When did the Fed last raise rates?published at 07:46

Image source, Getty Images

Image source, Getty ImagesWant to know when the US Federal Reserve last raised interest rates? We can help you with that.

The US Federal Reserve raises interest rates by 0.25%

Fed expects future rate increases to be 'gradual'

US shares rise after rate decision

UK unemployment falls to the lowest in nearly 10 years

Dixons Carphone shares rise on results and a hike in the dividend

Russell Hotten

Image source, Getty Images

Image source, Getty ImagesWant to know when the US Federal Reserve last raised interest rates? We can help you with that.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Today Programme

Today Programme

BBC Radio 4

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

"The dollar has gotten very strong relative to the rest of the world so I think we can sort of safely say over the next couple of years it will come down but what's going to happen over the next couple of months I think it's very hard to call," Ken Rogoff, economics professor at Harvard University tells Today. He adds that despite the rising dollar the US economy is "growing reasonably" and unemployment is low.

Professor Rogoff suggests everyone is getting very excited about a 0.25% rise. Things, he says, won't get interesting until rates rise to 1% or 1.5%. He also points out the Bank of England interest rate is 0.5% and no-one has been calling for rates to be cut.

Image source, Getty Images

Image source, Getty ImagesDixons Carphone has reported a 23% rise in pre-tax profit for the six months to the end of October of £121m,, external compared with £98m a year earlier. Most of its sales remain in the UK and Ireland with sales in stores open for more than a year up 7% in the last six months compared with the previous year.

Expect its shares to do well at the open. Dixons Caprhone has also announced a 30% hike in its interim dividend to 3.25p per share.

Image source, Getty Images

Image source, Getty ImagesNational Express has confirmed, external that it has won the contract to operate Nuremmberg's S-Bahn.

The company won the contract despite an appeal against the process by the current operator: Deutsche Bahn.

National Express will operate the service for 12 years from December 2018.

Image source, Getty Images

Image source, Getty ImagesRolls-Royce has confirmed a revamp of its management structure , externaland plans to recruit a chief operating officer, as Warren East strives to revive the ailing company.

Tony Wood, the head of aerospace, will depart, and Lawrie Haynes, who runs the land and sea division, will step down next year.

Removing the top layer of management is an attempt to simplify decision-making.

Rolls-Royce has issued a series of profit warnings that have battered its share price, leaving it down 38% this year.

Mr East said:

Quote MessageThe changes we are announcing today are the first important steps in driving operational excellence and returning Rolls-Royce to its long-term trend of profitable growth. This is a company with world-class engineering capability, strong market positions and exceptional long-term prospects.

BBC Breakfast

BBC Breakfast

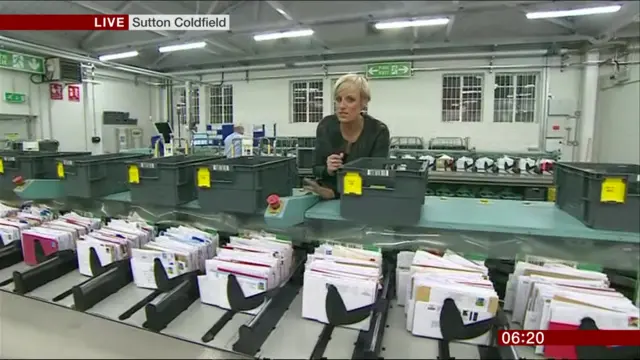

It's the Royal Mail's busiest day of the year, so Breakfast has sent Steph McGovern to a sorting office in Sutton Coldfield to help out.

The postal service expects to deliver ten million parcels today.

Apparently that machine she's standing behind sorts 40,000 letters an hour.

Today Programme

Today Programme

BBC Radio 4

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, FT

Image source, FTThis morning's Financial Times, external has a big interview with Bank of England governor Mark Carney, who is in no hurry to follow the Federal Reserve's lead and raise interest rates.

In fact, at the moment he seems more worried about the dangers from the buy-to-let housing market.

BBC Radio 4 tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

Image source, Getty ImagesKen Rogoff, professor of economics at Harvard University tells Today this is “a defining moment in Janet Yellen’s chairmanship” of the US Federal Reserve. She has “had to sit on her hands" since she became Fed chair three years ago, he says.

Now she gets the chance to move interest rates and also to give an indication as to the pace of interest rate rises and how that will be controlled, he says.

"Until interest rates hit 1% or 1.5% there’s still inflationary pressure potentially in the economy,” he adds.

Today Programme

Today Programme

BBC Radio 4

Today programme business presenter Simon Jack has been to New York to ask workers on Wall Street about their views on the imminent interest rate rise in the US.

One woman isn’t all that impressed or concerned: "It's always up and down. It could be a crisis one day and not so much the next... I’m 44 years old so I’ve seen this cycle before."

"We should be ready for this. We've known it's coming," she adds.

BBC Radio 5 Live

BBC Radio 5 Live

Image source, Getty Images

Image source, Getty ImagesRandy Kroszner was one of the rate-setters at the Federal Reserve when it last moved rates in 2008 and he's been on 5 Live.

Quote MessageDiscussion was about whether we would say we were going to do this for some time or is this just a temporary measure and we won't characterise it as something that's going to hang around. But no-one around that table - even the most pessimistic person there - thought that it would be seven years later that we'd be debating whether we're going to have our first rate rise or not.

BBC Radio 5 Live

BBC Radio 5 Live

On Wake Up to Money, David Stubbs from JP Morgan has been talking about the impact of the expected rate rise in the US this evening:

Quote MessageThere will be a slight bump in household income in America because they hold three times as many interest-bearing assets as they do liabilities. After that, things get uncertain. Will they spend that extra income? Will businesses and consumers perceive this as a vote of confidence in the economy or see it as... something to fear?

Welcome to a big day on the Business Live page.

Whether we have a rate rise or not in the US later today it will be big news, so stay with us for full coverage.

You can get in touch via bizlivepage@bbc.co.uk or @BBCbusiness.