Via Twitterpublished at 13:01 GMT 18 March 2015

Robert Peston

Robert Peston

Economics editor

I calculate that Osborne has reduced spending-cuts gap between Labour and Tories from £50bn to between £20bn and £30bn #Budget2015

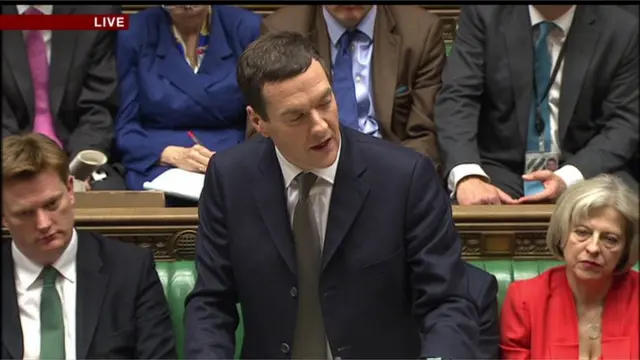

George Osborne presents the 2015 budget

2015 UK growth revised up to 2.5% by OBR

Chancellor pledges to end austerity by 2019/20

Tax free allowance to go up to £10,800 next year

New personal savings allowance for first £1,000 interest

Labour leader says chancellor has 'failed working families'

Pippa Simm and Sarah Weaver

Robert Peston

Robert Peston

Economics editor

I calculate that Osborne has reduced spending-cuts gap between Labour and Tories from £50bn to between £20bn and £30bn #Budget2015

Now the chancellor turns to the scale of the cuts needed in the next parliament: £13bn from government departments, £12bn from the welfare budget, £5bn from tax avoidance/evasion. "We have done it in this Parliament; we can do it in the next," George Osborne says. That is a much lower number than the £70bn of cuts predicted by Labour - in a recent speech by Ed Balls.

Another history lesson, although one from more recent times. George Osborne says that state spending by the end of this decade, as a share of national income, will be the same size as Britain had in the year 2000. "That's the year before spending got out of control and the national debt started its inexorable rise."

Duncan Weldon

Duncan Weldon

BBC Newsnight

The BIG change is the surplus in 2019/20, now at £7bn against previous £23bn. Big relaxation in purse strings at end of period. #Budget2015

Image source, Getty Images

Image source, Getty ImagesHere's what the chancellor had to say about borrowing figures: "This year borrowing is set to fall to £90.2bn; a billion lower than expected at the Autumn Statement. It falls again in 2015-16 to £75.3 billion; then £39.4bn the year after that, before falling to £12.8bn - in total that's £5bn less borrowing than we forecast just three months ago."

Joel Hills

ITV News business editor

Note: UKAR still owes taxpayer around £38 billion. Sale of mortgage book will not raise spendable cash. @ITVJoel, external

Britain will be running a surplus by 2018/19, he says, when it will be 0.2% of GDP. But it will be just £7bn by 2020, not the £23bn figure seen in the autumn statement.

Money raised from bank sales and the lower interest payments will be used to pay down the national debt, not increase spending. "We put economic security first," the chancellor says.

Robert Peston

Robert Peston

Economics editor

Osborne: the squeeze on public spending to end a year earlier, public spending will increase in 2019/20 in line with economy #Budget2015

Mark Broad

Economics reporter, BBC News

UK national debt = over £1 trillion. Northern Rock/Lloyds assets to be sold = £22bn #Budget2015

The chancellor reels off some figures to support his debt success claim: "Debt as a share of GDP falls from 80.4% in 2014-15; to 80.2% in the year 2015-16. And it keeps falling to 79.8% in 2016-17; then down to 77.8% the following year, to 74.8% in 2018-19 before it reaches 71.6% in 2019-20."

George Osborne's target of getting national debt falling as a share of GDP by 2015/16, he says, triumphantly, has been met. "The sun is starting to shine and we are fixing the roof." Ah, that roof again, it's been a while since we heard about that. Ed Balls and Ed Miliband look rather unimpressed.

Image source, PA

Image source, PAThe chancellor gives the House a history lesson on debt, with a promise to redeem the last remaining undated British government bonds in circulation. "We'll have paid off the debts incurred in the South Sea Bubble, the First World War, the debt issued by Henry Pelham, George Goschen and William Gladstone." There are chuckles all round though when he adds that the debt Gordon Brown left "will take a little longer to pay off".

George Osborne says £13bn of the mortgage assets still held from the bailouts of Northern Rock and Bradford & Bingley are to be sold off. There's a further £9bn of Lloyds shares being sold, too. That significantly boosts the room for manoeuvre the chancellor has in making spending plans - but he says that he prefers to spend this money by paying down the national debt.

Duncan Weldon

Duncan Weldon

BBC Newsnight

Big saving in interest costs. Lower govt borrowing costs than expected have done a lot of the work of deficit reduction #Budget2015

Evan Davis

Evan Davis

BBC Newsnight presenter

Households don't judge whether their living standards are up or down on the basis of the figures the Chancellor quotes. #budget2015 @EvanHD, external

Image source, Royal Mint

Image source, Royal MintGeorge Osborne makes a unionist point when he talks of the design of the new pound coin. It will feature a rose, thistle, leek and shamrock. "We are all part of one United Kingdom," he declares.

There's a promise that economic revival will help those people who may have suffered most during the recession. "It's the oldest rule of economic policy. It's the lowest paid who suffer most when the economy fails and it's the lowest paid who benefit when you turn that economy around."

Image source, Getty Images

Image source, Getty ImagesGeorge Osborne says living standards have risen over the course of the last parliament - ordinary families are around £900 better off, he says. Lots of Tory cheers on that - and shouts from Labour, presumably incredulous ones, too.

George Osborne says that on the basis of figures announced in the Budget, "under this government, 1,000 jobs have been created every single day." He's also promising more apprenticeships.