Postpublished at 21:00

That's it for another day. The Live Page wakes up again at 6am tomorrow.

Institute for Fiscal Studies warns of another year of austerity

George Osborne hits back at critics

Labour says Budget is 'unfair' to those on low incomes

Small business groups hail Budget reforms

Questions about prospect of a surplus in 2020

Russell Hotten

That's it for another day. The Live Page wakes up again at 6am tomorrow.

Aston Martin has announced a tie-up with Red Bull that will see the UK carmaker return to Formula 1 racing. Aston Martin last appeared in the sport in 1960 after a brief two-season spell. The brand will now be adorned on Red Bull cars throughout the upcoming campaign, starting at Sunday's season-opening Australian Grand Prix.

Red Bull design chief Adrian Newey is also working with Aston Martin's chief creative officer, Marek Reichman on a new supercar which will be called the AM-RB 001.

It is expected to launch in two years and could cost up to £2m. "This is a very exciting project for everyone at Red Bull Racing," said team principal Christian Horner at the announcement in Melbourne.

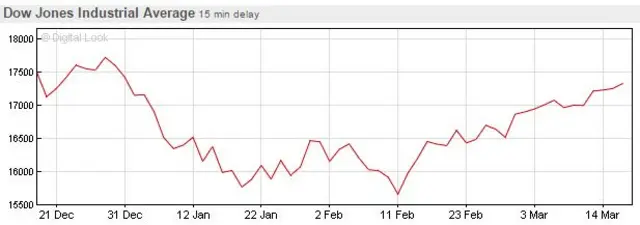

Wall Street closed higher to push the Dow into positive territory for the year. Commodity prices rose on the back of a weaker dollar, boosting shares in the energy and materials sectors.

The Dow Jones index rose 155.73 points, or 0.9%, to 17,481.49, the S&P 500 gained 13.37 points, or 0.66%, to 2,040.59 and the Nasdaq added 11.02 points, or 0.23%, to 4,774.99.

The rally came a day after the Federal Reserve struck a dovish tone in keeping interest rates low.

"We're back to game-on," said Mace Blicksilver, director of Marblehead Asset Management. "The Fed took themselves off the table."

Prime Minister David Cameron won backing at a European Union summit this evening to end the so-called "tampon tax".

"We're a step closer to ending the tampon tax," a government spokeswoman told reporters after EU leaders agreed to express support in the summit statement for an adjustment to VAT on women's sanitary products.

"It shows we can come to Brussels and get people to listen," she said.

Image source, Reuters

Image source, ReutersPhotoshop maker Adobe Systems reported a 24.7% rise in quarterly revenue, helped by strong demand for its cloud-based design and digital marketing tools.

The company's net income rose to $254.3m in the first quarter ending 4 March, from $84.9m a year earlier. Revenue rose to $1.38bn from $1.11bn.

BBC Scotland business editor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

US traffic safety regulators have announced a voluntary deal with carmakers to make automatic emergency braking a standard feature on new cars within the next seven years.

The commitment by 20 automakers, representing more than 99% of the US auto market, will make the safety technology a standard feature on cars and light trucks no later than late 2022, the National Highway Traffic Safety Administration said. It will become standard on heavier trucks three years later.

A planned 48-hour strike by Co-op drivers in a row over transferring staff to haulier Eddie Stobart has been suspended. Members of Unite were due to walk out next Monday and Tuesday and launch a work to rule which has also been called off. Talks will be held between the two sides at the conciliation service Acas.

Image source, EPA

Image source, EPAReuters is reporting that European Central Bank president Mario Draghi expects interest rates to remain low, or even lower than now, for a considerable period.

Speaking after briefing EU leaders on the economic outlook at a Brussels summit, Mr Draghi told reporters: "The Governing Council expects the interest rates to remain at present, or at lower levels... for an extended period of time and well beyond the end of our asset purchase programme."

Scotland business editor Douglas Fraser tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Wall Street is edging higher as gains in FedEx and GE shares lift the industrials sector. It comes a day after the Federal Reserve lowered the projection of interest rate hikes. The Dow Jones was up 0.73% at 17,452.39, the S&P 500 was up 0.52% at 2,037.81, and the Nasdaq was up 0.09% at 4,768.169.

Bank of America chief executive and chairman Brian Moynihan received pay and shares worth $16m (£11m) last year, up from $15.5m in 2014, according to a filing with US regulators.

He was the Wall Street giant's highest paid executive, a position that was held by Thomas Montag in the previous three years. Mr Montag oversees the investment banking operation.

Image source, AP

Image source, AP"One question that remains unanswered is why did the chancellor decide to undertake what's been described as the biggest ever reduction in borrowing right at the end of the Parliament to magically meet his political target?"

If you like political conspiracies, read Laura Kuenssberg's latest blog.

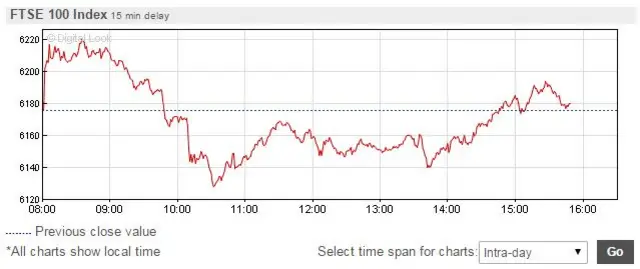

It's been a good day for mining shares on the FTSE 100. The top five biggest risers were all commodities stocks, led by Anglo American, which closed up 9.99%. A rise in metals prices, and also the oil price, seems to have boosted confidence. The biggest faller was payments processing firm Worldpay, which ended down 2.48%.

The FTSE 100 finished 0.42% up, or 25.63 points, at 6,201.1.

Britain is about to secure a deal with the European Commission allowing it to scrap the so-called "tampon tax", the government says.

VAT is currently charged at 5% on sanitary products, the lowest rate allowable under EU law.

Chancellor George Osborne said he hoped to announce it would be scrapped altogether "in the next few days".

He is under pressure from Eurosceptic Conservatives who want him to defy the EU and act unilaterally to scrap it.

The PM's spokeswoman said the government wants to see progress on the move to a zero rate of VAT on sanitary products "as quickly as possible".

Anthony Reuben

Anthony Reuben

BBC News

In its forecasts yesterday, the Office for Budget Responsibility said: "We continue to expect borrowing to fall faster in February and March than over the year to date, although this may not be reflected fully in the initial outturn data due in April."

When asked for more detail, the OBR said it was talking about factors such as borrowing by local authorities, data for which may come out later than other public borrowing figures.

"The ONS also take that into account, but we may have different views," the OBR told BBC News.

The Office for National Statistics says that its first estimate of the full year public sector finances is subject to revision - upwards or downwards - as provisional figures are replaced by final ones.

But it seems that the OBR thinks the ONS is overstating public borrowing in its first estimates.

Image source, BBC news grab

Image source, BBC news grabThousands of staff at insurance firm Admiral will get a £1,000 bonus as a thank you from boss Henry Engelhardt before he retires.

Mr Engelhardt and his wife Diane told staff at the Cardiff-headquartered insurer they will give £1,000 as a personal gift to full-time employees with at least one year's service and £500 to all other workers.

Admiral employs 8,375 staff, including more than 6,000 in the UK.

Thousands of staff at insurance firm Admiral will get a £1,000 bonus as a personal thank you from boss Henry Engelhardt before he retires.

Read More

Away from the Budget for a moment... The FTSE 100 is back in positive territory - just. The index is 0.07% up at 6,179.8 points, led by Anglo American, 9.28% ahead. In fact, mining stocks are the top five best performers. Drugs firm Shire, down 2.98%, is the biggest faller.

By Anthony Reuben

Reality Check

Reality Check

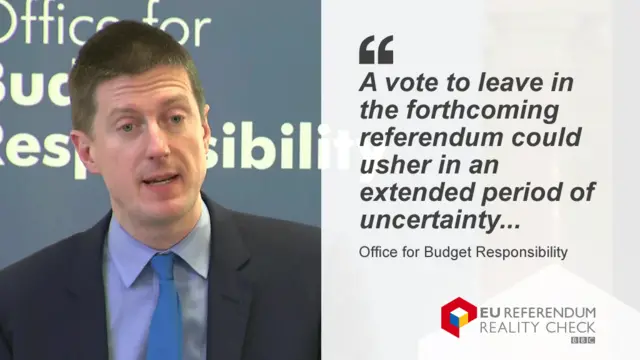

Can it really be the case that suggesting a vote to leave the European Union would create uncertainty means you are backing the Remain side?

Some felt that the way chancellor George Osborne quoted the Office for Budget Responsibility (OBR) in his Budget speech made the independent body seem in favour of staying in the EU.

This was the line he quoted: "Whatever the long-term pros or cons of the UK’s membership of the European Union, a vote to leave in the forthcoming referendum could usher in an extended period of uncertainty regarding the precise terms of the UK’s future relationship with the EU."

"This could have negative implications for activity via business and consumer confidence and might result in greater volatility in financial and other asset markets."

Is there going to be uncertainty?

In the murky world of economic forecasting, predicting uncertainty is about as safe as it gets. How can anyone disagree with you?

In its forecasts, the OBR assumed that the UK would be staying in the EU, because that's what Parliament told it to do, and it did not calculate what would happen in other scenarios.

And the passage that the chancellor quoted didn't even say that there would be uncertainty it said there could be, which is hedging your bets to an extraordinary extent.

After that he says it "could have negative implications" and "might" lead to volatility, which is hedging his bets again.

If the OBR were trying to come out in favour of staying in the EU I would expect it to do a better job than this.

BBC New York business correspondent Michelle Fleury tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.