Postpublished at 21:30 GMT 9 December 2015

That's it for another evening. The livepage resumes at 06:00 tomorrow. Goodnight.

Neil Woodford sells Rolls-Royce stake

Yahoo abandons spin-off of Alibaba stake

Brazilian inflation rises above 10%

Volkswagen cuts number of cars affected by emissions scandal

Dupont and Dow Chemical reportedly in advanced merger talks

North Face founder dies following kayaking accident

Russell Hotten

That's it for another evening. The livepage resumes at 06:00 tomorrow. Goodnight.

US stocks closed down in a choppy session as oil resumed its decline.The Dow Jones fell 75.03 points, or 0.43%, to 17,492.97 and the S&P 500 lost 15.93 points, or 0.77%, to 2,047.66. The Nasdaq dropped 75.38 points, or 1.48%, to 5,022.87. Yahoo fell 1% after saying it would scrap a spin-off of its big stake in Alibaba. Apple and Microsoft also fell about 2% each.

Reuters reports that a settlement has been reached in a US lawsuit with Warner/Chappell Music over the copyright to "Happy Birthday to You" that will put one of the world's most recognisable songs in the public domain, according to court papers.

The terms of the deal were not disclosed, but it puts an end to the class-action lawsuit filed in 2013 by a group of artists and filmmakers who had sought a return of the millions of dollars in fees the company had collected over the years for use of the song.

The news agency says that once the settlement is finalised, the song will be in the public domain - and so free for all to use without fear of a lawsuit. Phew!

Image source, Getty Images

Image source, Getty ImagesThe US clothing billionaire Douglas Tompkins has died in a kayaking accident in southern Chile, aged 72.

The North Face and Esprit co-founder died of hypothermia after the kayaks he and five others were in capsized in strong waves, authorities said.

He was taken by helicopter to hospital in Coyhaique but had stopped breathing when he arrived, doctors said.

After news that fund manager Neil Woodford has lost faith in Rolls-Royce and sold his stake, the engineering company says:

Quote MessageWhile we do not comment on individual analyst or investor opinions, Warren East [chief executive] has made very clear his confidence in Rolls-Royce as a great business with significant growth potential. We are strongly positioned in attractive markets, with a record order book and are on course to increase our share of the global installed base of widebody aircraft to over 50%. We are also undergoing a process of industrial transformation which will make us a stronger business in the long-term. While we are suffering the impact of short-term headwinds in several of our markets, action is being taken to make the business more resilient and sustainable through our ongoing wide-ranging restructuring.”

For those of you that find your handsome looks are holding you back in the jobs market, Tim Dowling in the Guardian, external has some advice.

Tips include dressing down, not being emasculating and being vigilant about your photos on Facebook.

Image source, PA

Image source, PAMore on star fund manager Neil Woodford's sale of his stake in Rolls-Royce. He doesn't say in his blog, external how much was sold, nor when, although there are media reports it was more than 2% on 12 November, a sale worth £232m.

"Many investors have become frustrated with the company’s inability to manage expectations effectively," Woodford wrote in the blog, called Engine Trouble.

"Although we have shared this frustration to an extent, we have previously taken share price weakness as an opportunity to add to the holding, believing that the dip in profits and cash flows would be relatively short-lived.

"November’s very disappointing trading update has changed this view, however."

The high-profile fund manager Neil Woodford has sold his entire stake in aero-engine company Rolls-Royce.

In a blog on his website, external he says that, after holding shares for 10 years, he's lost his "long-term confidence in the business model".

It's another blow for the company, which has issued several profit warnings this year and is undergoing a major organisation.

Shares in the yogawear firm Lululemon have tumbled 10% after it reported disappointing results.

The company cut the upper-end of its full-year forecasts and reported a fall in quarterly profit.

It doesn't seem to have fully recovered its reputation after a recall in 2013.

The material in some of its leggings was so thin they were effectively see-through when the wearer bent over - a not infrequent occurrence when practicing yoga.

I think that's what they call a #humblebrag

The boss of Yahoo, Marissa Mayer, has been in the spotlight as a result of the company's decision to change its mind over the sale of its Alibaba stake.

However Ms Mayer has told the Financial Times, external she's going nowhere.

“I’m very proud of the accomplishments we have made and there’s a lot more I’d like to see done here. So I have no intention of stepping down."

The Telegraph points out, external that Tesco's shares have closed at an 18-year low.

"Investors clearly think, based on the shares’ trajectory, that Lewis will not deliver a Christmas that is in line with either projections or the rest of the market," says the paper.

Image source, Getty Images

Image source, Getty ImagesHard times at the Dutch bank Rabobank.

It has announced 9,000 jobs are to go over the next three years, more than a third of its workforce.

"The job losses will be mainly in the back office and support functions and will come on top of the reduction of 3,000 jobs already planned," said the bank, which has almost 24,000 employees in the Netherlands.

The owner of hotels including the Savoy in London and Raffles in Singapore has been bought by Accor for €2.6bn (£1.9bn).

FRHI Holdings owns three of the world's most famous hotel brands: Fairmont, Raffles and Swissôtel.

It has 155 hotels in 34 countries, with 42 in North America, including The Plaza in New York.

�.��+&

Wall Street reversed course and fell in early afternoon trading as a brief rally in oil prices fizzled out. Crude prices resumed their slide, after rising as much as 4% earlier in the day.

Meanwhile, Apple is down nearly 2%, making it the biggest drag on the Nasdaq index.

The Dow Jones is down 0.41% at 17,496.58 points, and the S&P 500 is 0.73% lower at 2,048.57. The Nasdaq is off 1.35% at 5,029.67.

Image source, Thinkstock

Image source, ThinkstockBBC Scotland editor Douglas Fraser blogs:

Quote MessageThere can be a high price to be paid for doing nothing. So it is for OPEC. In this case, doing nothing is described as "closely monitoring developments". Meeting last Friday in Vienna, its failure to agree on a strategy to steer the oil price back up has resulted in the price per barrel falling. Monday's decline was more than 5%. Another 1% down took the price of a barrel of Brent crude below $40 for a few minutes on Tuesday. Wednesday has seen it rising a bit, to $40.66 as I write. Some of this may be traders taking short positions - gambling the price would fall - and now taking their profits. Yet the downward trend may not have finished yet."

Douglas Fraser, BBC Scotland editor

Some good news - finally - for investors in Volkswagen Group. Shares in the car giant ended 6.2% up, easily the best performer on Germany's Dax index. It came after VW cut the number of cars affected by inaccurate carbon dioxide emissions and fuel usage measurements.

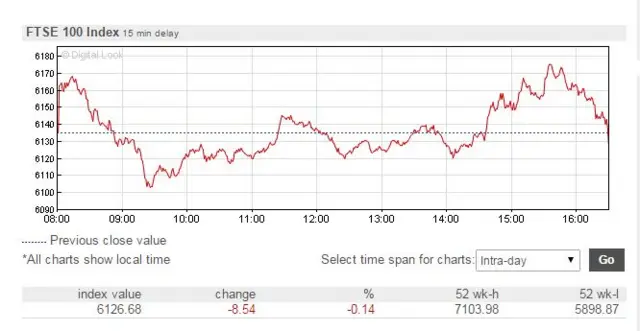

A rally in commodity stocks helped the FTSE 100 end just 0.1% down at 6,126.68 points. Glencore, BHP Billiton, Rio Tinto and BG Group rose between 2.46% and 4.57%, with the sector having fallen in early trading.

Anglo American closed 1.2% down amid continuing worries about its restructuring, but the stock bounced back from a 10% fall.

On the FTSE 250, shares in Stagecoach Group were the biggest losers, down 14.1% after the rail and bus operator cut its earnings forecast.

Image source, Getty Images

Image source, Getty ImagesYahoo's about-turn on plans to spin off its stake in Chinese e-commerce giant Alibaba, external Group adds another layer of uncertainty over chief executive Marissa Mayer's attempts to re-build the US internet firm.

So, does she have the full confidence of the board? "Absolutely," Yahoo's chairman Maynard Webb told CNBC television. "I've had the distinct pleasure of running (it) with her now for three years, and I've never met anybody that works harder, that's smarter, and cares more.

"So we want to help her return this great company to an iconic place where it belongs," he added.