 the budget will be £20bn higher than it is now, once inflation is taken into account.

Currently, NHS England spends £114bn a year.

But the plan does not include other parts of the wider health budget, such as training, stop-smoking clinics and other preventative services, so the overall "health" increase might be lower than 3.4%.

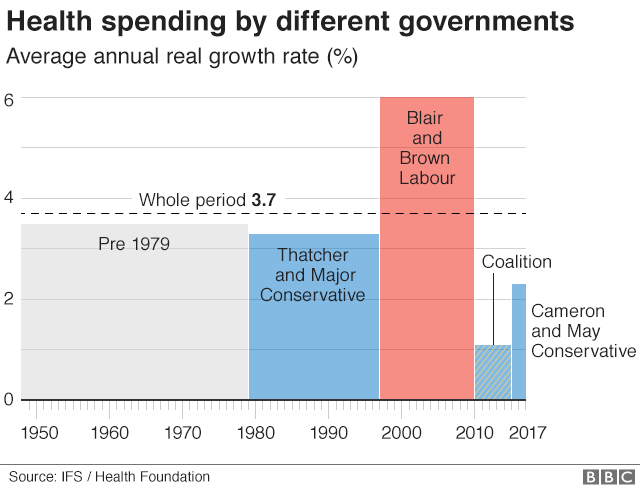

The average annual rise since the foundation of the NHS in 1948 is 3.7%.

How is it being funded?

Health Secretary Jeremy Hunt said the boost in funding was agreed with the Treasury on the basis it would come from three sources - Brexit, economic growth and the taxation system.

Like the prime minister, Mr Hunt did not spell out what that could mean for taxes.

Economic growth would mean the size of the public purse would grow, which leaves more for public services.

Referring to Brexit, Mr Hunt the savings "won't be anything like enough."

In fact, some have questioned the very idea of a "Brexit dividend" with the Liberal Democrats even asking the UK Statistics Authority to rule whether the government is right to claim there is one.

The Conservative chair of the Commons' Health and Social Care Committee, Sarah Wollaston, said the concept was "tosh".

And Paul Johnson, director of economic think-tank the Institute for Fiscal Studies (IFS), said the only way the rise could be paid for was by an increase in taxes.

He said the financial settlement with the EU, plus the UK's commitments to replace EU funding, "already uses up all of our EU contributions" for the next few years.

Jeremy Hunt tells Today there will be an "increased burden of taxation" to fund the NHS

Analysis: By Hugh Pym, BBC health editor

It was a significant funding announcement - few at senior levels in the NHS in England disagree with that.

But as the dust settles after the weekend, several unanswered questions are still hanging in the air.

What about the areas of health which are not covered? What about investment in hospital buildings and equipment? How will it be paid for?

Tax rises: The options

Ministers say there will be more details in the Budget in the autumn.

There will be a desire to keep any rises to a minimum given the Conservative Party manifesto at the last election said its intention was to reduce taxes on businesses and working families.

The IFS has looked at how much could be brought in and what the options are.

The manifesto ruled out a rise in VAT, but that does not exclude extending the range of goods the tax is applied to.

A commitment has also been made to reduce corporation tax.

Income tax and National Insurance are the two biggest sources of tax revenue to the government.

The IFS says adding a penny to the basic rate of income tax would raise £4bn, while 1p on all the main rates of NI would bring in nearly £10bn.

Changing the thresholds at which different rates are applied is another option.

The 10-year plan for the NHS

Work on the plan will get under way almost immediately, with final proposals expected towards the end of the year.

Four main areas of the NHS will be looked at:

The workforce

Technology

Buildings

Productivity

The plan will build on the five-year strategy Mr Stevens set out in 2015.

A big part of that was shifting care out of hospitals and into the community.

Mrs May is known to be keen to see a specific stress on mental health and improving cancer survival rates this time.

In her speech on Monday, the PM recalled her own reliance on the NHS for help when she was diagnosed with type one diabetes, saying: "I would not be doing the job I am doing today without that support."

Meanwhile, councils have questioned why the funding announcement did not also include more money for social care and public health, which covers everything from stop smoking services to obesity prevention.

Both are considered essential to the sustainability of the NHS, but the increase announced only applied to front-line NHS services such as hospitals, GPs and mental health care.

Councillor Izzi Seccombe, of the Local Government Association, said: "Without essential council services, which help people live healthy lives in their own homes and communities, the NHS cannot thrive."

The government said plans to reform the system will be published in the coming months.

- Published18 June 2018

- Published18 June 2018

- Published26 April 2018

- Published26 April 2018

- Published27 March 2018