Emirates airline profits soar 65%published at 11:14

Image source, Getty Images

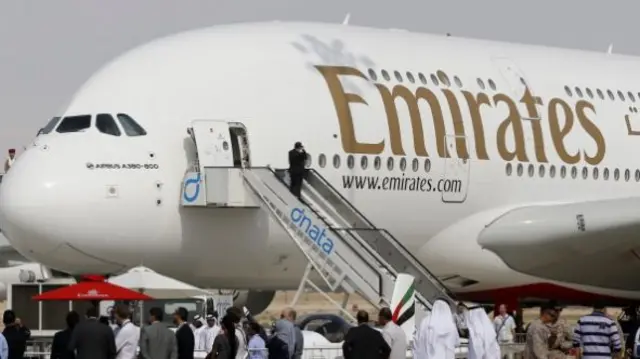

Image source, Getty ImagesDubai's Emirates airline has said its net profit surged 65% in the first half of the financial year to $849m (£552m) thanks to lower fuel costs and higher passenger numbers. The airline, the largest in the Middle East says fuel prices were 41% lower than a year earlier, while passenger numbers jumped 10% to 25.7 million in the six-months to the end of September.