Via Twitterpublished at 15:35 GMT 25 February 2015

Guardian political editor Patrick Wintour tweets:

"We are suffering from horrible reputational damage" says Douglas Flint HSBC chairman, but it's all in the past and no one responsible.

HSBC bosses face MPs over tax affairs

HSBC apologise for bank's failings

Chairman concedes list of problems is "terrible"

Chris Johnston and Katie Hope

Guardian political editor Patrick Wintour tweets:

"We are suffering from horrible reputational damage" says Douglas Flint HSBC chairman, but it's all in the past and no one responsible.

Mr Flint reveals some of the details about its Swiss bank accounts were stolen during a systems upgrade intended to improve controls at the Swiss private bank.

Douglas Flint adds: "We know what we know. It's always possible that something will be uncovered somewhere else. I sincerely hope there are no more skeletons."

Image source, AFP

Image source, AFPClearly on a fishing expedition, Liberal Democrat MP John Thurso asks Mr Gulliver and Mr Flint if there is anything else they would care to disclose while before the committee. Mr Flint admits it is a question the HSBC board asks him on a regular basis, but declines to make any other revelations.

BBC business editor Kamal Ahmed tweets:

HSBC's Flint: "I pay all my tax and I find it abhorrent that people don't"

BBC business editor Kamal Ahmed tweets:

Flint: clients withdrawing large amounts of cash would be "a red flag today". "In Switzerland it was quite common."

Image source, Reuters

Image source, ReutersMr Flint and Mr Gulliver are both initially stumped by the question of why a client would go to Switzerland to withdraw large amounts of cash from their accounts, rather than have it wired to them. "Some clients like to have a large amount of cash," Mr Flint eventually responds.

Mr Flint will not exclude the possibility of further problems emerging, saying the task of reforming HSBC will "always be ongoing".

Mr Tyrie reels off a list of failings that have afflicted HSBC, such as PPI mis-selling and alleged Libor manipulation. Mr Flint admits: "It's a terrible list."

Image source, PA

Image source, PAAndrew Tyrie asks Mr Flint who is responsible for the acquisitions made by HSBC in the late 1990s that have since soured and thus should carry the can. Unsurprisingly, he doesn't take the bait.

BBC business editor Kamal Ahmed tweets:

HSBC's Gulliver says he did not discuss Swiss bank issues with the Treasury.

BBC business editor Kamal Ahmed tweets:

Douglas Flint: says he feels shame and will "take his share of responsibility" for Swiss private bank failings

Mr Gulliver adds: "The important point is I've paid UK tax on my HSBC earnings during that entire period [since being based in the UK], so the amount of tax I have paid is the fair and appropriate amount."

Mr Gulliver has "followed the letter of the law" of the UK non-domicile rules, he tells the committee.

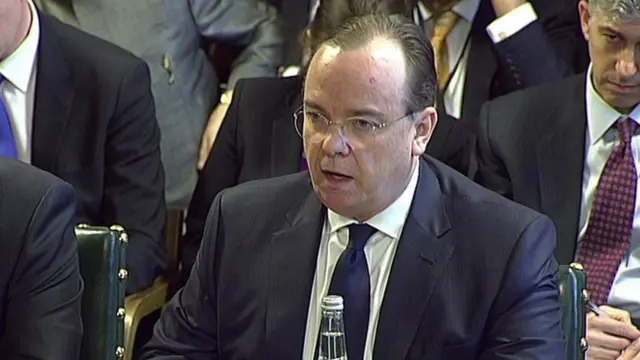

Image source, PA

Image source, PAHSBC chairman Douglas Flint is now speaking and says "we are the most transparent in terms of remuneration" - a point Mr Tyrie concedes.

Mr Gulliver is explaining his financial arrangements to the committee, which he says reflected a desire for privacy from his colleagues at HSBC in Hong Kong. "There was no tax purpose to it."

Committee chairman Andrew Tyrie begins by asking Stuart Gulliver about his "extraordinary" tax arrangements. The chief executive begins by apologises to the public and shareholders for the "unacceptable" actions that he admitted had damaged the bank.

The hearing had been due to start at 1415 GMT but the two HSBC executives are not yet in the committee room. Correction - they've just arrived.

Stuart Gulliver and Douglas Flint are being grilled after it emerged earlier this month that the Swiss unit of HSBC helped wealthy clients evade hundreds of millions of pounds' worth of tax. Senior UK tax officials will also answer questions at the hearing.

Chris Johnston

Chris Johnston

Business reporter

Good afternoon and thanks to Matthew West and Tom Espiner for this morning's coverage. Myself and Katie are primed to bring you the highlights from the Treasury select committee hearing where HSBC's two top bosses are set to be given a rough ride by MPs.