Postpublished at 21:29 BST 4 April 2016

That's all from the Live page on the Panama papers. There will doubtless be more in the coming days. And we will keep you posted. Thanks for your attention.

Leaked Panamanian documents reveal global elite's tax havens

Links to politicians including President Putin and Iceland's PM exposed

Panama legal firm kept clients subject to international sanctions

Panorama's Tax Havens of the Rich and Powerful Exposed to be broadcast on BBC One at 19:30 GMT

Rebecca Marston, David Gritten and Chris Johnston

That's all from the Live page on the Panama papers. There will doubtless be more in the coming days. And we will keep you posted. Thanks for your attention.

The President of Panama, Juan Carlos Varela, has said his government has "zero tolerance" for illicit financial activities.

Speaking at a news conference, Mr Varela said Panama was an open country and that he would co-operate vigorously with any judicial investigation in any country.

The president said that since he came to power 21 months ago, his government had taken steps to bolster the country's financial system and make it more transparent.

Image source, AFP

Image source, AFPSueddeutsche Zeitung says it was offered the leaked documents by an anonymous source

The editor in chief of the Sueddeutsche Zeitung newspaper says more than 1,000 Germans, external are named in the leaked Panama Papers - and they used all the major German banks. Wolfgang Krach says the banks involved included Deutsche Bank, Commerzbank, HypoVereinsbank and Bayerische Landesbank.

The Munich-based paper says it was offered the leaked data from a Panama legal firm more than a year ago through an encrypted channel by an anonymous source.

Mr Krach told the Associated Press that the paper and its partners verified the authenticity of the data by comparing it to public registers, witness testimony and court rulings.

Image source, EPA

Image source, EPAThe leaked Panamanian documents revealed the global elite's tax havens

The allegations made in the Panama Papers case are not representative of the international financial services industry, affirms the boss of one of the world’s largest independent financial advisory organisations.

Nigel Green, founder and chief executive of deVere Group,says: “Clearly, tax evasion is illegal and punishable by law. It is a serious criminal global issue that needs to be tackled with more vigour. However, I do not believe that the Panama Papers allegations are representative of today’s wider international financial services industry.

"Many of the documents that have been revealed by the Panama Papers case date back decades... the idea of a ‘tax haven’, in the traditional sense of the phrase, is now somewhat outdated. In today’s world, in which financial information is being automatically exchanged with tax authorities globally, it is almost impossible to hide money. No longer can people stash assets on ‘treasure islands’ and not expect to be caught."

He adds such centres have a legitimate place: “Offshore financial centres allow those who qualify to do so to use legal, bona fide international investment products to form part of a robust and sensible financial planning strategy."

Leaked files from the legal firm in Panama show it enabled leading regime figures in Syria and North Korea to keep their companies trading, despite being blacklisted by US Treasury sanctions.

Mossack Fonseca said it had never knowingly allowed individuals connected with Syria or North Korea to use its companies.

But a BBC investigation found the firm had set up a company for a North Korean official, Kim Chol Sam, who managed millions of dollars of transactions in support of the country's nuclear weapons programme.

Mossack Fonseca also fronted six businesses for the Syrian billionaire, Rami Makhlouf, who has been subject to US sanctions since 2008.

The Swiss branch of the British bank, HSBC, provided services for Mr Makhlouf's shell company, Drex Technologies. The bank denied any wrongdoing. It said it worked closely with the authorities to fight financial crime and implement sanctions.

Image source, AP

Image source, APRami Makhlouf is the cousin of Syria's President Bashar al-Assad

Image source, EPA

Image source, EPAMore than 11.5 documents from a Panama-based law firm were leaked

The UK government's tax agency, HM Revenue and Customs (HMRC), says it has asked the International Consortium of Investigative Journalists (ICIJ), external to share the leak of more than 11.5 million financial and legal firms from the Panama-based legal firm, Mossack Fonseca.

Jennie Granger, HMRC Director General of Enforcement and Compliance, says in a statement: "HMRC is committed to exposing and acting on financial wrongdoing and we relentlessly pursue tax evaders to ensure that they pay every penny of taxes and fines they owe.

"HMRC can confirm that we have already received a great deal of information on offshore companies, including in Panama, from a wide range of sources, which is currently the subject of intensive investigation.

We have asked the ICIJ to share the leaked data that they have obtained with us. We will closely examine this data and will act on it swiftly and appropriately."

The US Department of Justice is reviewing leaked documents published by international media organisations to see if they contain evidence of corruption that could be prosecuted in the US, the Wall Street Journal reports, external.

Earlier, White House spokesman Josh Earnest said that while he could not specifically comment on the Panama Papers, "greater transparency allows us to root out corruption", according to the Reuters news agency.

Image source, AP

Image source, APSigmundur Gunnlaugsson has insisted he will not resign

More than 26,000 people in Iceland - almost 8% of the population - have now signed an online petition, external calling on the country's Prime Minister Sigmundur Gunnlaugsson to resign, after details of his family's financial affairs were revealed in leaked documents from Panama.

Mr Gunnlaugsson is accused of hiding millions of dollars of investments in the country's banks, behind a secretive offshore company. Mr Gunnlaugsson says no rules were broken, and that neither he nor his wife benefited financially. He said he would not resign.

BBC business correspondent tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, AFP

Image source, AFPMichel Platini has denied wrongdoing in a statement

Suspended Uefa president Michel Platini has said his accounts and assets are known by the tax authorities in Switzerland.

The former French footballer was identified in leaked documents from the Panama-based law firm Mossack Fonseca as managing an offshore company named Balney Enterprises Corp, according to the Le Monde newspaper.

The Associated Press quotes a statement by Mr Platini's advisers as saying he "wants to inform that, as he stated it many times to the journalists in charge of the investigation, all of his accounts and assets are known to the tax authorities in Switzerland, where he has been a fiscal resident since 2007".

France has opened a preliminary investigation into possible money laundering and tax fraud in response to media revelations based on a vast trove of leaked documents about offshore financial dealings known as the Panama Papers. The possible tax evasion was "likely to concern French taxpayers," the financial prosecutors' office said. Several hundred French citizens reportedly feature among the individuals mentioned in the leaked documents.

Spanish state prosecutors have opened a money laundering probe on Monday in connection with the massive leak of documents exposing the offshore dealings of clients of the Panama-based law firm Mossack Fonseca, the AFP news agency quotes a judicial source saying.

The Associated Press reports that a representative for Georgia's ruling party says former Prime Minister Bidzina Ivanishvili has nothing to hide, after his name allegedly featured in documents released about offshore accounts.

Gia Volski, a member of parliament for the Georgian Dream party, told state TV that Mr Ivanishvili - a reclusive billionaire who stepped down in 2013 - "has nothing to hide and has never hidden anything".

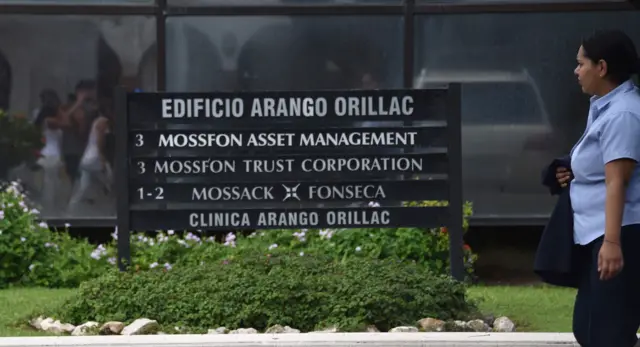

Image source, AFP

Image source, AFPLaw firm Mossack Fonseca is based in Panama City

Panama City-based newspaper La Prensa reports, external that Panama’s Public Ministry will open an investigation into the firm Mossack Fonseca, BBC Monitoring says.

This would be the second investigation the Public Ministry opens into the law firm this year, the first one being related to its involvement with the Lava Jato case, external in Brazil.

Panama's President, Juan Carlos Varela, has announced that his government will co-operate with any investigation, domestic or international, that should arise.

The Organisation for Economic Co-operation and Development (OECD) has attacked Panama over its tax haven status. Pascal Saint-Amans, head of tax for the OECD, told the BBC: "Panama has refused to commit to automatic exchange of information."

"They've dragged their feet on exchange of information on request. They have not signed a multi-national convention, offering themselves as the place of the ultimate secrecy, and therefore it's no surprise that you have a concentration of bad business there today," he said.

The OECD was tasked by the G20 at the London summit of 2009 with setting out new rules to reform the international tax system. Panama is under investigation over its tax haven status and has yet to pass "Phase 2" of the new transparency rules. It passed "Phase 1" - agreeing to share some tax information globally - only with "reservations", according to OECD sources.

Fascinating: the Suddeutsche Zeitung reporter (the original recipient of the information) still doesn't know the identity of #panamapapers, external mole via @WIRED, external@ICIJorg, externalbit.ly/1XbGtIY, external

Chris Johnston, BBC business reporter

Ramon Fonseca, one of the founders of the firm at the centre of the Panama papers scandal, says: "We believe that there is an international campaign against privacy. Privacy is a sacred human right. There are people in the world who do not understand that. We definitely believe in privacy and we will continue working so that legal privacy works. If a company that we have formed finds itself in trouble and they approach us to solicit information via the appropriate channels, we immediately give out that information. And I would like to repeat, we have never been implicated in anything except by the media."

Image source, EPA

Image source, EPASpanish filmmaker Pedro Almodovar and his brother Agustin have insisted their tax payments are in order following revelations that they were listed as agents of a British Virgin Islands company handled by Mossack Fonseca in the early 1990s.

The Argentine newspaper Clarin reported the brothers had denied their involvement in such a company, but El Confidencial reported that Agustin admitted he launched it in 1991 but had shut it down "because it did not fit with the way we worked.''

The allegations stem from a leak of 11 million documents held by the Panama-based company Mossack Fonseca to German newspaper Suddeutsche Zeitung, which were then shared with the International Consortium of Investigative Journalists.

Top Norwegian bank DNB says it regrets having helped about 40 customers open offshore companies in the Seychelles with the help of Panamanian law firm Mossack Fonseca. The bank, which is partially state-owned, said it helped set up the firms between 2006 and 2010 and that the practice had now ended.

"It's the customers' responsibility to report their own funds to tax authorities. Still, we believe we should not have contributed to establishing these companies," Reuters reported Chief Executive Rune Bjerke as saying.

Trade and Industry Minister Monica Maeland said in a statement she had invited board leaders of 30 firms to talks on corruption in June.

"There has recently been revealed several cases of corruption and ethical issues in the broader sense. As owner we have clear expectations to how the companies work with corporate responsibility," AP reported her as saying.

A report in Norwegian newspaper Aftenposten said DNB had helped customers set up shell companies in the Seychelles to avoid taxes. The Norwegian Tax Administration said it is trying to gain access to the leaked documents.

The BBC's Moscow correspondent Steve Rosenberg says the three main pro-Kremlin broadcasters aren't giving any attention to the Panama tax papers, which allege a President Putin connection. Our correspondent says they contain nothing whatsoever about the Mossack Fonseca story. They are talking about a scandal, but it is what they are calling the "grandiose" UK sports doping scandal.