Over and out!published at 21:20 BST 18 August 2016

That's it from Business Live today. Join us again tomorrow for more of the action!

News site Gawker to close next week

William Hill suitors pull out of bid

Oil price climbs above $50 a barrel

Asda quarterly sales plunge 7.5%

Uber plans driverless taxis

Dan Macadam

That's it from Business Live today. Join us again tomorrow for more of the action!

The main indexes on Wall Street close higher - just. Sentiment was lifted by the rising oil price - which is back above $50 a barrel. Chevron and Exxon were among the biggest gainers on the Dow.

As we mentioned earlier, prison shares were huge fallers after the US announced plans to phase out use of privately owned prisons.

Corrections Corp. of America plunged 35.3% and The Geo Group 39.6%.

The Dow Jones index closed up 0.1% at 18,595.65

The Nasdaq was up 0.2% 5,240.15.

The S&P 500 also gained 0.2% to close at 2,186.85

Image source, Getty Images

Image source, Getty ImagesHarley-Davidson has been fined $15m (£11.4m) for selling defeat devices that increased the air pollution created by its motorcycles.

The company sold "super tuners" which increased the vehicle's performance but raised its emissions.

As part of a settlement with the Environmental Protection Agency and the Department of Justice Harley-Davidson agree to pay a $12m in a civil penalty and spend $3 million on programs to mitigate air pollution. The company will also stop selling and recall the device on the market.

A whistleblower who helped expose false accounting at Deutsche Bank , externalhas turned down a multimillion-dollar award from the US regulator - the Securities and Exchange Commission - in protest against the agency’s failure to punish executives at the bank.

In an article in the Financial Times, Eric Ben-Artzi, a former Deutsche risk officer, says he has told the SEC that he is declining his share of a $16.5m payout - the third largest in the whistleblower programme's , externalhistory - awarded for information that led the agency to fine Deutsche Bank $55m last year.

Image source, AP

Image source, APShares in US prisons have plunged on Wall Street after the Justic Department said it planned to phase out its use of privately-operated prisons because of security concerns.

Contracts with 13 private prisons will be reviewed and allowed to expire over the next five years.

Geo Group Inc shares fell about 28% while Corrections Corp of America shares sank about 20%.

Sterling jumped above $1.31 against the dollar today, and for a while lifted above €1.16 against the euro before falling back slightly to €1.1592.

"The British pound was the biggest riser amongst major currencies," according to Jasper Lawler from CMC Markets.

Hargreaves Lansdown's Chris Saint put the pound's rise down to retail figures showing "the UK consumer came out in force during July". It was also helped by a fall in the dollar overnight, he said.

After strong July retail sales, former Bank of England policymaker Andrew Sentance gives his views on whether the Monetary Policy Committee jumped the gun by cutting interest rates...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

North America tech reporter Dave Lee finds out a bit more about Uber's plans to trial driverless taxis in the US in the coming weeks...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The oil price is now up more than 20% so far this month - entering what is known as a "bull market".

It’s also been up for six consecutive days. The last time it managed such a steady climb was back in March.

However let’s get this in context. It’s still nearly $60 per barrel below its peak back in 2014.

Image source, AFP

Image source, AFPThe oil price is now pushing even higher - Brent crude is up 2.3% so far today to $51 a barrel. But it's not the first time we've seen oil exporters jacking up the oil price before a major meeting, Natixis analyst Abhishek Deshpande said.

He told the BBC there was a similar bounce before talks in Qatar in April, when some Opec producers had spoken of an output freeze only for negotiations to collapse.

They're meeting again in Algeria next month, and Saudi Arabia has again made comments in the run-up suggesting that an output cap will be discussed.

Quote MessageI doubt this will lead to an agreement in Algeria. Iran is key to these talks and I see no reason why Iran will change their stance on supply."

Abhishek Deshpande, Natixis oil analyst

Twitter has put out a couple of bits of housekeeping. First is the launch of a "quality filter" which will cut down on content that users don't want to see.

Secondly, the US company says it's suspended 360,000 accounts since mid-2015 for promoting terrorism, a move which has "dramatically" cut the number of followers of so-called Islamic State figures.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The editor of video gaming site Kotaku, part of the same group as Gawker, tweets about the news site's closure...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

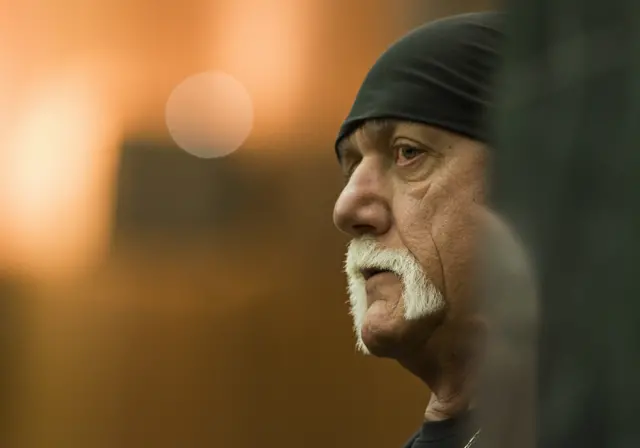

Image source, AP

Image source, APA bit more about Gawker.com, which is shutting down next week after a $140m privacy lawsuit brought by former wrestler Hulk Hogan and funded by Paypal co-founder Peter Thiel.

The news and video site - whose tagline is "Today's gossip is tomorrow's news" - started as a chronicler of the media industry in New York before branching out into salacious stories of all kinds.

Gawker was sued by Hulk Hogan after the website published a video from 2007 of Mr Hogan having sex with the wife of a friend. It was later revealed that tech billionaire Peter Thiel had paid Mr Hogan's legal bills. Mr Thiel said he wanted to curb Gawker's "bullying" after it published an article that outed him as gay in 2007.

Parent company Gawker Media also has six other blogs, including the women-focused Jezebel, tech-oriented Gizmodo and sports site Deadspin. Gawker's announcement suggests those sites will continue under incoming owners Univision.

Journalists react to news that gawker.com - the acerbic news site which specialised in celebrity gossip - is closing down next week (although six other sites owned by Gawker Media will continue).

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, EPA

Image source, EPAUnivision, which bid $135m for Gawker Media at a bankruptcy auction last week, isn't much of a household name outside of the US. But it's huge in America - it's the largest Spanish-language broadcaster, known for its high-octane "telenovela" soap operas.

It's also been buying up edgy news sites before it went for Gawker, which was sued for $140m by former wrestler Hulk Hogan. Univision owns more than 40% of satirical news site The Onion, for example.

But what does the firm, which paused a stock market listing last year, want with Gawker Media? According to the Wall Street Journal, external, Gawker's seven blogs "skew toward upper-income, millennial male visitors, a very attractive and hard-to-reach demographic".

Gawker's also making money. In 2015, Gawker generated $48.7 million in revenue, jurors in the Hogan case were told.

Online news site Gawker, which filed for bankruptcy to avoid paying $140m in damages to former wrestler Hulk Hogan, will end operations next week, according to a post on its website, external.

Nick Denton, the company’s outgoing boss, informed current staff of the site’s fate on Thursday afternoon.

A bankruptcy court will decide later whether to approve media firm Univision's $135m bid to acquire Gawker Media's other assets, the post said.

Quote MessageThis time last year, ex-chief executive Andy Clarke talked about Asda's sales decline hitting a nadir - unfortunately today's results represent a new nadir, with the scale of the problems facing the grocer becoming ever more severe. If Asda has been waiting to push the button on its latest wave of price cuts, the time must be now, especially as a more uncertain post-Brexit consumer becomes ever more price sensitive."

Greg Bromley, Verdict Retail

Scotland business editor Douglas Fraser tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

London's blue-chip index has made back its afternoon losses to finish 0.1% higher at 6,868.96 points in a quiet day of trading.

Mining stocks helped to lead the FTSE 100 higher, after a fall in the dollar boosted commodity prices. However, publisher Pearson, insurer Legal & General and tobacco giants BAT and Imperial Brands, which were all ex-dividend, held back the index.

William Hill has commented on, external gambling firms Rank and 888 walking away from their takeover attempt. Gareth Davis, chairman of William Hill, said: "We will continue to focus our efforts on our strategy to deliver value for shareholders."

That involves focusing on its online-gambling turnaround, delivering a technology roadmap, driving more efficiencies, and refocusing its international strategy.

"We have had a good start to the second half of the year and the board now expects operating profit for 2016 to be at the top end of the previously guided £260-280m range," Mr Davis said.