Easyjet leads FTSE 100 lowerpublished at 12:32 BST 27 June 2016

Image source, AFP/Getty Images

Image source, AFP/Getty ImagesEasyjet was the biggest loser on the FTSE 100 shortly after midday. The budget airline was down 19% after it issued a profit warning due to a mix of factors, including Brexit.

Major banks and housebuilders also dragged the blue chip index down, as it fell 1.5% to 6,046.11. Their falls were partly offset by mining stocks and pharmaceutical firms.

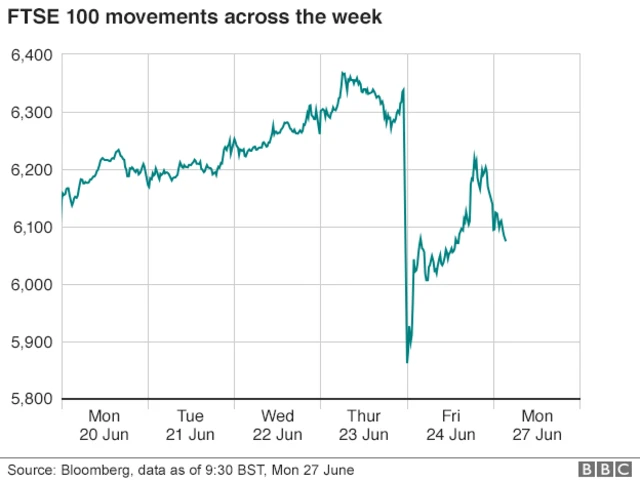

The FTSE 100 is now back below where it was at the start of last week.