Citizens Advice says 'stronger measures' may be neededpublished at 07:57 BST 9 August 2016

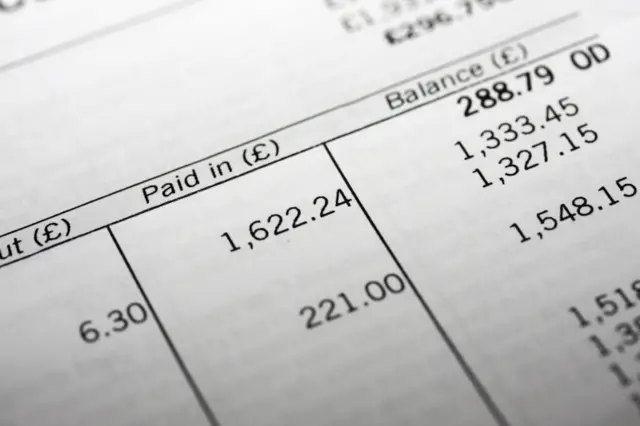

Citizens Advice says "stronger measures" need to be kept as options if the current bank reforms suggested by The Competition and Markets Authority, external don't work.

Quote MessageThe CMA’s move to force banks to be clear on their maximum overdraft charges is good, but banks really need to step up to the plate and set limits that are fair on consumers. Better use of data is a positive step and could make it easier to switch and unlock benefits for customers. The changes announced today need to be monitored closely to ensure they are effective - and stronger measures should be kept on the table if they are not working.”

Gillian Guy, Chief Executive of Citizens Advice