Markit economist explains his latest PMI datapublished at 12:30 BST 22 July 2016

'Major downturn in the economy', says Chris Williamson from IHS Markit

'Dramatic deterioration' in UK economy in July

Pound falls but FTSE 100 rises after PMI data

Wall Street ends the week with further gains

Vodafone shares surge after trading update

IMF chief Christine Lagarde to stand trial in Tapie case

UK fiscal policy could be 'reset' this year

Dan Macadam and Chris Johnston

'Major downturn in the economy', says Chris Williamson from IHS Markit

BBC business correspondent tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Brexit causes fall in economic activity July, says Makit

Andrew Walker

BBC World Service economics correspondent

"The figures in PMI surveys are taken seriously by economists as early warning signs of what is in the pipeline. When there is a downturn, the PMIs generally tell the same story. So this is a troubling set of results. But it is just one month’s worth.

It is possible that this is a “shock-induced nadir”, as the chief economist at the firm who conducted the survey put it, and that the economy will right itself in the coming months. In addition, the financial markets have stabilised and in some areas rebounded, in an adjustment after the vote that was described by the IMF as severe but generally orderly.

That said, the survey results do increase the chances of some action from the Bank of England, perhaps an interest rate cut in August, or perhaps even some additional spending plans in the Chancellor’s autumn statement."

Image source, Getty Images

Image source, Getty ImagesThe world cannot depend on China alone to save it from a Brexit-induced downturn, the country's premier said on Friday.

Li Keqiang made the remarks after meeting the heads of six global economic organisations.

"Given the financial fluctuations as a result of Brexit, China will advance market-based reform of its exchange rate," Li said, adding, "we will not engage in a trade war or currency war.

But "it is impossible to carry all of the burden of the whole world on our shoulders," he said. Improving global economic growth would require the world to step up macroeconomic coordination and increase the transparency of macro policies, Li added.

MPs have accused Sports Direct, one of Europe's biggest retailers, of not treating its workers like humans.Iain Wright, chairman of the Commons Business Committee, said company founder Mike Ashley must have been aware of the appalling conditions for workers. Sports Direct has said its company's policy was to treat all people "with dignity and respect". Mr Ashley has previously told the committee he was “100 per cent” unaware of allegations of workers being promised permanent contracts in return for sexual favours. Mr Wright told presenter Sarah Montague he accepted the company had grown too big for Mr Ashley to control personally.

Iain Wright chairs the business select committee

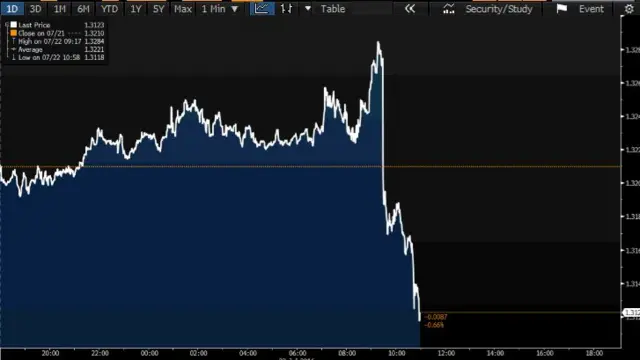

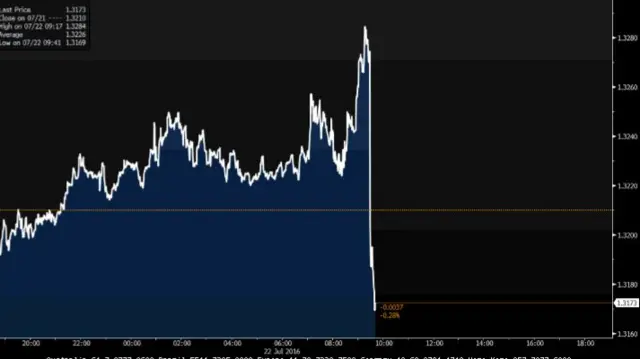

Image source, Bloomberg

Image source, BloombergThe pound remains weak following the PMI data (see above). A short while ago it was trading at $1.3122, down more than a cent and a half from its level before the numbers came out.

But the FTSE 100 climbed back into positive territory (see below). A weaker pound might well be good for some of the international companies listed on that index. Traders may also be anticipating further stimulus measures from the Bank of England.

Image source, Bloomberg

Image source, Bloomberg Image source, Getty Images

Image source, Getty ImagesFund management company Schroders has this to say about that PMI data:

"While this data only represents several weeks of information and there may be a rebound after the initial shock of Brexit, the scale of the decline in activity is alarming.

"A lack of reliable data on activity prevented the Bank of England, external from taking action at the last gathering of rate setters, however, this data will likely support the Bank in potentially cutting interest rates for the first time in over seven years on 4 August.

"It should also support the government’s view that austerity needs to be put on hold as the economy weathers the economic Brexit storm."

Andrew Lilico is an economist who argued in favour of Brexit. He tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Ferdinando Giugliano, is an economics commentator for Italian newspaper Republica.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Data could have been worse if construction sector was included

Quote MessageThe first economy-wide gauge of post-referendum activity showed signs that the economy is contracting, boosting the case for a loosening in monetary policy in August... Today’s release does not cover the construction sector, which looks especially vulnerable to Brexit uncertainty given its reliance on large investment projects. But given that the Markit/CIPS surveys were conducted in the immediate aftermath of the referendum, the PMIs may well stabilise or pick up in coming months as the dust settles. Nonetheless, the latest figures clearly reinforce the case for loosening monetary policy in August.

Ruth Gregory, UK economist, Capital Economics

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Samuel Tombs is chief UK economist at Pantheon Macroeconomics:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Markets Analyst, Neil Wilson from ETX Capital writes:

"The readings suggest we are heading for a recession again and it is almost certain the BoE [Bank of England] will pull the trigger on aggressive stimulus to boost aggregate demand.

"Sterling was sold off dramatically on the announcement, with the pound dropping by more than a cent against the dollar to trade around $1.317."

Peter Dixon, London-based global economist at Germany's Commerzbank, thinks the PMI survey points to tougher times ahead.

"I think we’ll get a recession, but it’ll be a shallow one. But yes, we are in for a prolonged period of sluggish growth,” he tells Bloomberg.

Image source, Bloomberg

Image source, BloombergThe pound rose as high as $1.3284 just before the PMI data came out.

But afterwards fell by more than a cent, hitting $1.3169.

According to Markit's data, external, so far in July the downturn in services has been more severe than the downturn in manufacturing.

Manufacturing output and new orders both fell for the first time since early 2013. But new export business rose, helped by the fall in value of the pound.

Chris Williamson, chief economist at Markit, said:

Quote MessageJuly saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in early-2009. The downturn, whether manifesting itself in order book cancellations, a lack of new orders or the postponement or halting of projects, was most commonly attributed in one way or another to ‘Brexit’.

Markit's purchasing managers' index for July has come in at 47.7, the lowest reading since April 2009.

That's down from the June figure of 52.1.

The report is based on a survey of purchasing executives at 600 manufacturing companies and more than 650 services firms.

Image source, AFP

Image source, AFPThe number of counterfeit euro banknotes is on the decline, according to the European Central Bank. The ECB says 331,000 counterfeit notes were withdrawn from circulation in the first half of 2016.

Around 80% of the counterfeits were €20 and €50 notes. The ECB said: "The number of counterfeits remains very low in comparison with the increasing number of genuine banknotes in circulation - over 18.5 billion during the first half of 2016."

That said, fakes are clearly big business. Italian police have seized €7m in fake banknotes and arrested three men who were caught printing copies of the new-style €20 bill, introduced last year with added security to deter counterfeiters.

"This is the first print shop of the new 20-euro series we've discovered," Lieutenant Colonel Guglielmo Sanicola said. "The fake bills don't need to be perfect, just good enough to trick the average consumer. And these were very high quality," he told Reuters.

Image source, Getty Images

Image source, Getty ImagesNorth Korea's economy contracted for the first time in five years in 2015, the South's central bank says. The isolated North's gross domestic product appeared to have shrunk 1.1% last year, the first downturn since 2010 and the sharpest fall since 2007, the Bank of Korea (BoK) said.

The figure is based on information compiled from state and private organisations, as Pyongyang does not make public its official economic data. According to the estimate, almost all sectors except for construction and services suffered sharp declines, particularly mining and utilities including power and gas.

The mining sector contracted 2.6%, while the utilities industry dived 13% as a drought sapped hydropower production, the BoK said.