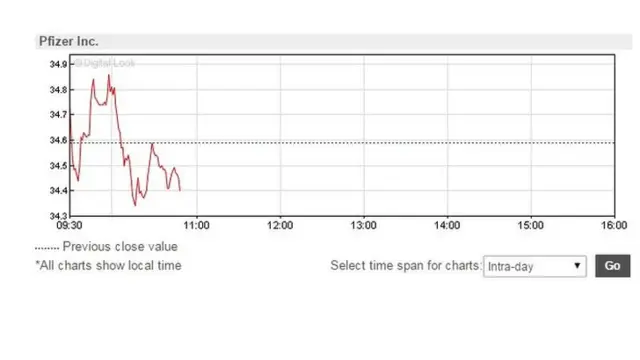

Pfizer resultspublished at 16:06 BST 28 April 2015

Pfizer has cut its sales and profit forecast, external for the year blaming the strong US dollar. Around 60% of the company's sales are outside the US and the strong dollar reduces the value of profits on those sales. However Pfizer's first quarter results were better than expected. Shares are down 0.38%.