Wall Street tipped to dippublished at 13:02

Image source, Getty Images

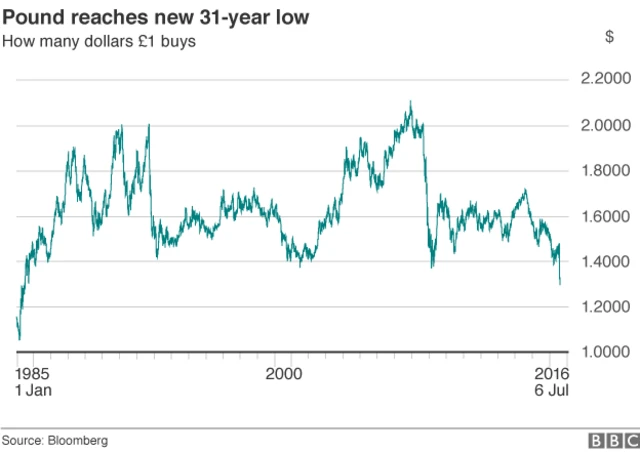

Image source, Getty ImagesWall Street is expected to open at least 0.5% lower today following earlier falls in Asian and European markets and a 1.6% slide in the FTSE 100 in London. The falls have been sparked by the uncertainty following the UK's Brexit vote.

"We've seen strong selling interest across the board this week," said Michael Hewson, chief market analyst at CMC Markets in London.

"While some have speculated that some 'Leave' voters may have undergone some form of buyer's remorse, it would seem that the same could also be said of the investors who took part in last week's stock market rebound."

Later today the US Federal Reserve release the minutes of its June meeting and investors will be looking for clues as to when it might raise interest rates.