Via Twitterpublished at 11:51 GMT 3 December 2014

Robert Peston

Robert Peston

Economics editor

tweets, external: "Big focus on this year's deficit, which will be bit worse than March forecast. But forecast for next few years v important #AutumnStatement"

UK growth forecast raised for this year to 3.0%

Stamp duty cut for most home buyers

New tax to stop big companies shifting profits offshore

Borrowing forecast for this year raised to £91.3bn

Esther Webber, Ben Morris, Amber Dawson and Paul Harrison

Robert Peston

Robert Peston

Economics editor

tweets, external: "Big focus on this year's deficit, which will be bit worse than March forecast. But forecast for next few years v important #AutumnStatement"

How many people or professional investors own those 1932 war bonds that the government will redeem next March? At least 120,000 it seems. 97,000 of the investors own less than £1,000 worth of the bonds (at face value). And of those nearly 38,000 holders own less than £100 worth. Since the original debt was issued in 1917, the government has paid out £5.5bn in interest to the bond holders.

BBC News Channel

BBC News Channel

BBC Business Editor, Kamal Ahmed says the chancellor might announce a reform to the way technology firms are taxed - what has been termed a Google tax. Kamal also says that as revenue from North Sea oil has been falling, there might be tax cuts for that sector.

Norman Smith

Assistant political editor

The Conservatives' strategist Lynton Crosby likes to tell the party: "A day not talking about the economy is a day wasted."

The chancellor will be seeking to hammer home the good news - growth revised upwards, and earnings at last beginning to rise. But he is unlikely to have as much to shout about when it comes to cutting the deficit - the Office for Budget Responsibility March forecast for borrowing in 2014-15 was £86.6bn, but George Osborne is expected to announce it's higher than this.

Simon Gompertz

Simon Gompertz

Personal finance correspondent, BBC News

tweets, external: "2 banking things you might hear about in #AutumnStatement: faster current account switching and new-look basic bank accounts #AS2014"

Image source, Reuters

Image source, ReutersIn some non-Autumn statement news, Lufthansa is unhappy about yesterday's decision by their pilots to go on strike again - for the tenth time this year - on Thursday this week. "That the pilots have already announced the next strike while one is still ongoing is completely incomprehensible," said a company spokesman. The dispute is about the airline's plans to change its pension scheme and expand its "low cost" services.

Shadow chancellor Ed Balls has released a taster of Labour's line on the Autumn Statement, saying that if he were at the dispatch box he'd be setting out a plan "to deliver a recovery that works for the many and not just a few".

Expect to hear more along those lines from him later, along with plenty on Labour's plans to:

Raise the minimum wage

Invest in house-building

Expand free childcare

BBC News Channel

BBC News Channel

The News Channel speaks to John Longworth (director general of the British Chambers of Commerce). He says he "appreciates" that the chancellor might not be able to cut business rates as he is constrained by the budget deficit. Mike Cherry from the Federation of Small Businesses warns that some of his members are facing a "cliff edge" next March when transitional relief on business rates is due to end.

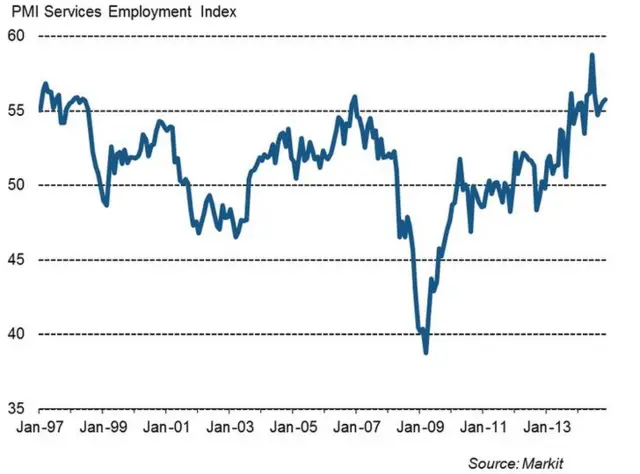

Image source, Markit

Image source, MarkitThis graph shows how employment in the services sector has recovered since the financial crisis. It has recently been reaching new heights.

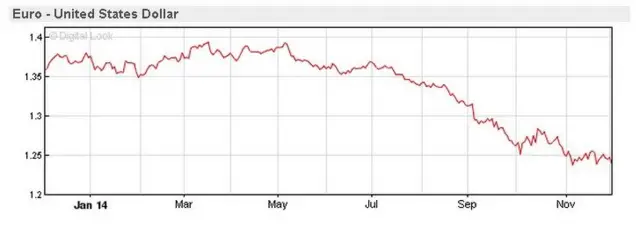

The euro has fallen further against the dollar today, down 0.35%, which means one euro buys you just $1.23. Back in May, a euro bought almost $1.40. The European Central Bank holds its policy meeting on Thursday. The euro has also dropped 0.44% against the pound, with a euro buying just 78p.

Image source, AIB

Image source, AIBThe state-owned Allied Irish Bank, which was bailed out following the financial crisis out by Ireland's government (with money from the IMF and the EU), could be sold back to the private sector as early as the end of next year, according to the Irish finance minister.

BBC News Channel

BBC News Channel

The BBC's Jo Coburn is at Bombardier's train factory in Derby. She speaks to Simon Nelson who runs a road haulage business (so is he on enemy territory?). He welcomes spending on roads and plans to boost lending for small firms, but he says there is shortage of drivers in the industry and he would like the government to announce some support with training.

Just to give you some indication of quite how big the services industry is in the UK, it accounts for roughly 78% of overall GDP, and about three-quarters of all jobs. So strong growth in the sector is a pretty big deal.

Image source, Getty Images

Image source, Getty ImagesMr Osborne will be rubbing his hands with glee at this announcement. Latest figures show that the services industry in the UK - which accounts for a large part of the economy - grew stronger then expected in November, rising to 58.6 from 56.2 the month before (a reading above 50 indicates growth). Employment in the sector also continued to rise strongly. All that is according to the CIPS/Markit purchasing managers' index survey for November. What a mouthful. Can't they get a shorter name?

Berenberg Economics

tweets:, external "Big upside UK services #PMI surprise. 58.6 vs consensus of 56.5. Shaking off any eurozone gloom, driven by domestic strength."

Robert Peston

Robert Peston

Economics editor

tweets:, external "Activity in crucial services sector in France, Germany, Spain all pretty weak, according to @MarkitEconomics. No sign of eurozone recovery."

Image source, Sage

Image source, SageThe FTSE 100 is slightly down this morning, by 0.2%, with Royal Mail falling a further 2.8% after regulator Ofcom said yesterday it would not change rules obliging the company to deliver across the UK for one price. The big winner thus far is business software company Sage Group - up more than 4%, after it reported a 70% rise in statutory pre-tax profits for the past year.

Kamal Ahmed

Kamal Ahmed

BBC Business editor

Our business editor Kamal Ahmed blogs on a possible "Google tax" - "a tax on technology companies that will mean them paying more in the UK rather than diverting profits to other countries with lower tax rates". At the Conservative party conference earlier this year, the Chancellor seemed keen to crack down on large tech firms, so we may just get an announcement on it in the Autumn Statement.

Image source, Getty Images

Image source, Getty Images Image source, Getty Images

Image source, Getty ImagesThe government is going to pay off more of its old borrowings, first raised to pay for the cost of fighting WW1. Next March it will pay off the holders of £1.9bn of war bonds. They were issued in 1932 in an earlier attempt to refinance the original war borrowings. These latest repayments will be paid for by new government borrowings, but at a lower interest rate, and thus at a lower cost to the Treasury.

Image source, Other

Image source, OtherEd Conway, economics editor at Sky News, writes about why George Osborne, external has approved a project to build 10,000 new homes at a disused RAF base in Northstowe - the first time that central government has got directly involved in homebuilding since 1971. "It is a sign of how concerned the Chancellor is about the inability of the private sector to fulfil housing demand," says Ed.